Peeking Into Steem's History: Hardfork 16

I reached at this subject trying to research another: the correlation - or lack thereof - between STEEM's price and bitcoin's around the time of the previous bitcoin halving (only during the last one was Steem also born).

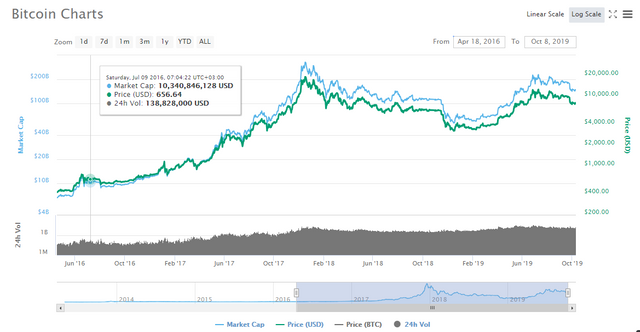

I'll put the charts below for those curious, but they are not comparable for many reasons, including:

- Steem blockchain was very new, launched in March 2016

- During its first year, 16 hardforks of the Steem blockchain took place, but I only found information on the last and probably the most significant one

- In March 2017 Dan Larimer broke ties with Steem, but his dissensions with Ned Scott started earlier (at half of March 2017, STEEM reached a relative low, but was on a downtrend since July 2016)

Please note that bitcoin halving took place on July 9th, 2016, which is marked on both charts and are represented on a log scale and on the same interval.

After the relative low in March 2017, STEEM pushed up to catch with the rest of the market, but on the correction that came since mid-July 2017, STEEM started to decouple from bitcoin. Probably STEEM (maybe other alts as well) were sold aggressively in preparation for the final push up of bitcoin. Since then the gap has remained between the two. I don't think the same scenario can happen again, because at lower prices the demand for STEEM rises, and we already are close to ATL in raw values (not in percent). But surely that's just an opinion, do your due diligence if you make investment decisions.

Anyway, in my research I had a closer look at Hardfork 16, which took place in November 2016.

We don't have time travel yet, but we have imagination, and when we couple it with a little historical information, you can almost recreate some periods.

Let's take a look at what was included in Hardfork 16, according to @steemitblog:

Changes:

Power Down in 13 weeks instead of 104

Inflate at 9.5% APR narrowing to 0.95% APR by 0.01% every 250,000 blocks (Roughly 0.5% per year).

Steem Dollar conversion takes 3.5 days (down from 7)

Witnesses receive 10% of inflation, runner up witnesses get paid 5 times the top 19 per block produced.

Miners get paid the same as the top 19 per block produced

Witnesses / Miners will continue to be paid in Steem Power

75% of inflation goes to authors and curators

15% of inflation is allocated to Steem Power

Switch to Equihash Proof of Work algorithm.

Remove rewards for including Proof of Work transactions

So, how was it like Steem before HF16, as far as I see it from this list of changes and other posts I read on the topic?

- You needed 2 years to power down! (reduced in HF16 to 13 weeks - a little over 3 months)

- Previous inflation rate was 160%, from which 90% paid as interest to SP holders and 10% paid as rewards (source); after HF16, the total annual inflation was set to 9.5% and decreasing by approximately 0.5% annually until it reaches 0.95% (currently we have roughly a 8.5% annual inflation).

- Before HF16, SBD conversion took 7 days, after 3.5 days.

- The distribution of rewards that was in effect until HF21 was set in HF16 (10% witnesses, 15% interest, 75% authors and curators)

- Before and after HF16, mining was still working on Steem (couldn't find when it was deactivated)

I hope the little trip to the history of Steem was... exciting. :) We can certainly see progress with different eyes when we do that.

Congratulations @gadrian! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!