Satoshi Pie crypto fund heavily into ICOs to maintain lead over Ether

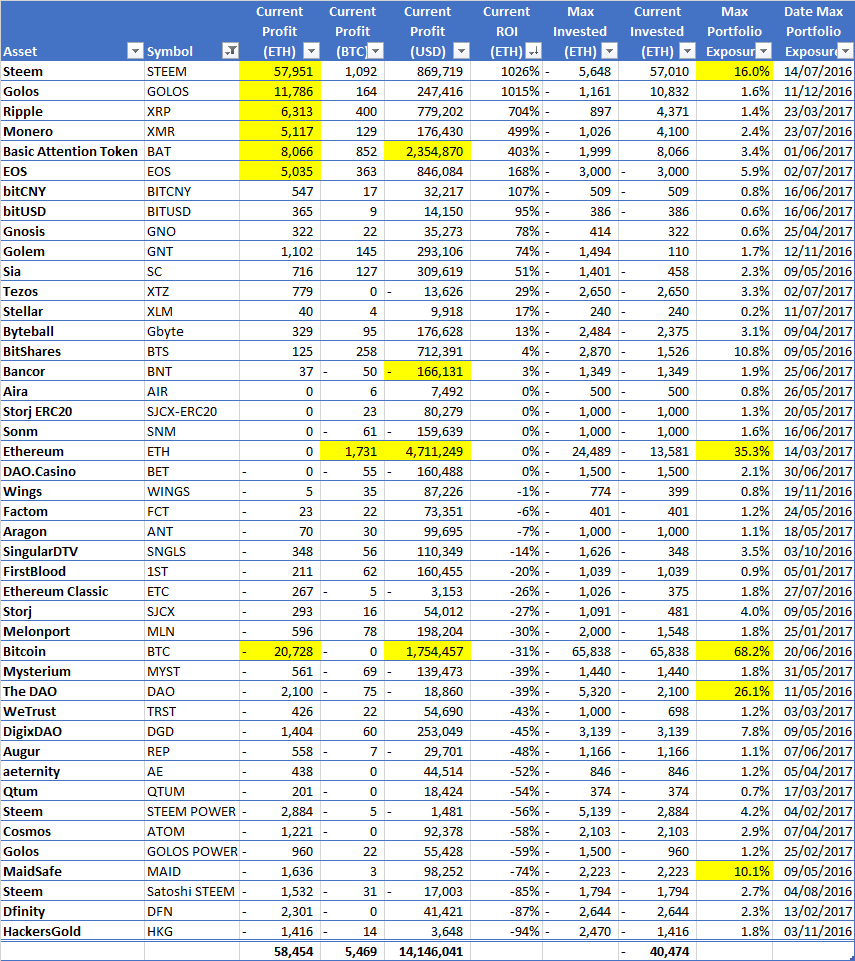

Satoshi Fund provides on their site a daily updated google spreadsheet showing Satoshi Pie’s portfolio composition from the first day they started (9 May 2016) until today (13 July 2017). Based on this I reviewed the profits (and losses) made on each asset. In below table you can see that the big profits in absolute USD terms were made on BAT, Ether and Bitcoin. The latter 2 obviously because of their high exposure. BAT was a quick 4x profit cashed directly after the ICO. Bancor is the biggest USD loss to date.

However, rather than using USD as a base, I am more interested to see how the investments did versus Ether, i.e. did they outperform Ether during the same period. Below table shows on the bottom the total ETH Profit and ETH Invested amount. The 98,929 ETH (USD 20,5 Mln) difference between these 2 numbers is the market value (Funds under Management) of the Satoshi Fund (matching with amount on their homepage). I also added the BTC Profit for comparison.

Below table includes an ROI proxy showing the performance of the asset relative to the max amount invested.

- SPIES earned 58,454 Ether to date, meaning SPIES outperformed an Ether buy and hold strategy by that amount. Or alternatively put, USD 12 Mln (= 58,454 ETH * 207 USD/ ETH) of the current USD 20,5 Mln Funds under Management mentioned above are due to returns in excess of an Ether buy and hold strategy.

However since the 10x Steem trade in the early days of the fund, which yielded 57,951 ETH, the fund has performed more or less at par with an Ether buy and hold strategy. USD 270 k (5,600 Ether) was invested around 23 June 2016 and sold for an equivalent of 64,000 Ether within 1 month’s time, coinciding with a large Steem price spike.[1] - A repeat of this 10x trade was made, albeit smaller, when Golos (the Russian counterpart of Steem) launched in Nov 2016 and SPIES invested an equivalent of 1,200 Ether.

- SPIES has invested in most of the Larimer family assets. In addition to Steem and Golos, investment were made into BitShares, bitCNY, bitUSD and most recently EOS. Note that SPIE itself is also listed on the OpenLedger exchange.

SPIE has made a number of ICO investments in recent months:

- Mysterium with ~1,500 Ether on 31 May 2017. Currently 29% under (Ether) water.

- BAT with 2,000 Ether on 1 June 2017. Sold completely with 4x profit in weeks thereafter.

- SONM, supercomputer organized by network mining, with 1,000 Ether on 16 June 2017. According to SPIE’s data the ETH price remained flat since ICO but liqui.io reports a 34% decline.

- Bancor with 1,380 Ether on 25 June 2017. Currently the largest USD loss of all SPIE investments but a 0% ETH ROI (i.e. Bancor dipped as fast as Ether in same period). Note that 18,000 BNT, which SPIE reports to be present on account 0x01A7d9fa7d0Eb1185c67e54dA83c2e75dB69E39f, can not be found by Etherscan on this account currently.

- DAO Casino with 1,500 Ether on 30 June 2017. ICO ongoing currently.

- Tezos with 300 BTC on 2 July 2017. Currently 40% above (Ether) water

- EOS with 3,000 Ether on 2 July 2017. Currently 168% Ether ROI

In general it will be challenging for the fund to keep its performance up. Whether the participation in a fairly large number of ICOs will produce another BAT-type-profit remains to be seen. Some will certainly not.

Please note that none of these observations have been checked with the Satoshi Fund and the analysis can contain errors. Therefore all comments and suggestions to improve are much appreciated.

Definitions:

“Current” = 13 July 2017

“Current Profit” = “Current Invested” + “Current Market Value”

“Current Invested” = Net cumulative amount for an asset of (i) purchases/ costs (as negatives) and (ii) sales/ revenues (as positives)

“Current Market Value” = Current Balance of an asset multiplied by Current Price of same asset

ROI = (“Current Profit”) / ( “Max Invested”) of an asset

“Max Invested” = Lowest Invested amount (i.e. when most was invested, because investments are shown as negative numbers) into an asset

“Max exposure” =Maximum share of portfolio value on any day in which balance of an asset was increased by more than 1% (i.e. a significant amount of assets were bought).

[1] The following article suggests the profit was created through a sale of the Steem tokens to the new Satoshi-Steem fund because SPIE couldn’t liquidate the Steem holdings when on 14 July 2016 SPIE exceeded the self-imposed 15% cap on illiquid assets.