SLC S21W5: "Amazon Affiliate Income and Deduction

Hello friends and welcome to my article in the SLC: S21W5 and I would be well detailed in explanations.

Tax rates are quite important and readily available in any state, for self-employed citizens, it is equally a prerequisite, I would be sharing these rates for self-employed citizens. In Nigeria all self-employed individuals are all deducted to the Personal Income Tax(PIN) under Personal Income Tax Act(PITA) in the constitution. These rates are progressive annually.

| Annual Income Tax | Tax payable Annually | Rate |

|---|---|---|

| 300,000 | 21,000 | 7% |

| 300,000 | 33,000 | 11% |

| 500,000 | 75,000 | 15% |

| 500,000 | 95,000 | 19% |

| 1,600,000 | 336,000 | 21% |

| 3,200,000 | 24% |

Amazon Affiliates income is considered Self Employment or Business Income, We deduct legitimate expenses related to earning income as;

Advertising or Promotional Costs

Internet & Hosting Fees

Professional Services

All these synchronise to deductions which are valid exclusively for business purposes and properly documented. Non-business related expenses are non-deducted.

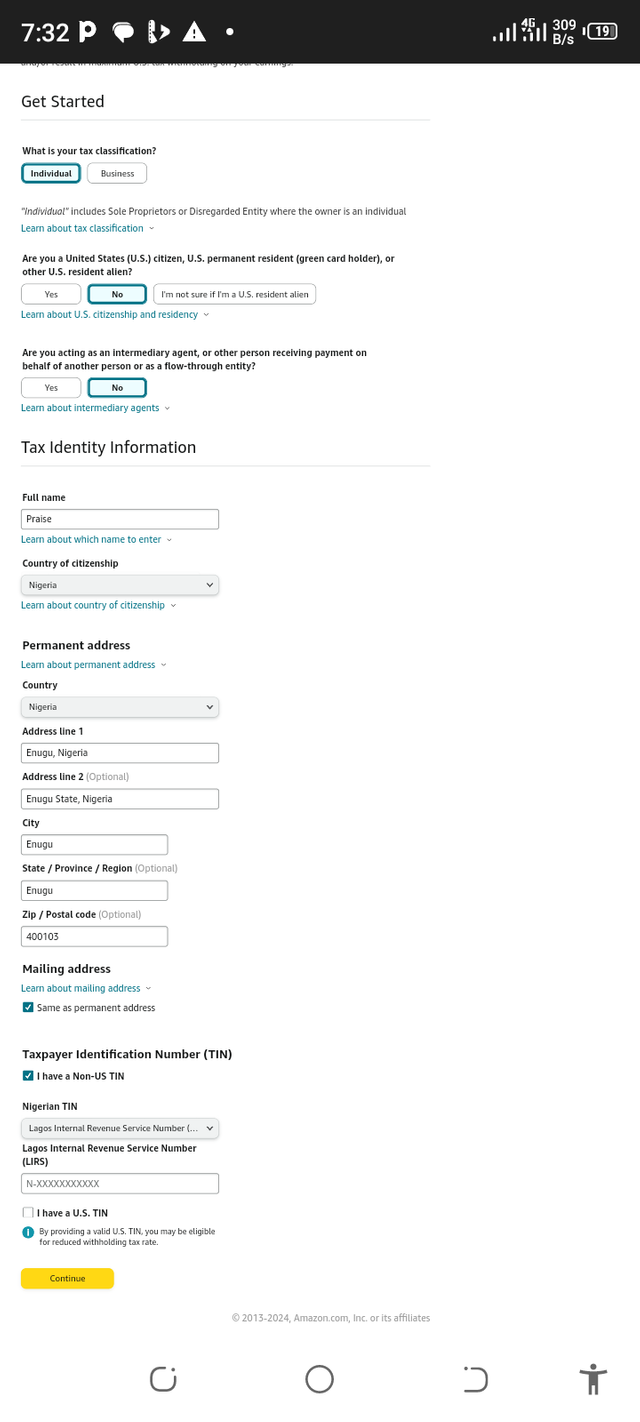

Submission of W-8BEN form (For Non-Resident)

