New record in stablecoin capitalization

The rise in the speculative market precedes the arrival of Donald Trump to the presidency. Stablecoins are experiencing a historic boom, driven by rumors of more flexible regulations.

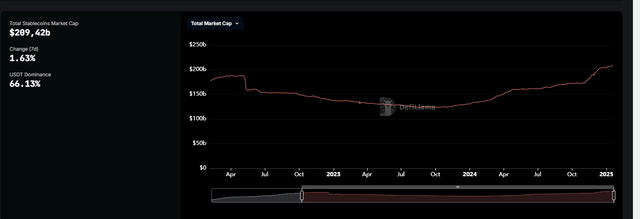

In a surprising turn for the cryptocurrency ecosystem, the total capitalization of stablecoins reached a new record of $209.45 billion, according to data provided by Defillama. This remarkable increase, which occurs in the midst of a speculative wave alongside the inauguration of the new president of the United States, Donald Trump, raised the tide of cryptocurrency investment.

Total stablecoin market cap hit new record high of $209.45 trillion / Defillama

Rise of stablecoins

Since November 5, 2024, the capital of stablecoins has registered exponential growth, when it stood at $173.68 billion. The new figure underlines how the market overcame the fear caused by the MICA regulations in Europe, consolidating a more optimistic environment for cryptocurrencies.

Tether Leads the Way

Tether (USDT) remains the largest stablecoin by market cap, reaching $138.48 billion, followed by USD Coin (USDC) at $47.51 billion. In third place is USDe from the Ethena ecosystem, with a market cap of $5.80 billion, surpassing DAI at $4.66 billion.

Circulation and Adoption Dynamics

It is interesting to note that 47.33% of USDT circulates on the Ethereum (ETH) network, while 42.4% is on the Tron (TRX) network. On the other hand, 64.54% of USDC circulates on Ethereum and 11.85% on Solana. This circulation pattern highlights the dominance of Ethereum in the stablecoin space.

What Drives This Growth?

This growth in stablecoin market cap is indicative of a system that continues to attract fresh capital. The recent recovery in the price of Bitcoin sparked renewed interest from investors, supported by institutions that are taking advantage of the flow of capital from exchange-traded funds (ETFs). In addition, open interest in the futures market continues to rise, signaling an increase in liquidity in the system.

Tether's impact in El Salvador

Recently, Tether announced its intention to move its operations to El Salvador after obtaining a Digital Asset Service Provider (DASP) license. This decision aligns with the growing adoption of Bitcoin in a country that is positioning itself as a global hub for digital assets. Tether's strategy reinforces its commitment to innovation and the creation of accessible financial solutions for its users in a dynamic environment.

A promising future

The intricate relationship between regulation, policy and the market leads to an environment where stablecoins not only have a place in the economy, but are becoming stronger in the current context. With Donald Trump coming to power, expectations for a friendlier regulatory environment are rising, which could mean a bright future for digital assets.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrencies carry risks and investors are advised to conduct their own research.

Upvoted! Thank you for supporting witness @jswit.