Tether

Tether (USDT) is a stablecoin pegged to the US dollar meaning that one Tether coin (tethers) will always be worth roughly one dollar. Unlike other cryptocurrencies which experience wild price swings and extreme volatility, each Tether coin is supposed to have a stable ($1) value. To accomplish this, Tether utilizes a proof of reserves system to maintain a one-to-one reserve ratio between the tethers and US dollars. This means that if 1 million tethers have been issued, Tether Limited, the company who created Tether, must maintain $1 million. To issue new tokens, Tether Limited must receive the same amount in dollars, and when account holders cash in their tethers, Tether Limited plans to remove the cashed-in tethers from the supply (i.e., destroy the tethers). To prove they are maintaining the proper amount of reserves, Tether Limited claims they will subject themselves to regular audits and publish the bank balance which will be matched up against the number of tethers in circulation. The number of tethers in circulation can easily be verified on the respective blockchains in which they live (e.g., the Bitcoin blockchain, the Ethereum blockchain, etc.), but account holders have to rely on Tether Limited to regularly subject themselves to audits and publish bank balances.

Pros: Substantially reduces price volatility compared to other cryptocurrencies; users get the benefits of cryptocurrencies and blockchain technology (increased security and lack of censorship due to immutability and decentralization) with the stability of fiat currency

Cons: TETHER MAY NOT BE MAINTAINING THE APPROPRIATE RESERVES – they have yet to publish the results of an audit and recently fired the accounting firm, Friedman LLP, that had been working on the audit. If Tether is not in fact maintaining the appropriate fiat reserves, Tether’s value may plummet to close to zero; founded by Brock Pierce the former child actor who was recently removed from the EOS project amidst allegations of a shady past; Tether seems to have a little too close of a relationship with the cryptocurrency exchange Bitfinex – both companies share two of the same operators

Analysis

To perform an objective analysis, each cryptocurrency is rated based on the following factors: (1) validation method; (2) leadership; (3) community participation in development; (4) transaction volume and market capitalization; (5) industry participation; (6) security; (7) usability; (8) technical features; (9) growth; (10) legal risks; and (11) estimated time of arrival.

Validation Method

Tether coins are issued both on the Bitcoin blockchain via the Omni Layer protocol and the Ethereum blockchain as an ERC20 token.[1] There have also been talks of adding Tether coins on the Litecoin blockchain. In any event, the validation method for each of these blockchains is a proof-of-work (POW) system. This requires validators known as miners to solve a cryptographic riddle which is difficult to compute but easy for others to verify.[2] Therefore, mining requires a large amount of computing resources and electricity. The Tether transactions validated by the miners are then recorded on the Bitcoin blockchain or other blockchain. The link in the footnote below is an example of a Tether transaction record on the Bitcoin blockchain.[3]

Leadership/Community Participation

Former child actor Brock Pierce founded Tether. Pierce is a very controversial character and was recently removed from the EOS project amidst allegations of an unsavory past.[4] If this isn’t bad enough, Tether has an unusually close relationship with cryptocurrency exchange Bitfinex. The two companies share multiple operators in common, Phil Potter and Giancarlo Devasini.[5] This intimate relationship with an exchange leads to several concerns calling into question the entire legitimacy of the cryptocurrency. For example, some believe that Tether Limited is not maintaining close to the appropriate amount of cash in US dollar reserves, and is instead issuing unbacked tethers and selling them on Bitfinex for bitcoins. Bitfinex/Tether can then obtain Bitcoin by “printing” currency.[6]

Transaction Volume and Market Capitalization

Tether currently has the highest transaction volume of all cryptocurrencies at about $2 billion. However, its market cap (~2.3B) is closer to fifteenth.[7]

Industry Participation

Several exchanges have begun to accept Tether including Bitfinex and many others. On the other hand, retailers have not started to accept the coin and it is very limited in where it may be used.

Security

In terms of security, Tether has many of the same advantages and disadvantages as the blockchain it lives on, such as Bitcoin, Ethereum, etc. However, the proof of reserves system requires that users trust a third-party (Tether Limited) to maintain the appropriate amount of reserves. Therefore, there is an element of centralization to the Tether protocol, and if Tether Limited is hacked, robbed, or loses the fiat reserves in any other way, then the value of each Tether coin may decline significantly. Unfortunately, Tether is currently facing allegations that it has been printing coins without maintaining the corresponding amount of US dollars in reserves. Firing their auditor amidst these allegations did not quell anyone’s concerns.[8] Accordingly, the entire value of the Tether network (which should be the value in US dollars it has in reserves) has been called into question.