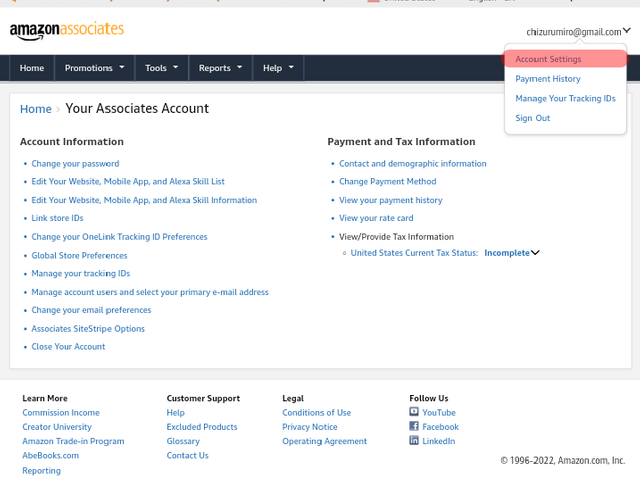

STEP 1:

Log into Amazon Affiliates Account

STEP 2:

Access Tax Interview, Navigate Settings, Account Into

STEP 3:

Select Tax Information and click on View /Provide tax information

|  |

|---|

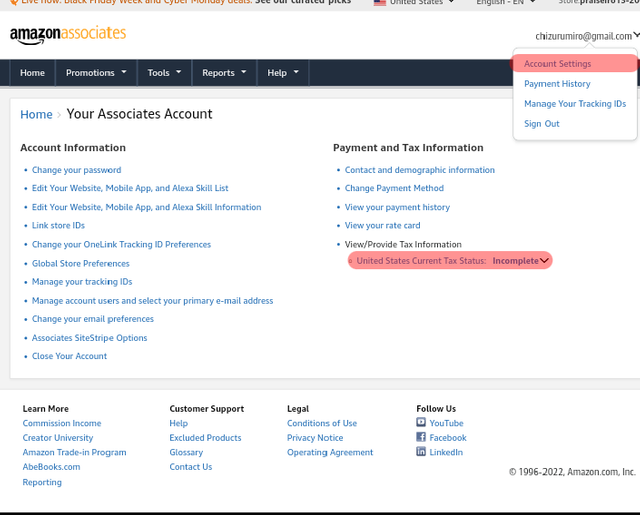

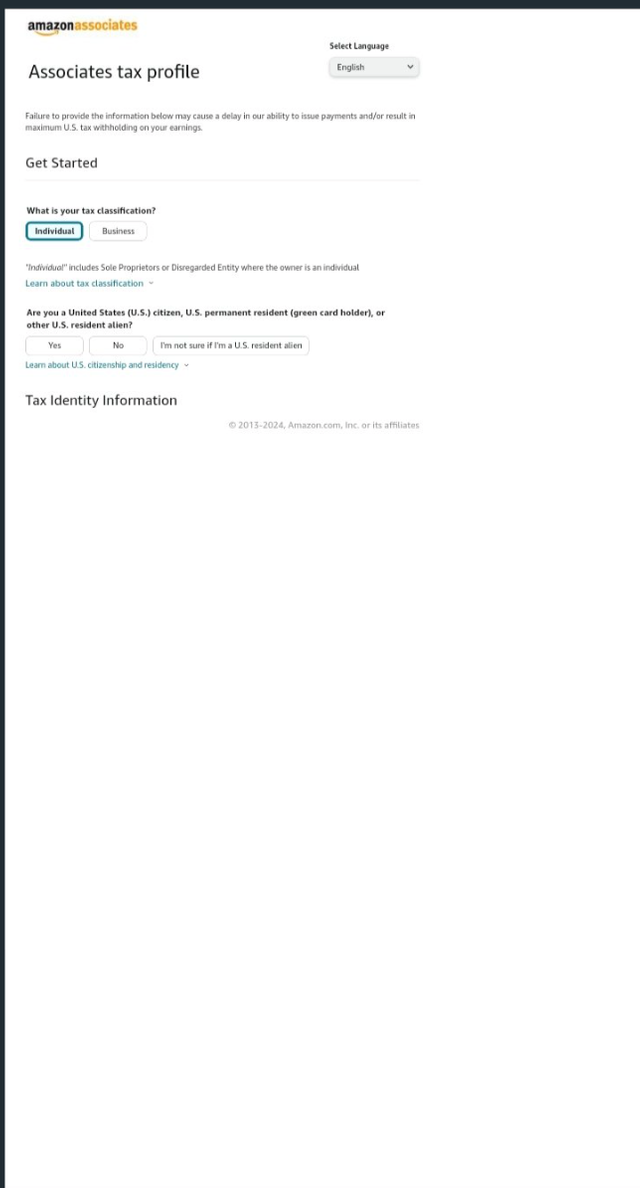

STEP 4:

Choose W-8BEN From selecting W-8BEN form required for individuals or entities outside U.S where I belong. Fill in your legal name country of and local tax identification number.

