Saddle.Finance: Your go-to platform for low slippage swaps for every corner of Defi optimized for stablecoins and WBTC across different EVM networks

Another good day to all here on cryptoverse! Here is your Mr. Decentralized again that is going to talk about a platform that is building another Defi lego block called Saddle.Finance. I am going to tell you as to why Saddle is different than any other AMMs out there and how it does make the computation of each trades advantageous for the traders globally!

What is Saddle Finance?

---> Based on my understanding viewpoint about Saddle, it is the decentralized AMM or the automated market maker for the swapping of different stablecoins and pegged-value crypto assets with minimal to no slippage if the liquidity is too deep and big for that particular pool and you are just trading a few thousands, the slippage is almost negligible. For the purpose of the said AMM, the AMM is a type of pool wherein there are no bid and ask on buyers and sellers but a computation of how many tokens on the pool depending on the pool's ratio. So depending on the demand of a particular asset such as WBTC or stable coins and other algorithmic coins, will be the slippage. More on to that later because I will tell you another feature of Saddle that will make this project unique unlike other AMMs around for quite some time.

Saddle Finance features and its SDL token features

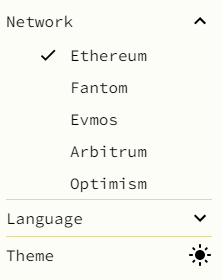

A. Multi-EVM cross-chain functionality

---> If you are going to see and check the Saddle Dapp here: https://saddle.exchange/#/ you will be able to see about 5 EVM chains that are online which are: Ethereum, Fantom, Evmos, Arbitrum and Optimism. Which means that depending on your budget for gas fees, Saddle exchange/ Saddle dapp got you!

B. Trading fees and other incentives

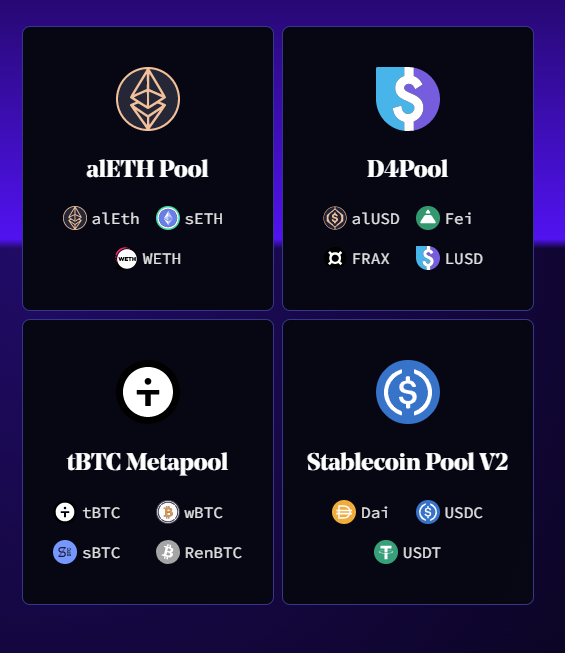

---> Being a liquidity provider has different incentives not just for the pool where they are participating into but also to them as a liquidity provider or also called as LPs. WIth Saddle, you can earn from trading fees and also external incentives from the pool where you are providing liquidity into. Take a look into these pools!

Depending on the pool that you are participating in, there will be SDL or the Saddle tokens for incentives as well being an LP. Amazing! Plus other incentives from the projects that are on the pool.

C. Advanced Features: Flash loans and Virtual swaps

----> When we say Flash loans, this is a type of loan wherein you are borrowing assets and giving it back with the same transactions with as well as trading the borrowed assets into other crypto assets that would make the liquidity pool conversion to be able to change its prices so that there will be a profit-making mechanism with the slippage. Most of the time, hackers do these flash loan attacks but Saddle Finance has mitigated these risks and with so huge pool in their ecosystem, the attacks could be virtually non-existent.

For the virtual swaps, it is a type of swapping aside from the flash loans. This is where the synthetic assets come into play so that the swapping huge amounts won't be a problem with different Defi protocols because there will be synths or synthetic assets that represents the assets in the pool and for the assets you wanted to get.

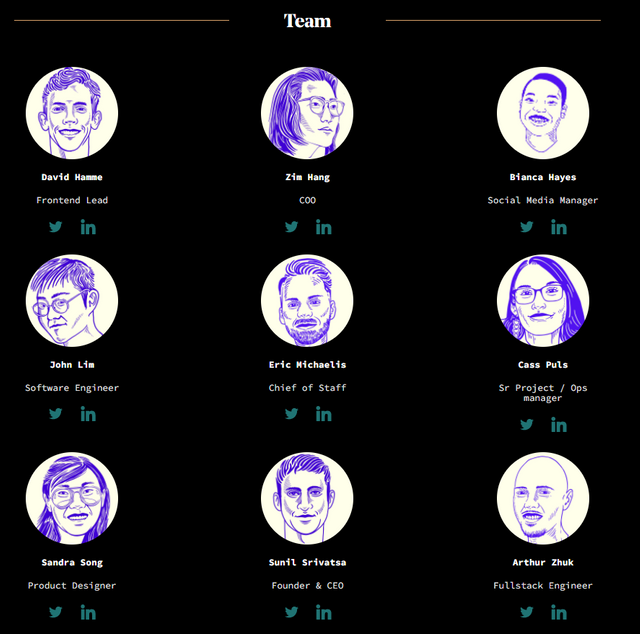

D. Built by legends of Defi Natives

---> Guys, in this times of uncertainty wherein there are so many different projects that are spawning now and then, you will be in good hands with Saddle Finance developers because they came from different Web 2.0 companies and is now also building the foundation of web 3.0

Imagine being a part of this boost in the internet ecosystem, it will be huge for all of us people!

