Ripple: New Partnerships and no XRP Appreciation (as expected)

On November 16th, American Express (AMEX) joined the 100 or so banking partners already experimenting with the RippleNet payment protocol. Leveraging this network, AMEX will integrate with Santander UK to make payments between the US and U.K. faster, cheaper and more transparent: a win for both institutions and their customers.

But what Does this mean for holders of XRP?

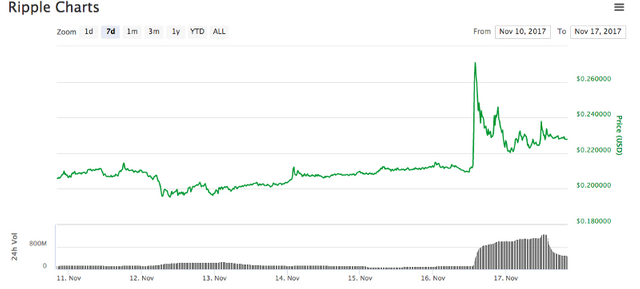

If they bought right before this announcement, when XRP’s price was $.20 this could mean very big short term profits. With the currency hitting about $.26 within a few hours, they could have realized a 30% gain in matter of hours.

But most people did not buy and sell at this time. S

o what does this new relationship really mean for holders of XRP?

In one sense it means nothing.

Like the other financial institutions on the RippleNet platform, AMEX has yet to touch XRP. The demand for XRP as a method to transfer wealth and source liquidity remains extremely low.

Likewise, supply has not changed much. XRP in circulation remain around 38.5 billion. With no change in either supply or demand, the quick correction was warranted. If there is no change to supply or demand, there should be no change in price.

In another sense, the addition of American Express to the network is a strong signal:

The network is growing.

RippleNet and XRP’s potential for success grow with the number of banks and payment providers on the platform. Think of joining RippleNet as a test run for these institutions.

Joining RippleNet allows banks and payment providers to get a taste of the operational efficiencies that Ripple’s blockchain delivers without touching the risky and volatile XRP currency. Seeing as the growth of RippleNet increases likelihood of XRP adoption, a more sustained increase in price could very well have been warranted with the addition of AMEX.

XRP and Settlement

Joining RippleNet speeds up payment but not settlement. RippleNet is speeding up the process that results in the “transaction pending” entry in your bank account but is not reducing the amount of time until these transactions are finalized.

Instantaneous settlement (the promise of XRP) would make payment and settlement essentially synonymous. With the use of XRP on the RippleNet platform, settlement would occur 4 seconds later rather than days later as it currently does. Nevertheless RippleNet can be successful without the use of and appreciation of the XRP currency. Given this growth of RippleNet, the case for future XRP adoption continues to become stronger and stronger.