Ripple (XRP) Valuation and Price Target Analysis

XRP has had a very strong run recently, driven by positive news flow. At a market capitalization of $56.7 billion, XRP is now the third largest cryptocurrency. I believe XRP has a place as part of a diversified portfolio of cryptocurrency investments, with an attractive return-to-risk profile as outlined below.

Overview

The Ripple network is an enterprise blockchain-based, cross-border payments and settlement solution for financial institutions. The digital currency of Ripple is XRP, which acts as a bridge between fiat currencies during a transaction and provides immediate liquidity. The value proposition of Ripple is that international payments can be settled in a matter of seconds with a very low cost on its network, versus a matter of days at a much higher cost for an international payment facilitated through current methods(1).

Analysis and Valuation

Per www.coinmarketcap.com at time of writing, the price of XRP was $1.46 on 12/28/17, which corresponds to a market capitalization of $56.7 billion. There are now over 100 financial institutions that have signed up for the Ripple network(2). By comparison, there are over 11,000 financial institutions using the SWIFT network(3), which Ripple is expected to replace. With less than 1% of global financial institutions currently signed up for Ripple, there appears to be significant upside as adoption increases.

According to an analysis completed by the Bank for International Settlements, trading in foreign exchange markets averages roughly $5.1 trillion per day(4). The demand for XRP ultimately will be driven by its usage as a bridge currency to facilitate foreign exchange on the Ripple network. It would seem as if Ripple’s ultimate value would be a binary event - either Ripple emerges as a better solution to the current FX network and takes a large share of daily volume, or it fails.

In my opinion and as discussed further below, there is at least a 50/50 chance that Ripple proves to be a better solution and takes significant share of FX transactions. This sentiment is supported by the fact that at least 100 financial institutions have signed up for the platform, and there has been significant interest expressed in the potential of this network.