STEP 5: Verification of details and submission of form, thus the process completed.

|  |

|---|

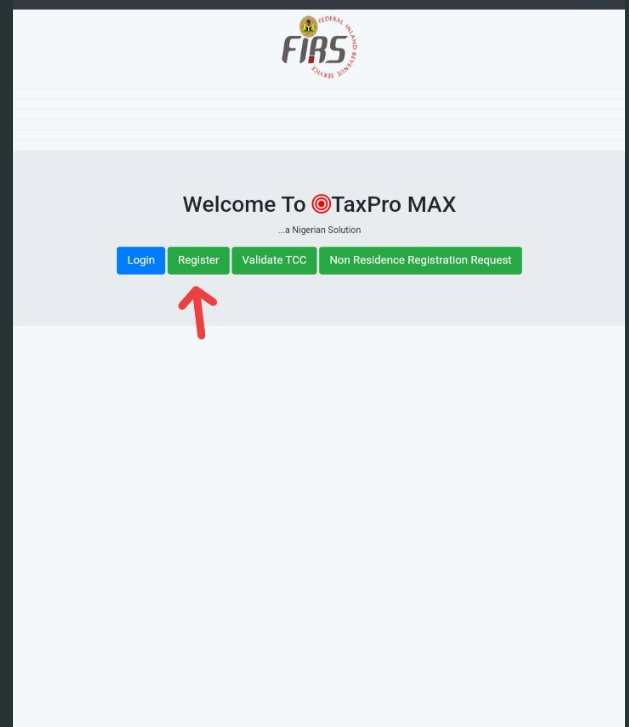

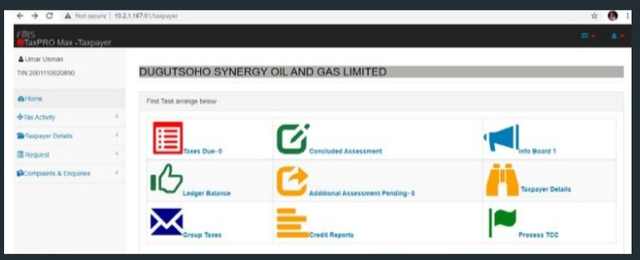

Filing taxes can be done using the Federal Inland Revenue Service [FIRS] website which would aid your glide your way through the process effectively.

Visit official FIRS website source

|

|---|

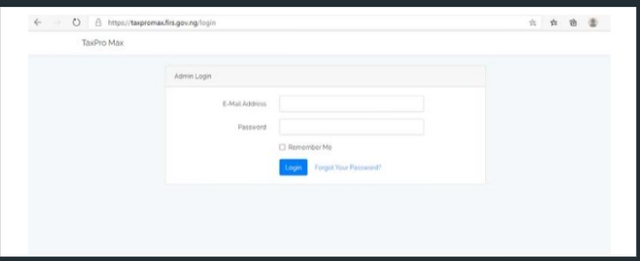

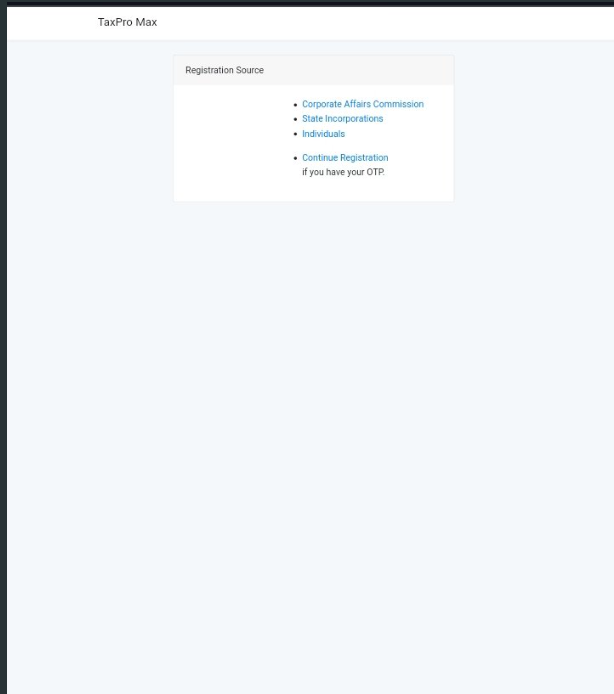

If account is missing you sign up and fill in the required field, including your Taxpayer Identification Number, email and other information. Account activation required email verification from the taxation body, and following due instructions.

|  |

|---|

You must have records of revenue or annual income, tax payer Identification Number [TIN] Proof of tax relief for individuals and deduction for businesses. Financial statement of business registration.

