Steemit Statistics Week 12

This post is a weekly, evolving post, analysing Steem(it) by numbers and deducing trends of interest for this project moving forward. As always, I would also invite anyone with special knowledge of Steem(it) to provide analysis (who, what, how, why, witness updates...) of my findings, and I will add this information where relevant to this post. There has been some very valuable contribution to this post in the past 11 weeks which is much appreciated.

Past Editions: Week 11 / Week 10 / Week 9 / Week 8 / Week7 / Week 6 / Week 5 / Week 4 / Week 3 / Week 2 / Week 1

Steemit Statistics Week 12 Highlights:

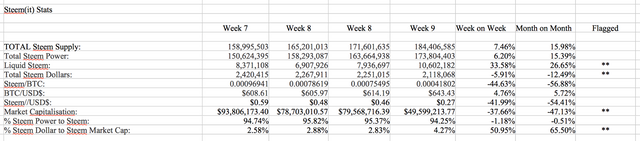

- Summary of Currency Fundamentals:

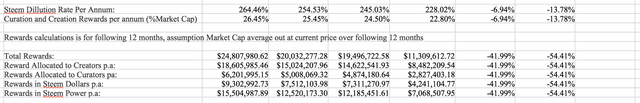

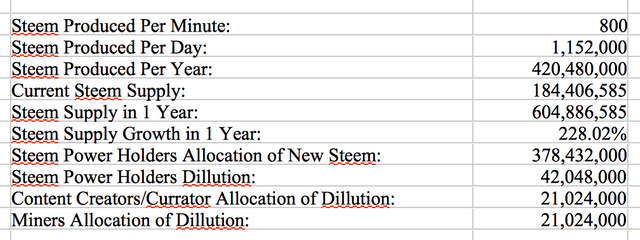

There has been a significant increase in Liquid Steem this week at +33.58%. This is due to a number of factors from, account holders Powering Down, The Steem Dollar Stability Mechanism rewarding Authors with Steem and User converting Steem Dollars to Steem. This has lead to fall in the price of Steem and subsequently the Market Cap (-37.66%), which matches expectations connected to increasing Liquid Steem Supply. I am anticipating further decline in the Price of Steem over the coming week, as the market has yet to find balance between the ballooning Steem Supply, and buying demand. - Top 100 and Top 10 Accounts Control of Steem Power Continues to Fall:

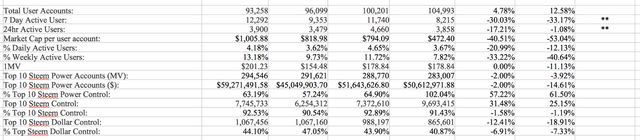

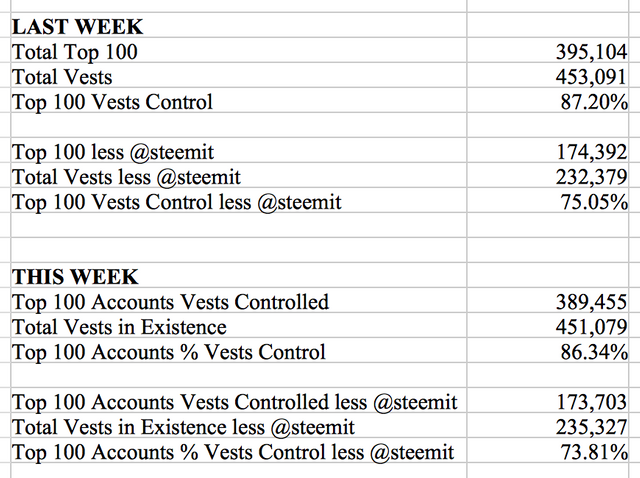

Whether you include @steemit account in your calculation (-0.86%) or not (-1.24%), the results are the same, another week on week fall in the Top 100 Steem(it) Accounts Control of Steem Power. This is also reflected in the Top 10 accounts control of Steem Power falling 2.00%. Steem Distribution is still ongoing, and I expect to this result recreated next week. These numbers represent an acceleration this week, as the number of accounts Powering Down increases. This information matches up with Liquid Steem Supply. - Active User Numbers Fall:

User number have fallen significantly week on week as Steemit continues to struggle with user retention. This is certainly the main growing pain the platform is experiencing, and (in my opinion) is mostly down to the fact that, users are joining the Steemit platform for the wrong reasons. This has been discussed at length elsewhere, however with Steemit still being in beta, there is a lot of time for @dan and @ned to get the message right, as the platform develops. - 24hr Traded Volume Falls

