Historic Quarter: CoinDesk Launches Q2 State of Blockchain Report

CoinDesk's Q2 State of Blockchain report key trends, data and events in the public and enterprise blockchain sectors in the second quarter of 2017.

Q2 at a glance:

Cryptocurrencies hit all-time valuations.

ICOs emerge as an industry force.

The asset class diversifies and bitcoin's total dominance wanes.

- Crypto prices rally

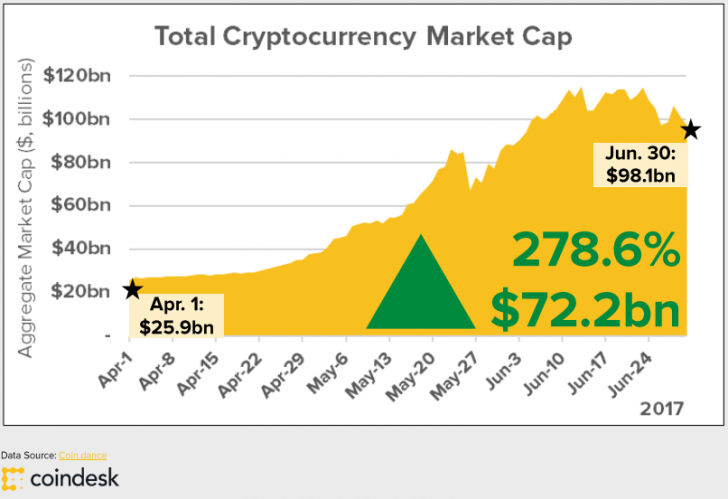

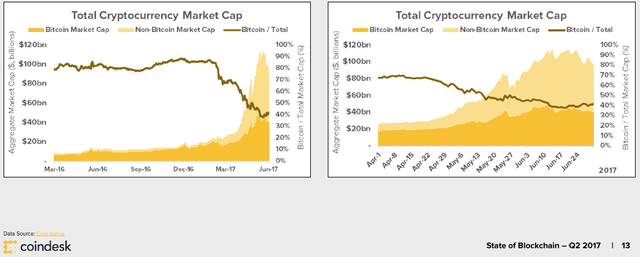

The story of Q2 begins with a rally that saw the total value of all cryptocurrencies rise to $100 billion, up from $25 billion at the start of the quarter.

Another way to put it is that the total market value of blockchain tokens skyrocketed 4x to an all-time high above $100 billion.

)

)

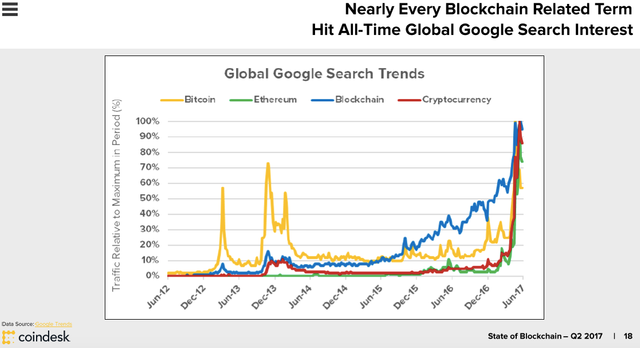

At the same time, industry search queries gathered immense attention, with Google searches for the technology hitting an all-time high in Q2.

- ICOs emerge as 'killer app'

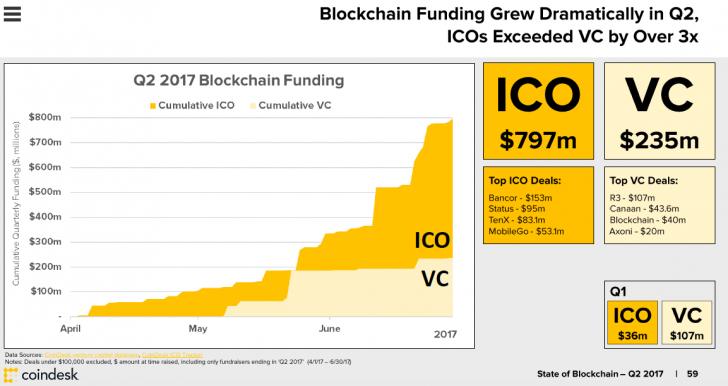

ICOs helped propel this growth and established a powerful trend in Q2.

The supply of new tokens exploded and crowdfunding and investment returns stunned the world. (To track the escalating funding totals, CoinDesk even went so as to launch its own dedicated ICO tracker, a free tool that tallies fundraisings via the mechanism).

One useful metric that underlines ICO dominance is how much more successful ICOs were traditional VC funding in the blockchain industry.

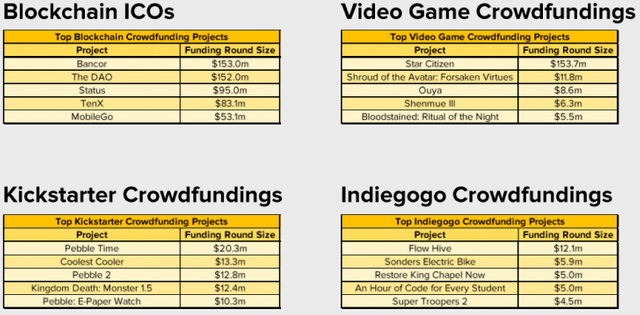

The upshot is that ICOs emerged in Q2 as the world’s most important crowdfunding tool, outstripping all-time successes of Kickstarter and any other platform.

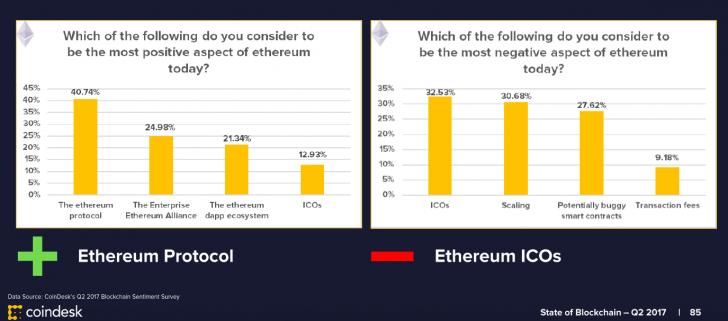

- Mixed sentiment around ICOs

As part of the State of Blockchain, CoinDesk conducted a sentiment survey designed to leverage the insights of its global readership.

This quarter's survey had over 1,300 respondents, and it served to capture the unease some investors felt as the blockchain use case took off.

- Diversified markets

In 2017, bitcoin's total domination of the ecosystem shrunk considerably.

At the start of the year, bitcoin represented almost 90% of all the value in cryptocurrencies. By the end of Q2, that number tracked down to almost 41%.

While the market diversified, bitcoin's growth remained impressive with all metrics we track up. Ethereum continued its run with growth across its network as State of Blockchain tracked spikes in transactions, trades, hash rate, block sizes and total distinct addresses.

Rising sun image via Shutterstock