So What's Been Going on with XRP? - An Interview with Ripple's (XRP) Chief Technology Officer

In the last couple days Stefan Thomas, Chief Technology Officer at Ripple, was interviewed by the Huffington Post discussing the recent boom of the cryptocurrency as well as concerns they've heard from others when bumping heads with the centralized, fiat banks.

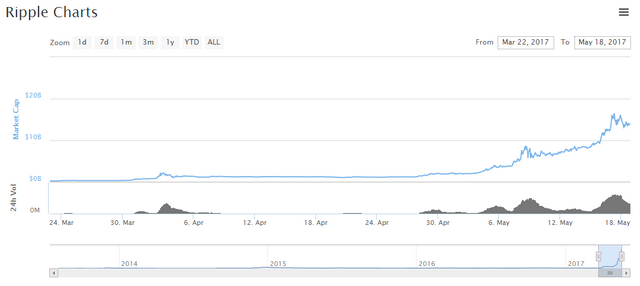

I personally remember a couple months ago when Ripple was trading at a few pennies. But since then the coin has gone from having a market cap under $1 Billion to now being over $10 Billion! I've seen this increase in price, now at a bit over 35 cents since then and while knowing that it was a crypto used by banks to move funds around, I was curious to see why it's been jumping up to this level.

Ripple works with banks to transform how they send money around the world — a necessary step to compete in today’s growing economy. Our vision is to enable the Internet of Value so the world can move value the way it moves information today.

Source: Ripple Website

What is Ripple?

Now before getting into the interview itself, it's worth pointing out the distinction between Ripple and the Ripple XRP coin. Ripple is the protocol that's run by the banks, allowing them to transfer any type of asset between them, whether it be a money (US dollar, Euro, etc,) or even more non-monetary things like airline miles. The huge benefit for the banks that use this is that their transactions which typically took days is completed often within a second.

What is the Ripple XRP Coin?

XRP is actually issued by Ripple Labs and is a form of cryptocurrency that can be traded and it’s not “mined”. So there is a finite number of ripples and that amount is actually issued by the company behind Ripple called Ripple Labs.

Source: BoxMining.com

XRP is the actual currency that is used within the Ripple network. Instead of actually being mined, Ripple Labs decides how much of the currency is released into the market. Right now only about 40% of the coins have been put on the market. While the creators of Ripple hold 20%, the company can decide when to release portions of the other 40%.

Ripple Labs is actually a company and this is very different from Bitcoin, where Bitcoin is fully decentralized and doesn’t have a central controlling authority. Ripple Labs is registered in many countries and it could be sued and held under police custody. This is again very different from other technologies.

Source

On to the Interview with Ripple CTO, Stefan Thoma

Many only see the surface growth, without digging into the facts. Those who see it as a bubble about to pop are the ones who don’t understand what XRP actually is and what Ripple is doing with it. They say things like:

“Their bank partners won’t be using XRP!” “It’s centralized!” “The supply is unlimited and will hyper-inflate!”

-Source: Huffington Post interview with Ripple CTO

Stefan Thomas breaks this down, essentially refuting each part of that statement.

First he brings up that the XRP coin is (and will be) the only coin used by Ripple, meaning that success of the company (and it's protocol) go hand in hand with the success of the coin. They won't be putting out any competing coins themselves.

Next he refers to the concerns over XRP being controlled by a centralized entity, compared to the more widely seen and accepted decentralized cryptocurrencies. Thomas makes reference to a blog post he published on Ripple's website last week discussing this matter. It says they have had the goal to be more decentralized than Bitcoin from the start and have been slowly ramping up on this as time has gone along.

Our strategy to further decentralize RCL consists of two components:

- Diversify validators on Ripple Consensus Ledger (RCL)

- Add attested validators to Unique Node Lists (UNLs) [with a focus on security versus pure mining power]

One piece that I didn't know myself is that XRP is deflationary (on top of having a finite supply,) with a small portion of the coin being permanently destroyed with each transaction. This would actually add a little more value to each XRP coin with each transaction.