Supports coming from the different aggregators for superior liquidity in Saddle Finance

The 3 Defi projects above also make it possible to have routing of different stable coins and WBTC for the Saddle finance users to easily swap different stable coins and algorithmic stable coins to be swapped easily and with the most minimal slippage especially for the biggest trades. Depending on the amount of trade, there will also be trading fees being distributed to the Saddle and those 3 defi projects above that makes this huge of a liquidity possible.

AUDITS

The Saddle Finance team has their smart contracts get audited by the best in the industry. The big 3 which are:

A. Certik: https://github.com/saddle-finance/saddle-audits/blob/master/10-29-2020_Certik.pdf

B. OpenZeppelin: https://blog.openzeppelin.com/saddle-contracts-audit/

C. Quantstamp: https://github.com/saddle-finance/saddle-audits/blob/master/12-09-2020_Quantstamp.pdf

Layer 2 solution and its pools

https://saddle.exchange/#/pools

If you want to get some Saddle Finance, be an LP in the pools above and be able to get some SDL emissions as time goes on.

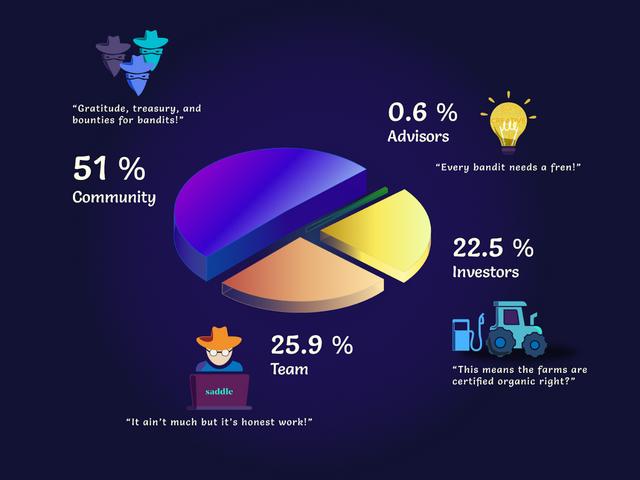

The SDL token

The Saddle token will be the governance token in the Saddle Finance ecosystem. With the Saddle token, you can propose and vote for the forward and improvisation of the Saddle ecosystem. If you held a lot of tokens, you can be a whale and be able to affect the protocol and the ecosystem. You can see the documentation about the tokenomics here:

https://docs.saddle.finance/sdl-token

This is the link to the source code of the Saddle token: https://github.com/saddle-finance/saddle-contract/blob/master/contracts/SDL.sol

While the graphs for dune dashboards are here:

https://dune.com/alphast0rm/Saddle

Building with Saddle

---> Because the Saddle Finance is open-sourced, anyone can build on top of it and be able to collaborate with the Saddle team and be able to interchangeably make the functions workable on both Saddle finance Dapp and the one being built on top of it. You can check out the projects that adapted their system and code plus their well-known investors here:

https://docs.saddle.finance/build-with-saddle

SADDLE FINANCE TEAM

My takeaways for the Saddle Finance:

---> The DEFI ecosystem is just starting. And we all know that these projects will flourish more because they are the one that has the liquidity for stablecoins market and be able to give the liquidity providers the incentives needed to have the total value locked or TVL to increase as time goes by. This is why community acts as a decentralized governor in this ecosystem. Flash loans and the synth swaps are necessary for the Defi to grow globally. I am seeing that Saddle finance team will introduce Saddle to our unbanked brothers and sisters in Africa and those who are in the native tribes to skip the typical banking and finance to decentralized finance. As what I mentioned awhile ago, the team comprising it are from the best web 2.0 companies and is shaping the web 3.0 now. It is up to you if you wanted to build with them and invest with them because for sure, this is going to be the future.

For more information about the Saddle ecosystem and if you have other questions, you may read and reach out to them in the following official social media links and documents here:

Website: https://saddle.finance

Documents: https://docs.saddle.finance/

Blog: https://blog.saddle.finance/

Dapp: https://saddle.exchange/#/

Twitter: https://twitter.com/saddlefinance

Defipulse: https://www.defipulse.com/projects/saddle

Discord: https://discord.com/invite/saddle

Github: https://github.com/saddle-finance

Telegram: https://t.me/saddle_finance

Snapshot: https://snapshot.org/#/saddlefinance.eth

Saddle Forum: https://www.saddle.community/

About the author:

Non-technical

Saddle Stallion: frankydoodle#2263