xRapid is Live, but Could it be Killed Off?

At Ripple's Swell conference on the 2nd October, Brad Garlinghouse announced that xRapid is now production ready and former president Clinton is optimistic about the future of xrp, provided that the SEC don't regulate against it. Following the announcement, so far the price of xrp is down, volume is low and the xrp community is stressing the need for patience. However, could Ripple be set to face fierce competition from JP Morgan in the cross-border transactions market?

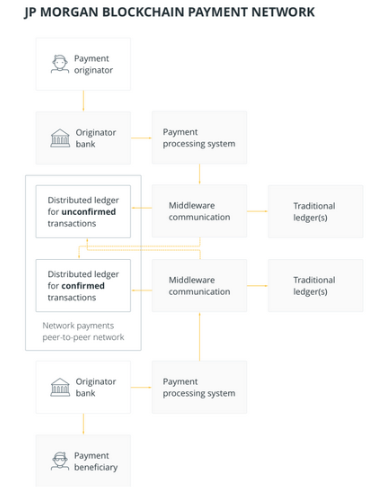

JP Morgan partnered with the Ethereum Enterprise Alliance to develop their own private blockchain called Quorum, an Ethereum hard fork, without a centralized ledger or database that uses the trusted and proven Raft implementation of Core OS's etcd for a consensus algorithm, rather than Ethereum’s POW, thus enabling a new block to be produced every 50 milliseconds. zkSNARK privacy was also added to Quorum by Zooko Wilcox of ZCash. The Interbank Information Network (IIN) is built on top of Quorum and has been piloted since 2017. The IIN has an accelerated and optimized method of global DLT cross-border transactions that eliminates traditional intermediaries and is not only intended to be a threat to Swift, but possibly to pressurize Ripple.

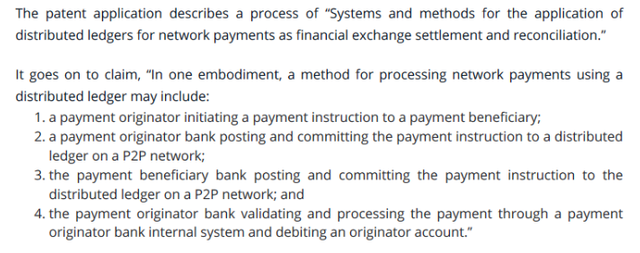

This threat to Ripple follows a patent application by JP Morgan in May for a P2P method of processing network payments using a distributed ledger and the similarities to Ripple's model are clear;

75 banks are reportedly part of IIN the network, enabling cross-border payments to be facilitated in all the major global markets, the Americas, Europe, Asia-Pacific, Central & Eastern Europe, the Middle East and Africa. Some of the big names involved include Royal Bank of Canada, Societe Generale, ANZ (also partnering with IBM on blockchain infrastructure) and Santander; also working with Ripple, but they appear to be hedging their bets.

How much IIN will affect Ripple depends on whether IIN will be cheaper and faster than xRapid for cross-border transactions and FX conversions and whether it be primarily focused just on making wholesale market payments work better.

But it seems that the banks, such as JP Morgan (one time partner of Ripple) are appropriating the Fintech innovations for themselves and the main concern that should make Ripple nervous is whether IIN will be compatible with Swift GII, integrating an the end-to-end payment visibility to its near real-time settlement for international payments. If that eventuates, then Ripple is in trouble.

https://www.businesswire.com/news/home/20180925005617/en/

https://cointelegraph.com/news/why-jp-morgans-blockchain-patent-application-is-not-that-surprising

https://internetofbusiness.com/75-major-banks-join-blockchain-payments-network/

https://www.businesswire.com/news/home/20180925005617/en/J.P.-Morgan-Interbank-Information-Network%E2%84%A0-Expands-75

Should be interesting to watch the showdown.