Sow SUN - Risk Analysis DeFi (feat Project W)

All kind of DeFi projects does have their risks and we will look into it what DeFi has as an opportunity and what risks are involved in participating in DeFi projects like $SUN or Project W. The analysis below can be used both for Ethereum or Tron based DeFi projects and would be similar for other blockchain DeFi projects.

1. Risk Analysis

1) Smart Contract Risk

Smart contracts are like Robots without the possibility to repair to change them after they are released into the world. Once open in the wild, the smart contract itself can not be altered nor changed, even from the publisher. In case of a buggy Smart contract, this can bear the risk that a Token needs to be replaced or deposited assets are not any more accessible.

As an example for single USDT staking on TRON, there had been several smart contracts where it was not anymore possible to unstake the USDT from the contract itself. In this case, it was not the Smart contract itself for staking but the original older version of the Smart contract for USDT that was not reacting the right way, so the stake was not returned. If you are not sure about a DeFi project, the safest way is simply don't participate in it. If you still are curious or don't want to miss the opportunity, first try staking on a DeFi smart contract with a very small amount and unstake it to check if everything is working.

2) Providing Liquidity

Unless you are staking a single entity like USDT or USDJ for yield farming, you will have to provide liquidity to participate in different DeFi projects. Providing liquidity means that you combine token A and token B to a liquidity pool. Both tokens are combined with the same value.

As soon as you have created a Liquidity Pool (LP) and somebody is swapping from this pool, your LP will get 0.3% of the swapping fee. (Based on JustSwap or UniSwap) But as a cryptocurrency trader, you know that there is a risk coming with the volatility of the value of a token. This does not change when providing liquidity for specific tokens.

- Example: Stake volatile token A + Stable Token USDJ => When the price of token A is falling, you will get more token A and less of USDJ when removing the liquidity pool. If the token A is falling in higher % your liquidity poll will be less valuable then when removing the LP. This effect doubles when both LP tokens are volatile.

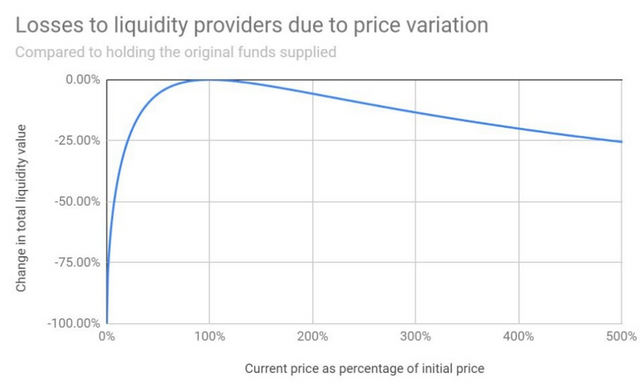

Those kinds of mechanisms result in an impermanent loss for LPs if the price change is too high.

1.25x price change results in a 0.6% loss relative to HODL

1.50x price change results in a 2.0% loss relative to HODL

1.75x price change results in a 3.8% loss relative to HODL

2x price change results in a 5.7% loss relative to HODL

3x price change results in a 13.4% loss relative to HODL

4x price change results in a 20.0% loss relative to HODL

5x price change results in a 25.5% loss relative to HODL

Source: via Pintail

2. Strategy for DeFi

Yield farming with LPs that have higher volatile assets included can have a negative influence on your investment while farming Governance tokens. If the value of a governance token can't cover the price fall of the combined assets in the LP the investment will be a loss. You should have always a keen eye on your yield farming LPs and keep those only running if you feel safe on the value the assets within the LP are providing. Similar to trading cryptocurrency, the value of your LP can also increase when the price of the assets within your LP rising.

Opportunity

The main reason why DeFi farmers are still providing liquidity to higher risked farming pools is, that in normal cases the mining hash rate is much higher than other pools. Especially if you believe in the general value a specific governance token can offer, like $SUN as the main driving DeFi project on Tron and endless possibilities for the future, you could enjoy early mining advantages like in the first days of Bitcoin.

3. About SUN and Project W

Project W is leveraging cross-blockchain technology to bring Steem with a wrapped $WST token directly into the TRON DeFi environment. Due to the fact that $SUN is in the moment one of the driving forces on the Tron blockchain for DeFi projects and besides that Steem is a candidate as a farming pool for SUN, additional projects leveraging and boosting the Steem economy getting into candidates for $SUN would definitely help and increase the usage and adaptation of Steem. (Project W is going to launch at the end of Sep. ~ beginning of Oct. 2020)

Information about Project W - Steem DeFi on TRON

- Project W - wrapping your coin to Tron

- Project W - Reverse Vault System

- Project W - Introduction of the Token Economy of Project W

Channels

Main Blog: https://steemit.com/@projectw

Medium Blog: https://medium.com/@projectw

Twitter: https://twitter.com/Projectw_io

Homepage: https://projectw.io