Nine Facts to Trigger Ripple Growth

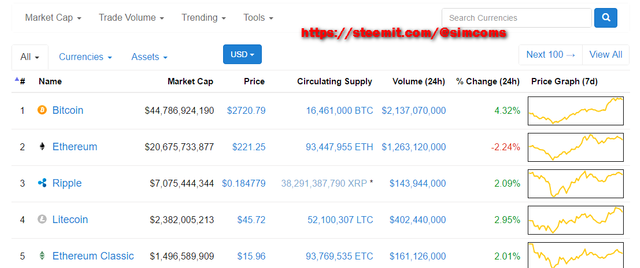

Ripple also known as XRP in the exchange market is currently ranking 3rd in the coin market and it really trending well.

Investing in cryptocurrency is not enough, you need to also also follow trending news and facts about such coin for maximum benefits.

Over the past few months, the world’s most famous digital asset, bitcoin, has had its share of the overall digital asset market capitalization drop by nearly half, from 80% to just over 40%. This is largely due to the rise of other digital assets that have driven the market’s total cap to break the $100 billion barrier.

Of these new assets, XRP is the one that is really turning the heads of market watchers and financial institutions. Since January, its value has surged from $0.006 to $0.30 by the end of May, while its growth of nearly 6500% since the start of 2016 compares favorably against bitcoin’s 700% increase.

The following Nine facts would trigger the price of Ripple (XRP) swiftly beyond investors imagination:

XRP is the only digital asset specifically designed for financial institutions and payment providers

A lot of digital assets lack a clear purpose. They may be used to store value, purchase commodities or for consumer transactions, but were not created with a single explicit application in mind. By contrast, XRP is specifically about the transfer of value and built for enterprises, making it one of the few digital assets with a real, clear use case as contained in its whitepaper.It acts as a bridge between fiat currencies

Some digital assets, like Bitcoin, aim to replace existing government-backed currencies. XRP works with fiat currencies on more than ten digital exchanges to help transfer value across borders quickly and efficiently.

For example, a Australian company needing to pay a supplier in China today would either need to pre-fund an account in China or go through a foreign exchange provider like a bank. Both options are expensive and slow.

With XRP, the company’s Australian bank or local payment provider allows the company to make the payment instantly and on demand. With no account pre-funding or foreign exchange fees, XRP makes for a faster, cheaper settlement.

Recently Japan and Thailand had a beta test of cross-border transactions using rippleXRP enables faster, cheaper and more reliable cross-border payments

XRP offers banks and payment providers a reliable, on-demand source of liquidity for cross-border payments. Today, it takes about 3-5 days to send money from one country to another through a bank, which usually involves high fees the risk of the payment being delayed (or never go through altogether). Alternatively, businesses can pre-fund nostro accounts in the recipient’s country, which ties up capital. XRP is part of a solution that fixes all these shortcomings, with an average settlement time of 4 seconds, at a fraction of the cost. By allowing financial institutions to source liquidity on demand, in real time, without having to pay foreign transaction fees or pre-fund nostro accounts, XRP will help them to expand into new markets, lower foreign exchange costs and provide faster payment settlement for its customers.It is part of an overall network solution for faster cross-border payments

Ripple is committed to solving the issues with cross-border payments and create an Internet of Value where we move money as efficiently as we exchange information. Our solution involves creating a common standard for payments and using XRP as the digital asset that will bring together currently disconnected ledgers and blockchains.It is Highly Secure

The XRP Ledger is where XRP transactions occur and are recorded. It is an open-source code base that is supported by a community of trusted validators and a team of full-time engineers that actively develops and maintains the ledger. Since day one, we’ve made the XRP Ledger more resilient and resistant to a single point of failure by decentralizing it, a process that continues today.XRP operates at a scale and speed far greater than Bitcoin

Bitcoin can process up to seven transactions per second, any of which can take more than two hours to clear. Compare that with a traditional payments service like Visa that averages 2,000 transactions per second and you can see that Bitcoin does not have the scalability to meet typical customer demands. The XRP Ledger processes more than 1,000 transactions per second and can scale to the same throughput as Visa, all in real-time.XRP is more sustainable than mined digital assets, like Bitcoin

Bitcoin is a mined digital asset, meaning that new coins are constantly created by huge datacenters processing complex math problems, or “proof of work”. This inefficient system demands massive amounts of electricity – the cost of producing one coin could power 3.67 US homes for a day – and has been called “unsustainable”. XRP is not a mined digital asset so every single unit of the currency that exists now has already been created, with most owned by Ripple (55 billion of which is held in escrow) and the rest held by companies and individuals.It’s easy to buy

There are different ways to buy XRP depending on who you are. If you’re a financial institution, it’s best to contact Ripple directly. If you’re an individual investor, you’ve got many ways to buy – you can visit any one of the digital exchanges that lists XRP and do it that way such as bittrex,gatehub, poloniexXRP is the Future

It’s a question of WHEN, not IF, banks and other financial institutions begin using digital assets in their day-to-day business operations and it will be interesting to see who the winners and losers in the digital asset space will be. We are confident that XRP will succeed because it has a purpose – enabling financial institutions to send money across borders quickly, cheaply, and easily – that is relevant to businesses and consumers everywhere.

I trust the above points has enlightened you about ripple and why you need invest in now ahead of potential growth.

For Ripple Wallet creation guide, Read https://steemit.com/steem/@simcoms/how-to-store-coins-securely-on-hot-wallet

Post other facts you know in the comment box.

As more updates unveil, i will post in the comment box.

XRP is centralized, controlled, pre-mined, and insiders own most of them and are dumping billions of XRP's themselves; one insider that left has billions and is allowed to sell millions of his XRP's every week. Also, XRP is not needed by banks to use, except using them for a small transaction fee. 100 billion circulation doesn't help either. This is why most in the Crypto world avoid XRP coin. It sounds like you were suckered into buying XRP for .20 cents + on their hype and you are left as a losing bag-holder. You should have bought $1900 Bitcoin last week if you gamble in Cryptos and you would have won - big time! Good luck!