Exchange Problems Mount at Kraken and Coinbase but Bitfinex Reopens Registrations for 10k+ Deposits

Exchanges are regarded by many in the cryptocurrency world as a necessary evil. They provide liquidity and an on-ramp from fiat currency, but many other aspects of their service leaves a lot to desired. From onerous KYC requests to sudden withdrawal of service, nary a week goes by without major exchanges leaving customers seething. This week, Coinbase and Kraken have been bearing the brunt of the rage, but there’s good news from Bitfinex at least, which is open for registrations again with a $10k fiat or crypto minimum.

Kraken Goes Down and Stays Down

Cryptocurrency exchanges are frequently forced offline for maintenance, but such outages usually take less than an hour to resolve. Kraken announced that it would be going offline on Thursday January 11, and was expected to be back the same day. 24 hours later though and there’s no sign of the exchange, with an update posted at 7am on Friday January 12 stating:

We are still working to resolve the issues that we have identified and our team is working around the clock to ensure a smooth upgrade. This means it may still take several hours before we can relaunch the site.

Kraken’s service has been the subject of jokes and discontent for months, but it had been hoped that recent infrastructure upgrades had laid these problems to rest.

Coinbase Can’t Code

Cryptocurrency exchanges have been having a hard time this week, whether it’s customers complaining about being “grandfathered” by Bittrex – trapped inside the exchange with no means of withdrawal while interminable verification procedures play out – or Bitstamp asking extraordinarily probing questions of its customers. And then there’s Coinbase, whose engineers simply can’t code, according to those in the know, including Bitgo’s chief developer Jameson Lopp.

He’s been scathing about Coinbase in the past, and today followed that up, tweeting: It’s not a new revelation that a significant cause of bitcoin network congestion is from popular services such as @blockchain, @coinbase, and @gemini who are using block space inefficiently. If you don’t want to contribute to the problem, don’t use them.”

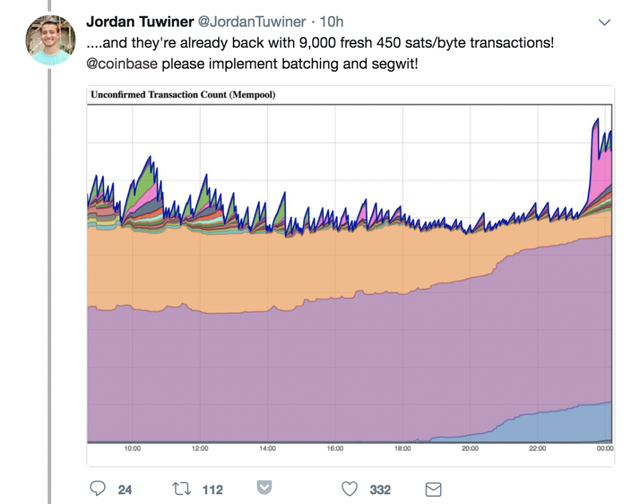

News.Bitcoin.com has previously reported on the “technical incompetence” of Coinbase for amassing millions of UTXOs, which is an extremely expensive and inefficient way of dealing with small fractions of a bitcoin. On January 11, Coinbase announced that it had been forced to temporarily disable BTC withdrawals. It was swiftly pointed out that the exchange was culpable of snarling up the network, with one individual complaining:

You need to batch your outgoing transactions. You are ALONE spamming the network. If you would use segwit and batch all outgoing transactions the mempool would be EMPTY.

They finished: “This is your core business and you are ruining it for your customers”. It is hard to fathom Coinbase’s reasons for such shoddy housekeeping, but it’s not doing them any favors with their customers or with users of the bitcoin network at large, who are also affected by their failure to batch transactions. CEO Brian Armstrong has since tweeted to say “Coinbase is working on batching transactions, SegWit, and a number of other strategies to improve transaction backlog. Thx for bearing with us!”

Bitfinex is Back

It’s been a bad week all round for cryptocurrency exchanges, with only Cryptopia, Binance, Bitfinex, and Kucoin earning pass marks, with the former three opening their doors to new customers once more. Such is the demand for an exchange that will take on new customers, and permit them to deposit and withdraw without requiring a dozen identification documents, Binance registered 240,000 new users in a single hour. It, together with Kucoin, is fast becoming the last refuge for cryptocurrency users who have had the door slammed shut on them elsewhere.

Bitfinex is also open to new customers again, explaining that the “extreme growth has not come without challenges…one month ago we decided to temporarily curtail new account registration in a move designed to preserve the trading, support, and verification experiences of our existing, long-term user base.” The exchange is open once more, but new signups will need fiat or crypto assets worth at least $10k to get involved.

Interest in Kucoin and Binance has grown exponentially in recent weeks.

Coinsmarkets Has Been Down for Days

Finally, users of Coinsmarkets, a small but thriving exchange – until recently at least – have become extremely concerned by its disappearance. The site has been offline for around a week, following a message declaring that the exchange was switching to new servers. Days later and with no word from the team concerns have been mounting that the site’s operators may have pulled an exit scam.

In a video message posted by Alqo, a privacy coin that’s listed on Coinsmarkets, its developers urged calm, explaining that like everyone else they’re in the dark.

[youtube

Cryptocurrency users are well aware of the mantra to keep control of their coins in wallets they hold the private keys for. The reality though is never that simple. Many new coins, such as those listed on Coinsmarkets, have desktop wallets that are buggy or simply unwieldy, requiring users to download the full client. As a result, they’re forced into the arms of cryptocurrency exchanges, a necessary evil for now.

Do you think 2018 will be the year when cryptocurrency users finally manage to break free of centralized exchanges? Let us know in the comments section below.

Images courtesy of Shutterstock and Twitter.