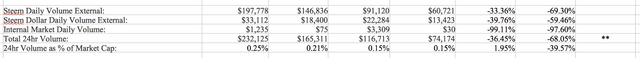

We have seen a significant fall in traded volume this week which is a concern. I believe these numbers are a key barometer to Steemit's success, and I would be very interested to see if we can buck the trend in the coming weeks and post a weekly gain. I believe this is as a result of the falling price of Steem, as some confidence has been lost on the buy side. This has exacerbated the move down, with the significant balance of volume on the sell side.

Sources:

https://steemd.com

https://steemd.com/richlist

https://steemle.com/charts.php

https://steemit.com/market

https://poloniex.com/exchange#btc_steem

https://poloniex.com/exchange#usdt_btc

https://coinmarketcap.com/currencies/steem/

https://coinmarketcap.com/currencies/steem-dollars/

Would be interesting to hear your thoughts...

thanks for putting all of this together man

I think passing the 90percent mark this week will be significant. Less than 90 percent is held as Steem power meaning passive holders increase ownership each week. I expect we'll see some power ups soon.

This hasn't happened. We are at 94.25%

Really? I thought you took vesting divided by virtual. How do you get 94? Looks like you are using vested to total Steem.

I think virtual is correct. If the virtual sky rocketed, the value of your stake would decline. You should be focused on your percent ownership of the virtual supply not actual supply (like diluted shares) Now I assume virtual grows with new Steem plus change in the amount of backing required for Steem dollars. If sbd teaches 5% no new sbd are printed and the change in supply for backing depends only on price. If price is stable virtual supply increase defaults to Steem increase. If vest holders get 90 percent of new Steem then then their ownership of virtual supply will be drawn to 90 percent. (Steem supply will be 3.28x as big in one year.) Large price swings could alter this but at some price it should stabilize.

I think 90 percent will be significant.

https://steemit.com/steemit/@dennygalindo/the-era-of-steem-curator-is-about-to-begin

My Calculation is Total Vesting Funds/Current Supply, I need to take a look at the difference between Virtual and Actual Supply, because your calculation does come in under 90% which is significant... Why are you using Virtual Supply?

I thought virtual supply is the the only way to account for the sbd dilution, the Steem required to back outstanding sbd. It seems similiar to using diluted share count vs basic sharecount to calculate ownership in equities. It's important here because in one year the equity ownership will converge to 90% because the inflation is so high.

Thank you very much for those clarification and thank you for the link you posted. Very enlightening!

Hi @dennygalindo! Are you on the official chat of Steemit? Let me know if you are. I would love some precision on this matter.

https://steemit.chat/direct/teamsteem

I hope you'll answer. I'm eager to hear your analysis Grand Wizard of Steem Numbers!

I am not generally on there. Maybe I'll try to get it working

"I am anticipating further decline in the Price of Steem over the coming week, as the market has yet to find balance between the ballooning Steem Supply, and buying demand."

I agree.

Thanks for this great report really aws alot of questions with what exactly is going on. I know you already explained why the steem dollar value is so low but I think you should go into abit more detail on your next post on what the people can do and why its happening, just a suggestion, anyway awesome stuff upvoted!

very informative report

I thought this was the only number that captured the impact of Steem dollars which are convertible to Steem.

It's a buyers market. I bought some SP in this dip and will wait for the next significant dip in price before buying more.

I'm not expecting the price to go up for some time. The only foreseeable pump may be around Steemfest, however I'm not expecting anything significant. I expect the price to continue to go down well into 2017. It could go sideways.

At the top end of SP holders, I think a gulf will appear between those that can afford to hold (and/ or power up) and those that choose to power down. It will be interesting to see how this plays out over the next few months, particularly if interesting things begin to happen with the Bitcoin price over that time.

When vest are under 90 percent of supply, vest holders increase ownership without powering up, voting or writing. If you want to hold and not participate (lots of people) the only time it makes sense to buy is when vest are less than 90, otherwise you lose too much to I fnflation. I would not be surprised to see fewer people powering down now.

I don't think you should talk of the price the way you did. I'd encourage you to do it in private if you think the price is looking on a downtrend. You are a shareholder in the company. I invite you to think about the plus and minus of both option.

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal