💵The dollar will continue like oil, rising 💸

In 2014 the parallel between the currency and the raw material was 90% negative, while in 2018 it happened to have a positive correlation of 20%.

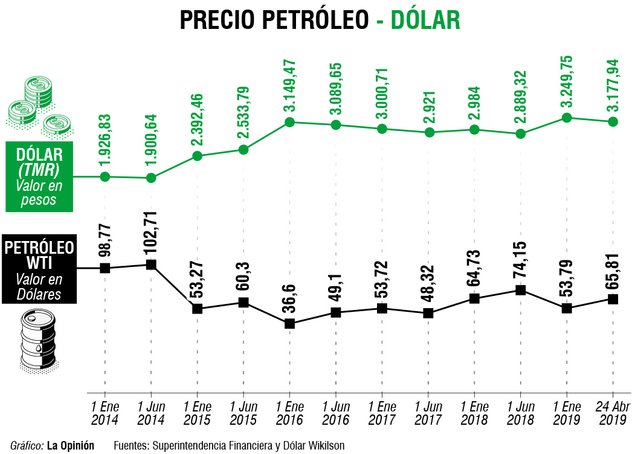

The rise of oil, the exit of the United Kingdom from the European Union (brexit) and the global economic slowdown, especially China, are some of the factors that will make the value of the dollar against the peso continue to rise in the second half of 2019 . Regarding the crude market, the correlation between the WTI reference barrel traded on the New York stock exchange and the dollar shows positive percentage changes that were not recorded before. In previous years, oil and the dollar maintained an inverse relationship, that is, while the price of one asset rose that of the other, it fell. Sebastián Salgado, founding partner of the Banca de servicios Finanvalue, explained that in 2014 the parallel between the currency and the raw material was 90% negative, while in 2018 it happened to have a positive correlation of 20% and in 2019, of 71% . He added that thanks to these variations, the market, in general, is paying attention to the movement of the oil industry. It should be noted that when talking about a positive impact between the relationship of these assets, it means that both are increasing their price. According to Raúl Moreno, equity analyst at Global Securities, the behavior of oil prices is at its highest level of the year, due to the sanctions that the United States will impose on the countries that buy oil from Iran. This measure resulted in a recovery and revitalization of oil as there was a high demand for Iran's exit from the oil market. Sergio Clavijo, director of the National Financial Association (ANIF), in the document 'Global oil cycles: what to expect for 2019 and 2020?', Pointed out other supply factors that have to do with the moderate recovery in oil prices. Among them: the new announcements of bigger cuts of the Organization of Petroleum Exporting Countries (OPEC), whose goal was fulfilled in more than 100% in January, the sanctions of the United States to Venezuela and a greater production of the Anglo-Saxon country, being the main global producer with 11.9 million barrels per day at the end of 2018, displacing Saudi Arabia and Russia. Against the political background, analysts consulted asserted that the US government intends to end the arms race by restricting the flow of money that Iran collects from oil to finance the wars in Yemen.

Deceleration risk Raúl Moreno, of Global Securities, considers that the Colombian peso against the dollar has been separating from oil "since worldwide exports of the product went from 40% to 20%". The analyst affirmed that this situation does not only occur in Colombia. Currently, the movement of the dollar is linked to the DXY index, which ponders the behavior of world currencies against the US currency. "At this moment, the euro has more impact against the cost of the dollar and the currency has strengthened because people are looking for riskier assets," said Moreno. He added that the next semester, the dollar will be more volatile due to risks of a global economic slowdown and a possible decline in the economy in countries like Germany and the already existing recession in Italy. "The alarms are on because Europe and Asia could enter a cycle of economic decline and when this happens central banks tend to make political decisions of interest, which influences the behavior of the dollar," said the expert. The stock market commissioner assured that if there is a global setback in trade and industry, there would be strong upward pressure on the exchange rate, that is, the dollar would reach levels of 3,300 pesos in the market. However, Moreno indicated that this possibility would fit, as long as, the aforementioned event materializes and, also, depending on whether the Federal Reserve (FED) tone changes, since today his position is patient before the topic. On the other hand, Sebatián Salgado added that the commercial opening led by Donald Trump has given way to the large American oil companies to wipe out the increase in shares and, subsequently, contribute to the rise of the dollar. The banker from Finanvalue clarified that despite the end of the inverse relationship between the dollar and crude oil, the increase in the foreign currency will maintain a correlation with oil, as the industry markets have undergone changes and now it is the United States that commands Stop at that trade.

Although the first months of the year have been characterized by relative calm, the second half of 2019 will bring volatility for the dollar not only because of the possible global slowdown but also because of political and commercial issues. Among the factors that will influence the rise of the currency is the resolution of Brexit, this is a political process that is ongoing and that seeks the exit of the United Kingdom from the European Union (EU). The nations, which have been making dialogues to prevent the separation from producing a negative economic transition, will have until October 31 to give a solution to the commercial issue. Although for the moment the issue is asleep for the term agreed, analysts say that if in the future there is a strong break it is likely that European trade will be affected, and weakening would present a rise in the dollar, taking into account the increases that the currency had before the new agreed limits were known. Regarding the issue of powers, we must remember that China, Europe and the United States mark the global growth. According to economic data released last week, Diego Franco, president of the investment organization Franco Group, says that China's economy, in its absence, showed a much lower decrease than expected in the market; when this happens, the nervousness seizes the trade and the purchase of the dollar increases, since the currency is taken as a refuge asset in front of complex income scenarios However, he clarified that the future of the dollar is uncertain due to the instability of foreign economies.

Спасибо за пост в #ru

Поддержано!

Congratulations @sincensura! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

@steemitboard gracias 👍

100%activo