Usability

Tether can be used for several different purposes, including as a store of value similar to Bitcoin. Because Tether is a stable coin users don’t need to worry about volatility when storing their life savings. Tether can also be used to purchase other cryptocurrencies. Typically, investors or traders prefer to buy cryptocurrencies at specific price points. For example, a buyer may want to purchase Cardano when 1 ADA is less than $0.10. However, ADA may only be purchased with Bitcoin or Ether. To buy Cardano at the moment 1 ADA drops below $0.10, a buyer must store a certain amount of Bitcoin or Ether with the exchange she is using to purchase Cardano. Bitcoin and Ether are extremely volatile and the value of either may drop significantly as the buyer waits for ADA to drop below $0.10. Accordingly, by storing Bitcoin or Ether on an exchange and waiting for ADA to reach a selected price point, the losses the buyer suffers from a drop in value of Bitcoin or Ether may offset the opportunity to purchase ADA at a lower price in fiat currency. Tether, on the other hand, should remain approximately the same value as it is stored on the exchange and therefore, the user does not have to worry about this problem. For example, if the buyer stores 1 Ether on the exchange when it is worth $1000 and ADA is worth $0.20, and the price of Ether dips to $200 when ADA reaches $0.10 per coin, the buyer can purchase 2000 ADA. On the other hand, if she stores 1000 tethers on the exchange worth $1000, the tethers should continue to be worth $1000 when ADA reaches $0.10. As such, she can buy 10000 ADA or 5 times the amount she could have bought if she instead stored Ether on the exchange. Tether could also be used for daily transactions (e.g., for a cup of coffee), especially when it’s executed on top of a daily transactions blockchain such as the Litecoin blockchain to limit transaction fees and confirmation times.

Technical Features

Tether was originally on the Omni Layer protocol, a protocol designed as a second layer on top of the Bitcoin blockchain that allows Bitcoin to create tokens that represent currencies.[9] As a result, Tether shares similar technical features with Bitcoin: decentralization, immutability, and transactions validated by miners in a POW system broadcasted to the network on a public blockchain. Tether also issued an ERC20 token on the Ethereum blockchain through a series of smart contracts enabling interoperability of Ethereum-based protocols and DApps.[10]

Growth/Legal Risks

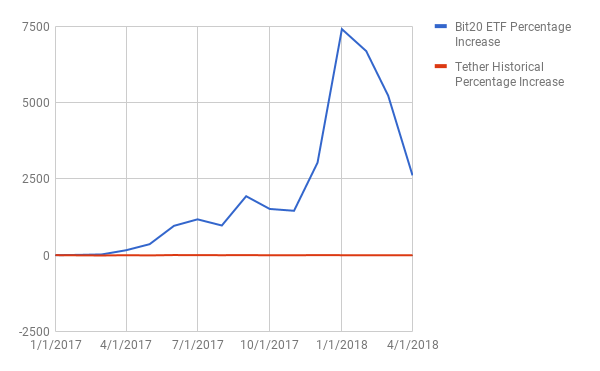

Unfortunately, as a stablecoin Tether does not have the potential for massive growth associated with other cryptocurrencies. The best-case scenario is that each Tether coin remains around $1. The value of the Tether network as a whole can go up as more tethers are purchased and issued to users. Currently, the market cap is around $2.2B and if price stability becomes a necessity for cryptocurrencies it could reach close to $1T. Nonetheless, there are substantial legal risks as Tether Limited has not released the results of an audit. If Tether Limited does not have the appropriate amount of cash in US dollars to back up the number of tethers issued the price of Tether may take a dive.

Estimated Time of Arrival

Like Bitcoin, Tether is currently in use and has been paired with many other altcoins on several exchanges. Tether plans to expand to different blockchains such as the Litecoin network. Further plans for expansion include compatibility with a hardware wallet such as TREZOR and with the Lightning Network.

ETA: Now

Conclusion

Tether seems to be a great concept allowing for the benefits of cryptocurrency utilizing blockchain technology (e.g., immutability, decentralization, enhanced security, etc.) without the volatility of its competitors. Nevertheless, Tether has not been implemented in a way that is fully decentralized as it requires its users to trust Tether Limited to maintain fiat reserves. Thus far Tether Limited has not been able to show that they have held up their end of the bargain, and this coin is too risky at the moment without knowing whether and to what extent Tether Limited is holding onto US dollars.

[1] https://tether.to/tether-update/

[2] https://en.wikipedia.org/wiki/Proof-of-work_system

[3] https://blockchain.info/tx/233b9b6ffdead31bb712e36e9357a8f4559c7d42e609228b6a9ec028506e6c3a

[5] https://www.financemagnates.com/cryptocurrency/news/analysis-bitfinex-tether-still-close-comfort/

[6] https://qz.com/1149772/the-murky-relationship-between-bitfinex-and-tether-is-raising-suspicions/

[7] https://coinmarketcap.com/currencies/tether/

[10] https://blog.ethfinex.com/announcing-the-erc20-tether-c84cc33f076f