And finally he talked to the fears that with 60 Billion of the coins that are held by Ripple Labs (out of a total 100 Billion) being quickly release and flooding the market (crashing the price.) Two days ago, Ripple announced that 55 Billion of their undistributed coins were to be locked into an Escrow/Smart Contract for the next 4 1/2 years. This essentially would mean they couldn't gain access to them even if they wanted to. The terms of this is to release 1 Billion XRP per month (at the start of the month) for the next 54 months.

Volatility

Ripple CTO also touches on the desire to minimize volatility in the market, stating that this is more important over the XRP coin price itself. Even with the transaction times between banks being relatively short, a small fluctuation in the coins price could result in a changed value of what is being sent/received across the network. Their solution for this is to use a "volatility lessening service" which will ensure the receiver will get the exact value that was sent so the banks wont be effected by any price changes. The volatility lessening service itself will either cover and costs due to a price dip as well as earn the extra when the price increased.

Other Topics Discussed

Stefan Thomas also goes on to say that there seems to actually be a calling from regulators (behind the scenes) for banks to adopt Ripple's XRP. Of course, this is a difficult statement for me to fully accept until I can actually see something more official.

He also touches on the drive to overtake Swift in the realm of moving funds around internationally. The cherry on top for him was stating how "Just last month they recruited the former business director at SWIFT[.]"

Ripple Adoption in Japan

Even though it wasn't in the Huffington Post interview, it's worth noting that there were stories, followed by more official statement in the last couple months about Ripple being adopted by Japanese Institutions. At the end of March, "The Bank of Tokyo-Mitsubishi UFJ (BTMU), the banking arm of the Mitsubishi UFJ Financial Group (MUFG) has joined Ripple in its endeavor to establish an international blockchain payments network of global banks." Also on May 14th, Cointelegraph reported that Japan has been putting in huge investments into cryptocurrencies, specifically Bitcoin and Ripple, potentially building a alt-coin bubble.

The Good Old Disclaimer

This should not be taken as being trading advice one way or the other. I was simply curious as to what had been driving up the price of the XRP coin over the last couple months. This is some of what I'd found that provided me with some insight as to what might have been causing the moves.

Additional Reading:

Huffington Post Interview with Ripple CTO

Ripple $14 Bln Quarantine Met With Suspicion As Website Crashes

Japan’s Biggest Bank Partners Ripple, Plans Global Blockchain Money Transfers in 2018

Japanese Investors Might Be Fueling the Next Altcoin Bubble

Don't Miss the Show! Follow the Steemit Talk Podcast (STP) Account

New STP Website!!

Are you new to Steemit and Looking for Answers? - Try https://www.steemithelp.net.

Image Sources:

Ripple Logo

Ripple Chart Screenshot

I remember when ripple first came out. it was a big thing and then it died and now its pushing with a Big Bang. Lets see where this goes.

It's definitely had a wild ride! Lol.

In the last couple of days it's seemed to have fizzled growth wise, but who knows. Recently, I've had some money in it, but a while back when it was under 500 satoshis I tended to steer clear. It's still on my radar though and like you said...lets see where it goes.

Like ETH sometimes these things grow so fast its just unbelievable.

Yea, that was crazy to watch! Seemingly out of nowhere...BAM, ETH at $100. Lol

:(

If it makes you feel any better..I didn't cash in on any of the ETH pump. Just watched it at the time. I was a little too 'noobish' at the time.

I feel the same way.

Ripple has a good future!

Ripple announcing to lock up some coins and lower the amount in circulation is a very smart move. Gonna make it more volatile and improve the price imo.

Way to vague for me..Devs. holding 20% and he didnt clearly say how they would distribute the other 60 billion..Ill stick with coins that are truly decentralized not coins like ripple who say were headed that direction. I like coins that inform you before you invest what the formula is in the white paper..Ya you can trade the dips and peaks and make some money with this coin.But this coin is too similar to central Banking that is corrupt to the core! Central power always corrupts!

Agreed. Being backed by big banks and being centralized is somewhat unappealing, but yes definitely money to be made on this coin.

I also remember when ripple came out they were giving away free ripple. I sold mine to someone shortly after I got them, doh! Haha :)

Our first giveaway was 50,000 XRP to members of the bitcoin forum. That's worth about over $17,000 now.