RE: Lower debt ratio with conversion of SBD?

but this can't be right.

Correct! That was, of course, a mathematically daring thesis. Of course, I can't draw conclusions about the fundamentals from one case. :-)

Indirectly, the goal can already be achieved. If the amount of the conversion is large enough so that the minimum price falls below the current feed reported by the witnesses, the haircut price no longer has an effect and the debt ratio actually decreases. This confirms your "update".

But now I've asked myself whether it's possible to find out when that will be?

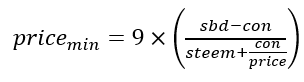

The formula for calculating the minimum price after conversion is:

- sbd = current_sbd_supply before conversion,

- steem = current_supply before conversion,

- con = converted amount (in SBD),

- price = conversion price

- price_min = minimum price after conversion

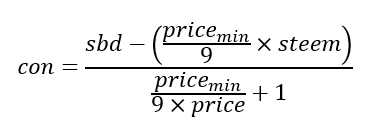

Converted to con, which is the converted amount:

I just didn't have the desire to convert this formula on my own, so I asked ChatGPT to do it - and only checked it.

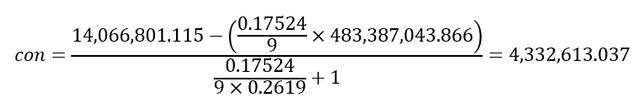

This allows us to calculate how much SBD needs to be converted in order to undercut the current STEEM price and thus actually reduce the debt ratio:

Let's take the current price of 0.17524 $/STEEM (which isn't the internal feed price) and the current global properties:

or for typing:

con = ( 14,066,801.115 - ( 0.17524 / 9 × 483,387,043.866 ) ) / ( 0.17524 / ( 9 × 0.2619 ) + 1 ) = 4,332,613.037 SBD

So if someone currently converts more than 4.33 million SBD, this reduces the minimum price to such an amount that the debt ratio falls below 10% and SBD are printed again.

Understandably, the necessary SBD amount changes inversely to the STEEM price.

Another interesting side-effect that I hadn't previously considered is that converting from SBD to STEEM would also reduce the range of variability in the

virtual_supplythat results from STEEM price changes, which would tighten the boundaries around the possibilities for future rates of daily STEEM production (when the STEEM price is above the haircut threshold).0.00 SBD,

0.40 STEEM,

0.40 SP

Oh yes... and we will see today another descent of the median price.

0.00 SBD,

0.37 STEEM,

0.37 SP

Median price, or haircut price?

This surprises me. I don't understand it, at all...

Something to do with SBDs being externally priced below a dollar plus conversion activity, I guess. But that's nothing like the way I was expecting it to work.

Unfortunately, I also don't expect to have much time to look at it in the near future. Hopefully I'll understand better before my next inflation post....

0.00 SBD,

0.39 STEEM,

0.39 SP

Currently both ;-) ...otherwise haircut price.

I had expected that. I had noticed that when I was researching my post. However, I would have expected at most a block delay until the debt ratio was back at 10%. But it obviously takes longer... I still don't understand why.

The next big convert will be filled in around an hour: https://steemworld.org/block/92968710/92968710-6

0.00 SBD,

0.71 STEEM,

0.71 SP

Fascinating. The SBD supply has declined by about 20% in a day and a half, and the haircut threshold has dropped by about 23%. I don't know how many conversions are still waiting to complete, but it will definitely be interesting to see what everything looks like when things settle down again.

0.00 SBD,

0.41 STEEM,

0.41 SP

Crazy! Moreover, the haircut price is already very close to the (real) median price...

My data source was steemdb.io: https://steemdb.io/labs/conversions

0.00 SBD,

0.35 STEEM,

0.35 SP

So far, STEEM trading volume looks a bit elevated, but it's not a huge increase by historical standards. I guess the volume of STEEM that left for exchanges is still a fairly low percentage, only around 2% or so.

Here are some graphs from the info in the steemdb.io page. Basically, it appears that 5 accounts cover a large majority of the conversion activity, and things have mostly settled down now.

As an aside: I think it might make sense for people to support the Reduced Inflation Proposal when SBDs are below $1 and the STEEM price is below the haircut threshold(?). No multikey magic needed to just burn SBDs.

0.00 SBD,

0.50 STEEM,

0.50 SP

I can't quite classify it all yet in terms of the market impact. I suggested among the witnesses that we consider whether we should take appropriate measures. It's just difficult to judge what measures would really be effective at the moment. I describe this as unhealthy markets at the moment (deposits and withdrawals are suspended on various exchanges, trading pairs are cancelled...).

But thanks for pointing out the proposal. That would currently be a third option for action besides the price feed bias and interest payments on SBD.

If you have any links to posts where I can get additional information about the witnesses' measures, I am always grateful.

0.00 SBD,

0.33 STEEM,

0.33 SP

I just hope we're not going to see a lot of selling pressure on STEEM after all those conversions. No idea what to expect.

0.00 SBD,

0.00 STEEM,

0.48 SP

Your content has been successfully curated by our team via @kouba01

Thank you for your valuable efforts! Keep posting high-quality content for a chance to receive more support from our curation team.