Earning RBS tokens in the newly launched DEFI protocol RobiniaSwap - Day 2

Earned RBS tokens as LP rewards for my deposited BSteem in RobiniaSwap

What’s nice about LP tokens is that one can earn it free by depositing your crypto into DEFI liquidity pools and earning LP rewards for it.

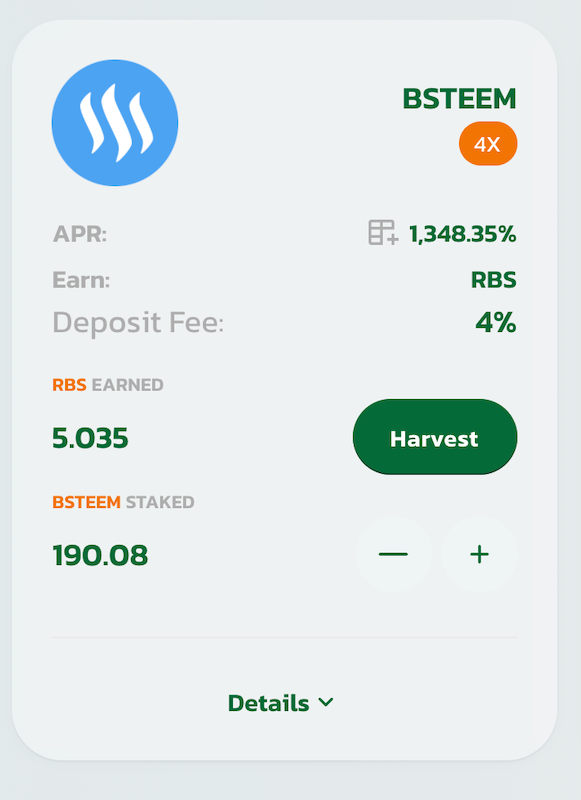

Yesterday, RobiniaSwap launched and I deposited my Steem tokens into the BSteem pool in RobiniaSwap. I have earned RBS tokens which are the native tokens of RobiniaSwap as reward for depositing my BSteem into the BSteem pool.

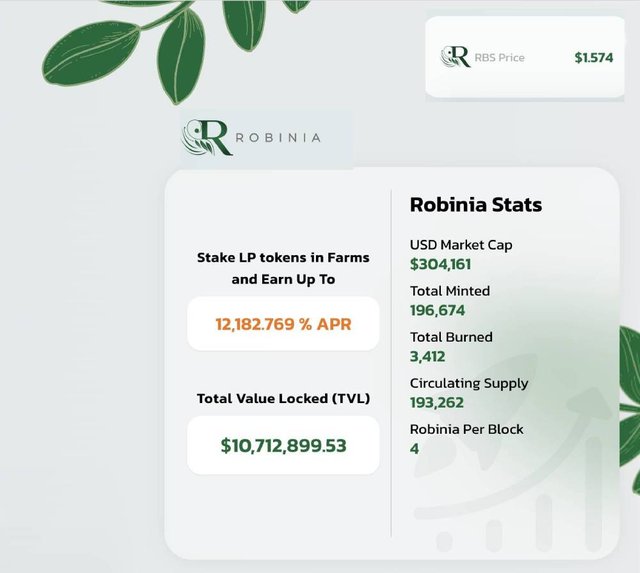

This is pretty sweet of course, however, I will be earning less and less RBS for this BSteem that I deposited as the emission rate of the RBS token keeps decreasing daily since its launch. Yesterday, the emission rate of RBS was 5 tokens per Block and today it has decreased to 4 tokens per Block.

Obviously, early investors of RobiniaSwap will benefit from earning more RBS tokens for their crypto deposit. After 32 days, the emission rate of RBS token will settle down to 0.5%, after which RobiniaSwap’s emission rate will be decided through Governance vote.

I have detailed how I have deposited my Steem into RobiniaSwap’s BSteem pool in this article -https://steemit.com/defi/@mintymile/steem-token-enters-the-world-of-defi-thanks-to-robiniaswap .

These earned RBS rewards are Liquidity rewards for providing liquidity to BSteem pool

Now, DEFI newbies may wonder why DEFI protocols like RobiniaSwap give rewards for depositing their crypto into pools. This is because RobiniaSwap is also an AAM dex, similar to Binance Smart Chain’s PancakeSwap. An AMM dex is short for Automatic Market Maker Decentralised Exchange. Here, crypto traders can swap their tokens for another token. There is no order book, instead liquidity for cryptos that are getting swapped and sold comes through cryptos deposited by DEFI investors into liquidity pools.

For instance, by depositing BSteem into RabiniaSwap’s pool I have provided liquidity for BSteem. So I have contributed BSteem to the pool which is essential for ample BSteem crypto volume in RobiniaSwap as this ensures that enough BSteem is there in RobiniaSwap platform for a trader to buy it through swapping another crypto for BSteem. Therefore, I earn RBS tokens as an incentive for providing liquidity to the RobiniaSwap DEFI protocol.

RBS tokens used in the Governance mechanism of RobiniaSwap

DEFI protocols are governed by a Governance Mechanism, where token holders of the protocol vote on proposals and influence the protocol’s development decisions. In the case of RobiniaSwap, RBS holders can participate in protocol’s Governance in aspects like determining the emission rate of the RBS token etc.

DEFI, involves the direction of a protocol to be determined by the community rather than decisions of the protocol’s modifications and development be taken in a centralised way without involving community by the team or heads of an Organisation.

RobiniaSwap functions in a way to add value to the Steem Blockchain. It’s great that Steem token is a crypto that’s used in this DEFI platform but there are more ways by which Steem value gets enriched by this protocol.

I would discuss this in my next article, in another day.

Thank you for reading my article.

Disclaimer - These are my novice impressions of Robinia Swap, everyone should do their own research before putting their money on any DEFI product. My article is not investment advice.

Website - https://robiniaswap.com/

Twitter - https://twitter.com/robiniaswap

Documentation - https://blokfield.gitbook.io/robinia/

@tipu curate 4

Upvoted 👌 (Mana: 0/4) Get profit votes with @tipU :)