Results From Club Vote #0005 and SteemPower Investment Club Vote #0006

Results From Club Vote #0005

The voting window for last weeks vote is now closed and results have been roughed into last weeks post. At the bottom of the post you will find a rudimentary table with vote #005 results. The club decided option 4 - using a combination of all of the available options together - was the best option for the club. It was a close call between option 2 and 4, but option 4 squeaked by with a 1-vote weight win.

A reminder on last weeks topic. With the changes being experienced in the leasing market, the club voted specifically on how to best allocate its passively earned STEEM moving forward. The club decided it is best that we use options 1, 2, and 3 for the best overall success for the Steem Power Investsments Club.

- Option 1: Continue the same tactics that have previously been employed (both on and off market leasing efforts)

- Option 2: Aim and focus attention on tribes/communities/other projects requiring large sums of STEEM POWER

- Option 3: Set up our own STEEM POWER leasing bank

The club will be using all 3 of the tactics above to help expand and propel our growth potential. Obviously some of this is going to take time, and it may even be best to wait it out a bit for SMTs and some changes coming in the future. For now, we shall continue to push forward with our nose to the grindstone. I know there are a lot of topics needing voted on, but most of the pertinent topics will need discussed in a club meeting before we decide any further.

This Weeks Vote

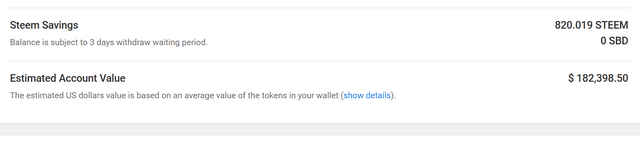

This week, we shall be deciding how to invest our STEEM savings. If we take a look at the spinvest savings wallet, we have just over 820 STEEM to invest. We shall be deciding on what amount and what investment to spend our passively earned STEEM on.

Our STEEM savings options

STEEM investment amounts will be either:

- 1,000 STEEM

- 1,150 STEEM

- 1,250 STEEM

- 1,500 STEEM

Our Investment Options

Remember, we are going for slow and boring growth. SPinvest was set up to get rich slowly, so with that, our investment options this week will reflect spinvest's motto from the origin's of @spinvest.

Our investment options for this week will be either:

- P2P lending

- Stock and Shares

- Gold

- Steem Monsters Packs (wild card investment option)

Some of the investment options may look familiar from previous club votes, but they match perfectly what we looking for and there has been some interest in them in the past. Also, we are leaving out cryptocurrencies from this vote because we have already invested multiple times in BTC and are making a decent interest by simply hodling. Mr Sp invest also recently completed our silver investment with the wirex card. So this week will be focusing in on investments that Mr Sp invest has some prior experience with and knowledge about. I trust him thoroughly and believe the options presented for this vote align directly with our goals and vision as a club that have been detailed and outlined in the partnership agreement.

P2P Lending Option

In the past, this option has been a wild card option, but could very well be a realistic investment option for the club. Mr Sp Invest has also mentioned that he has invested in P2P lending via Ratesetter in the past. I know previously he has mentioned having an account and could potentially still have access. Ratesetter provides peer to peer lending and offers lender contracts that are either monthly, yearly on a 5 year basis. Currently interest rates are ~3.1% (up from 2.6%) for monthly, ~3.8% (up from 3.6%) for yearly and 5.9% (up from 5.3%) for 5-year lending contracts. Please see this review for more detailed information on Ratesetter lending company last updated November 15, 2019. This could be a nice addition to our current off-chain investment portfolio and something to add to from time to time, building slowly over time (just what we like). 5 year contracts pay monthly interest and could provide an opportunity for compounding growth as well. Something to keep in mind when voting.

Stock and Shares

Without getting too overly complicated, a tracker fund mitigates most volatility and generally follow market patterns. Single stocks carry more risk and it would take forever to decide on one or a few to invest in. An FTSE 100 tracker could be a good starting point to begin an off-chain stake in stocks and shares. In a nutshell, FTSE 100 is a fund that invest's in the top 100 UK companies based on market capitalization. The yearly average returns are ~5-6% including dividends on top of any returns. As companies fall in and out of the top 100, holding are updated. There are of course different types of 100 trackers but a simple, well trusted one that pays out a dividend semi-yearly sounds right up our alley. The selection would be the "HSBC FTSE 100 Index Fund Accumulation C". This is a time tested and proven 100 tracker fund. It's a boring investment but auto compounds down dividends and simply holding could turn something small into something big in the future. These would also be held with AJ Bell investments. If you'd like the club to dip into stocks, then this is your pick.

Gold

Gold is the behemoth when it comes to precious metals, the same way BTC is in the world of cryptocurrency. For the reason stated here, we will give gold a chance to be added to our investment portfolio. We recently added silver, so gold may not be a bad investment for the club to dip into. If you wish to invest our STEEM savings into another precious metal, then this is your pick for this weeks vote.

STEEM Monsters Packs

This may seem like a serious wild card, but there has been some interest from a few different club members in adding this option to our investment portfolio. I personally have not gotten too involved with STEEM monsters as I am very busy with other things. In short, Steem Monsters is a collectible card game where card ownership and game results become published and verifiable on the STEEM blockchain. There is a starter pack consisting of 30 pre-selected cards required for purchase in order to get started. After the starter pack has been purchased, additional 5-card booster packs may be purchased which could contain powerful, epic and legendary cards. Blockchain-based games are making way rather quickly and could be a good on-chain investment opportunity for the club to get involved in. If you wish to see the club invest in STEEM Monster Packs, then please vote for this option in the comments below.

OK - it's time to vote

Club Vote #0006: How much STEEM from savings will we invest and what investment option will we choose from the options above?

Important Notice: For the sake of this vote, each member that votes will need to vote for both the amount of STEEM from savings as well as the investment they think is best for the SPI club. With that said, each member shall vote twice (One vote for STEEM amount and one vote for investment option).

If you have any questions, please do not hesitate to ask.

Option 3 (Investment option):

Confirmed SPI member.

Confirmed SPI member.

Confirmed SPI member.

Confirmed SPI member

Option 2 (STEEM savings amount):

Option 1 (STEEM savings amount):

Confirmed SPI member.

Confirmed SPI member

Option 1 (Investment option):

Option 4 (STEEM savings amount):

Confirmed SPI member.

Confirmed SPI member

Posted using Partiko Android

Confirmed SPI member

Confirmed SPI member

Option 4 (Investment option):

Confirmed SPI member

Posted using Partiko iOS

Confirmed SPI member

Confirmed SPI member

Posted using Partiko Android

Confirmed SPI member

Option 2 (Investment option):

Option 3 (STEEM saving amount):

Confirmed SPI member

Posted using Partiko iOS

Confirmed SPI member.

Congratulations @spinvest-votes! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

I only upvoted my options. Is it enough?

@ronaldoavelino thank you.

Please also comment “confirmed SPI member” under your vote options.

Much Appreciation

-conradsuperb

Posted using Partiko iOS