|  |

|---|

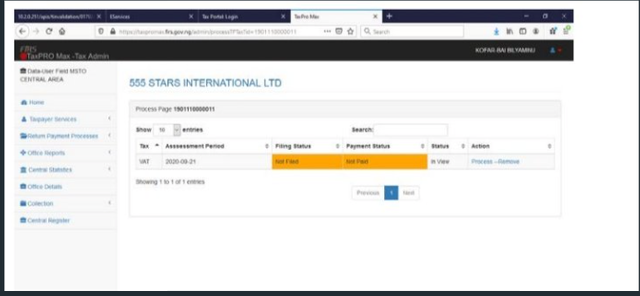

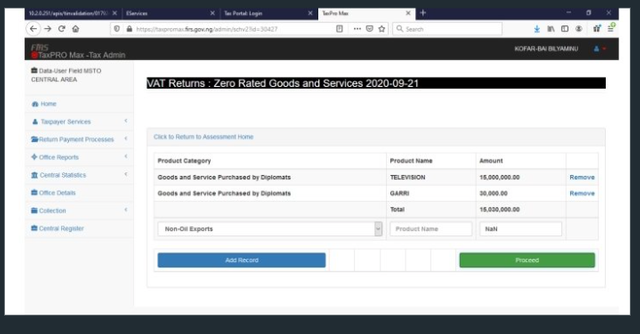

On already documents you log into Tax pro max portal, inputting your details in each field.

|  |

|---|

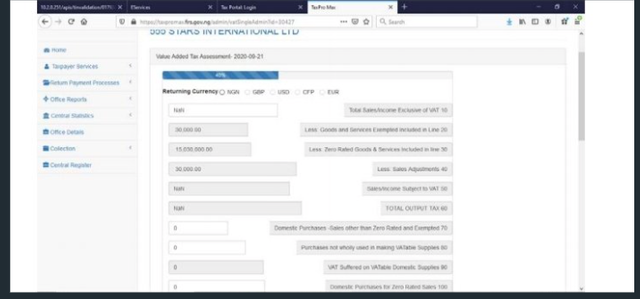

Select Tax type to file Personal Tax for self employed tax player and VAT or WHT for business withholding tax.

|

|---|

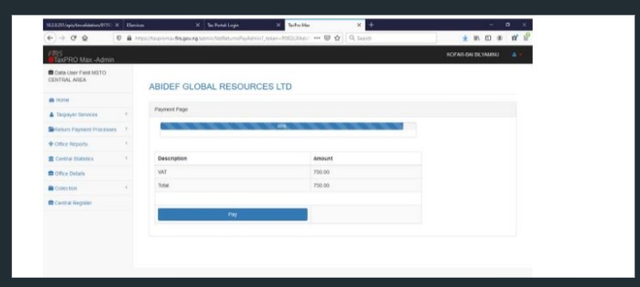

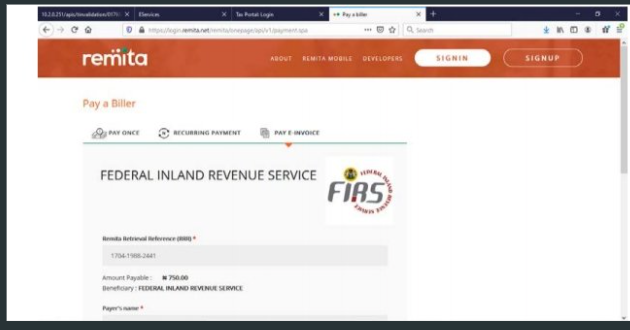

Submit Return One you are satisfied with information click submit. After submission generate remita retrieve references (RRR) fo payment you can pay online or other financial institutions. After payment obtain tax clearance certificate and you are good to go!

Reflection; Importance Of Tax Management

if tax record are not reported cordially there would be allegations of infringement if government regulations leading to series crime threat.

It track records of earning and spending and this regulates finances, aiding in financial growth and track of cash flow of through basic budgeting and business planning.

It maximizes credibility making entrepreneur to be professional in running business building there entrepreneur to managing greater business.

I learnt from the Process...

Tax lawz relevant to online earning can help make informed decisions which could grow business eventually.

Budgeting and concise spending is a route to making wholesome profit from business. Discipline of taxation where it is incorporated into daily activities world definitely assist in growing the world of business and otherwise.

Cc;

@hamzayousafai

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

To enhance the overall impact of your assignment in the future focus on adding more detailed reflections and ensuring all required components like attachments are included.

Total | 9.3/10