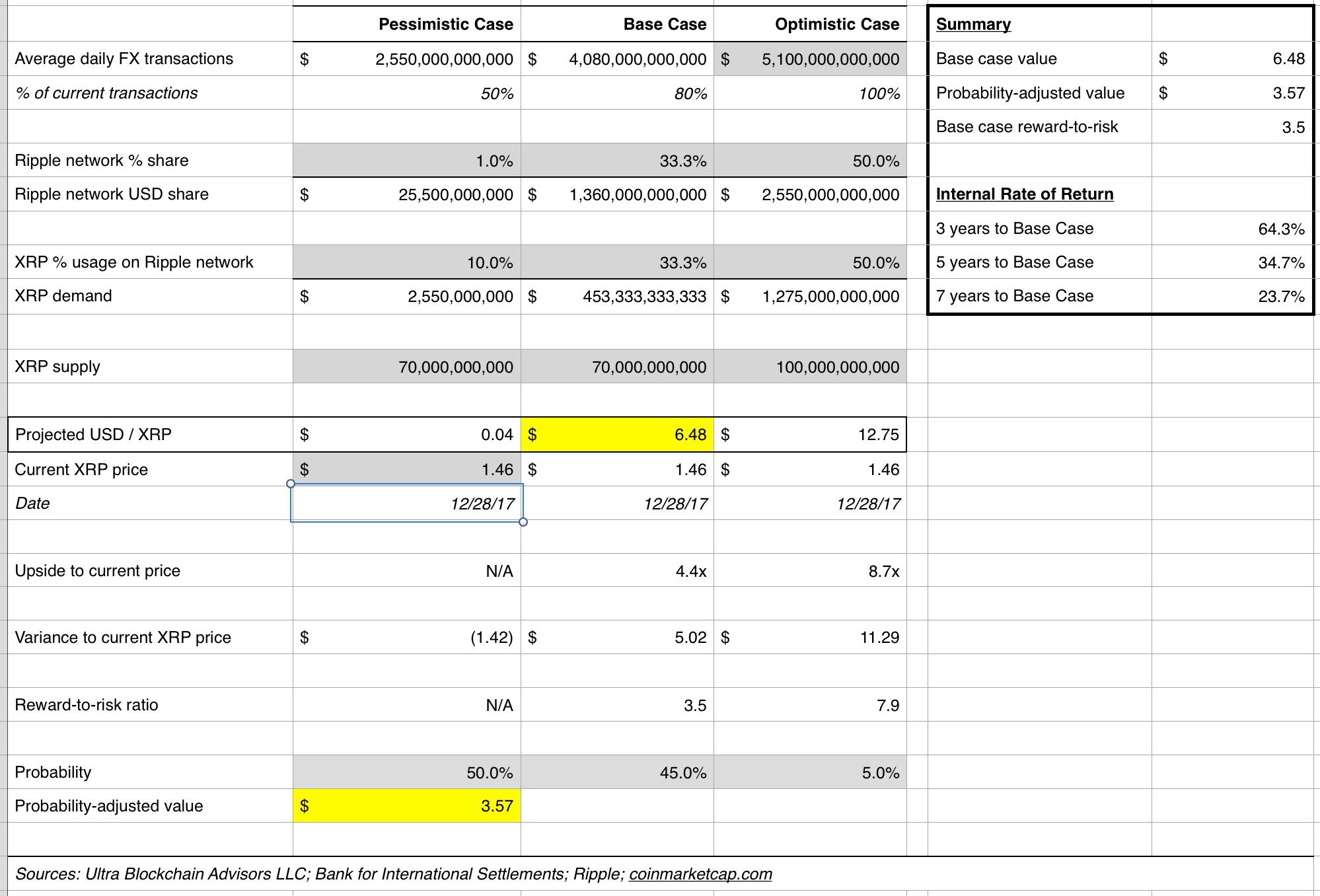

In the analysis below, I outline 3 scenarios, which include “Pessimistic Case,” “Base Case,” and “Optimistic Case” scenarios. Under my Base Case valuation, average daily transactions decrease (as other cryptocurrencies eat into this volume), and the Ripple network takes a 1/3 share of this market. While it is optional for participants to use XRP as the bridge currency, I assume that XRP is used in 1/3 of the transactions facilitated on the Ripple network.

One item to note is that the current outstanding supply of XRP is roughly 38.7 billion, and Ripple will place 55 billion XRP in an escrow account at year end 2017. The escrow account will release 1 billion XRP per month over the next 5 years, with any unused XRP going back into the escrow account(5). My Base Case and Pessimistic Case analyses assume that 50% of the amount to be released per month will actually be absorbed back into the escrow account, such that the outstanding supply of XRP stands at 70 billion by the end of 2022. The Optimistic Case scenario assumes the full 100 billion possible supply of XRP is outstanding within the next 5 years, as would likely be the case if adoption skyrockets.

My Base Case valuation for XRP is $6.48. This represents 4.4x upside to the current price of $1.46. In the chart below, I include a summary of the average annual rate of return (or IRR) implied by my Base Case valuation, assuming it takes 3, 5, or 7 years to transpire. If the Base Case price target of $6.48 is hit in 3 years, then the IRR would be 64.3% [caveat: this number could increase (or decrease) if the actual supply of XRP is lower (or higher) than my 70 billion estimate].

I assume a 50% probability for the Pessimistic Case, 45% probability for the Base Case, and 5% probability for the Optimistic Case. With a 1 in 2 chance of either the Base Case or Optimistic Case scenario unfolding, and a return of 4.4x (Base Case) or 8.7x (Optimistic Case) possible under these scenarios, there appears to be a very attractive reward-to-risk ratio for XRP investors at this point in time. The probability-adjusted price of XRP is $3.57, which also implies that investors are being well-compensated for the risk of XRP the current price level of $1.46.

Conclusion

XRP appears to represent an attractive return-to-risk profile, based on a forecast of its 3-5 year potential. There could be some dilution in the near-term, as up to 1 billion of incremental XRP could be released on the market per month over the next 5 years. However, this potential dilution from an increase in supply could be more than offset if adoption of Ripple and XRP scale at a faster rate that what is assumed in my analysis. XRP has had a strong run up in price recently, but the long-term upside appears attractive.

Footnotes:

(1) https://ripple.com/insights/fundamentals-of-xrp/

(2) https://www.cnbc.com/2017/10/10/ripple-has-over-100-clients-as-mainstream-finance-warms-to-blockchain.html

(3) https://www.swift.com/about-us/discover-swift?AKredir=true

(4) https://www.bis.org/publ/rpfx16fx.pdf

(5) https://ripple.com/insights/ripple-to-place-55-billion-xrp-in-escrow-to-ensure-certainty-into-total-xrp-supply/

Congratulations @ultrablockchain, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that @originalworks will get great profits by following these simple steps, that have been worked out by experts?

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content!

Your post was approved by me. As reward it will be resteemed by a resteeming service.

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Congratulations @ultrablockchain! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP