Rich people in China collectively abandon luxury goods.

Rich people in China collectively abandon luxury goods.

The cold wind of consumption winter has finally blown to the luxury market.

Major luxury goods groups have successively released financial reports for the first half of 2024.

LVMH, which was full at the Paris Olympic Games, had a double decline in revenue and net profit of 1% and 14% outside the camera. Holding LV and Dior is still difficult to cope with the market downturn.

Gucci's revenue plummeted by 20%, while its parent company kering's net profit directly halved, down 51% year-on-year.

But it seems that the bad economy alone cannot fully explain this cold wave.

In sharp contrast, Hermes' revenue and net profit rose in the first half of this year. Prada's brand-wide revenue growth, calculated at a fixed exchange rate, Miu Miu led the increase of 93%, which is a dark horse.

Behind the mixed performance, what changes are taking place in luxury consumption?

Especially in the China market, where high hopes are placed, with the middle class becoming "rational" and the rich becoming low-key, can luxury goods still be sold?

Performance of luxury goods groups in the first half of 2024

Miu Miu saved Prada, Gucci dragged Kaiyun down.

Several happy families and several sad families can best sum up the performance of the four luxury goods groups in the first half of this year.

Even the luxury giants who are most resistant to the economic cycle are gradually becoming divided in the face of the changing consumption environment.

Behind these divisions, Li Jin found four noteworthy consumption observations.

First, the performance growth of luxury goods groups depends on the core competitiveness of trump cards.

The poor performance of LVMH Group and kering, the moat has been loosened to varying degrees.

Although LVMH Group did not show the revenue contribution of various brands, the revenue of the fashion and leather goods department where its two main forces LV and Dior are located decreased by 2% year-on-year, and the profit of operating business decreased by 6% year-on-year.

GUCCI's revenue, which accounts for nearly half of Kaiyun's revenue, plummeted by 20% year-on-year, falling from the moat to a "drag bottle". Yves Saint Laurent, once regarded as a cash cow by the group in recent two years, can't sell any more, and its income decreased by 9% year-on-year.

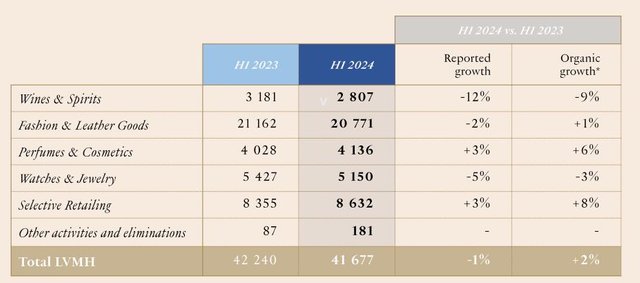

Business performance of various departments of LVMH Group. Source: 2024 H1 Financial Report of LVMH Group.

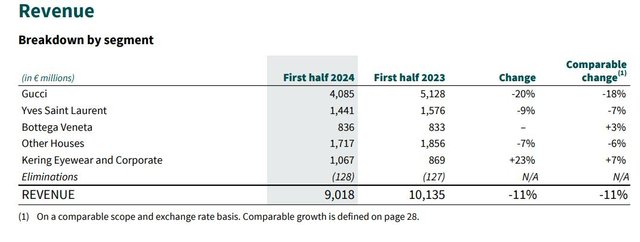

Business performance of various brands in kering. Source: H1 Financial Report of kering in 2024.

On the other hand, Hermes, platinum bags can still be played. The leather goods and harness sector, which contributed 40% of the revenue, saw a year-on-year increase of 15.7% in the first half of this year.

Under the Prada Group, in addition to the steady growth of Prada and Church's, Miu Miu is one enemy against a hundred.

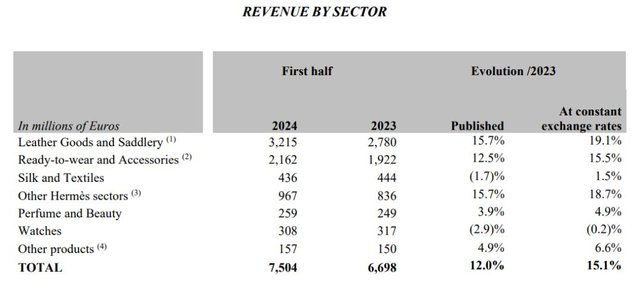

Business performance of various departments of Hermes Group. Source: Hermes Group H1 Financial Report in 2024.

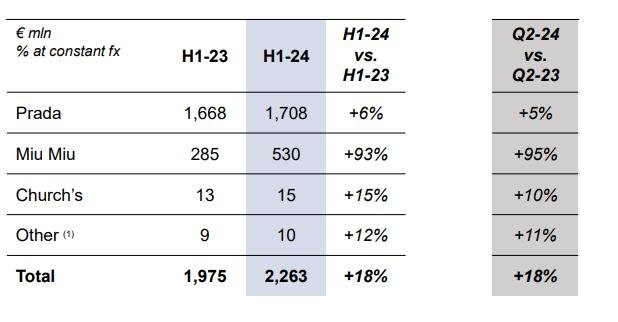

Business performance of Prada Group's brands. Source: Prada Group's H1 Financial Report in 2024.

For luxury giants, the competitiveness of the main brands has a profound impact on the performance of the whole group.

So why did the main brands that used to go hand in hand divide? This got the second and third observations of Li Jin.

Second, the core competitiveness of luxury brands in the economic downturn comes from 1% VIC.

A luxury research report published by Bain Consulting shows that less than 1% of VIC in the world contributes more than 30% of luxury brand income.

With the economic downturn, the rich continue their daily life in buy buy, but the middle-class people who used to bite their teeth and fight for classic models have to be "rational".

From this perspective, whoever serves the largest number of high-net-worth customers will be able to firmly grasp the 30% stable happiness and be the most resilient. So, Hermes won. This is particularly evident in the China market.

Third, luxury brands should pay more attention to fashion creativity and stimulate consumption with fashion potential in the economic downturn.

Without the ability to maintain the value of evergreen trees, we have to rely on the creative ability to lead the fashion trend. Therefore, Miu Miu, who is not in the same position as Hermes, also won.

In recent years, Miu Miu has been exporting phenomenal items and styles, from bare-bellied dresses and ultra-mini skirts to diamond underwear and ballet flats, with a sense of being a rebellious intellectual.

Today, there are more than 100,000 notes in Little Red Book studying the miu system, and Miu Miu has grasped the younger generation of consumers with its unique design.

In the cold environment of luxury consumption, returning to the fashion cycle and the creative track is still the way to break the ice for luxury brands that are not at the top of the pyramid.

Fourthly, the performance growth of luxury goods groups is deeply dependent on the China market.

In addition to the core brand, the overall performance of the Group is closely related to the performance of the regional market, and the biggest variable is the China market.

In the first half of 2024, the revenue of Asia-Pacific region (excluding Japan) accounted for more than 30% of the revenue of the above-mentioned groups, and the highest figure could reach 47%, such as Hermes Group.

There is no doubt that the key to boosting revenue in the Asia-Pacific region lies in the China market.

In the past two decades, consumers in China have shown strong purchasing power for luxury goods, but in recent years, this luxury fever has obviously dropped.

Luxury goods can't be sold in China?

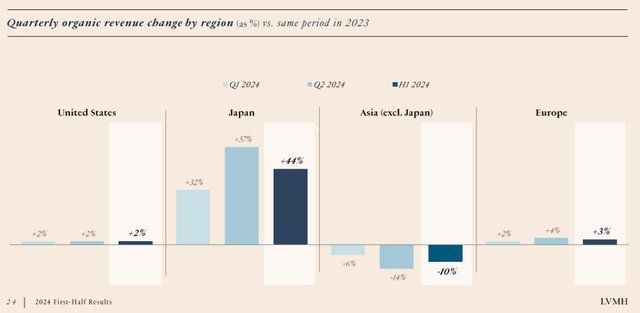

The poor performance of LVMH and Kaiyun in the first half of this year was largely influenced by the Asia-Pacific region including China (excluding Japanese). The former had a negative growth in organic revenue in the Asia-Pacific region for two consecutive quarters, while the latter was dragged down by a 22% decline in revenue in the Asia-Pacific region.

LVMH Group's regional income has changed organically. Source: LVMH Group's 2024 H1 financial report.

Kering's regional income changes organically. