# Is it good time to buy Bitcoin? Meet the DCA strategy

Bitcoin had produced the highest return for investors among all the other FIAT coins during 2016. Following this stat, many people have recently asked me whether to buy Bitcoins, and also if now is a good time to join the train. First, I never recommend to anyone on any investment, just because I will not be there again when they will have to take profit or cut losses in the worse case. On the other hand, as a website aiming to be professional source for the crypto world, I feel obligated to answer this popular question about buying Bitcoin.

As of this writing these lines, Bitcoin consolidates around thousand USD levels. Will it rise or fall from now on? You never know. My answer was the same even if the question was asked earlier this year when Bitcoin level was at 400 USD.

Update 2018 – We are at higher numbers, but the conclusion stays the same.

Meet the Dollar Cost Averaging Strategy

The Dollar Cost Averaging (DCA) trading strategy is where we actually divide our purchase amount equally into small portions, each portion will be bought at consistent intervals. These intervals can be once a week, once a day or once a quarter. There is a clear psychological advantage of buying using this method because we will be less worried about our buying price. DCA is aimed at long-term investment, and it is highly recommended for peace of mind investing in volatile assets such as Bitcoin. Another advantage of this method is that it is very suitable for payment investment, such as portion of our salary. It doesn’t require a large amount of money to invest, which is not available to everyone.

The disadvantage of the DCA method is that profit is not maximized in a bullish market. However, throughout history, there were periods during which investment by DCA on the American Stock Exchange yielded a higher profit than an investment using one lump sum. Another disadvantage is the persistence required to consistently purchase a fixed amount over time, even if you feel low and it’s very tempting to buy a larger amount, or vice versa.

DCA in Bitcoin since 2010: amazing ROI, relatively low risk

Analysis of historical Bitcoin data, carried out together with Bitrated’s Nadav Ivgi, produced some interesting conclusions. The analysis refers to exchange data Bitcoin since 2010, the days when Bitcoin was worth a few dollars, up to end of 2016. Intentionally, we ignored data from 2009 when Bitcoin was worth a few cents.

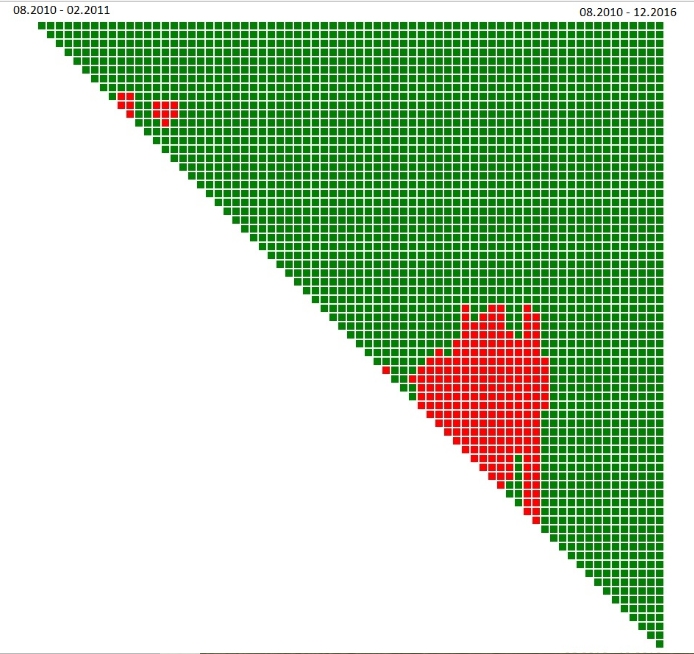

The analysis is based on model of investing through DCA, buying Bitcoins daily where the amount is fixed. It is interesting to see that the system has produced positive ROI in most points of entry and exit, and in fact, investing DCA for at least 2.5 years ensures a positive ROI for 100%. Even for those who joined Bitcoin in late 2013 at an all-time high of around $ 1,160. By the way, it’s amazing to find that those who persisted on DCA since August 2010 till December 2016 achieved an incredible 58,685% return on investment.

Explain to the above graph

Each square in the graph represents an investment period from August 2010 to December 2016, where the minimum period is six months. The color of the square represents the ROI: green means a positive return, red represents a negative return. The leftmost square on the top line represents the measured first period (August 2010 to February 2011, every day investing a fixed amount).

Each line begins in a new month, and each square further in represents another month. For example, the second square from the left side on the top row represents the return from August 2010 to March 2011. The first square to the left on the second row represents the return between September 2010 to March 2011.

The concentration of red squares occurred during late 2013 and early 2014, around Bitcoin’s first achieved all-time high. The second visit at this level took place over a month ago, at the beginning of 2017.

Epilogue

In summary, the DCA investing method is perfectly suited to long-term Bitcoin investment. The belief is that Bitcoin will continue to rise over time since the supply is limited. However, nobody can tell if now is a good time to join, or if the price is too high. The DCA investment method is ideal for this.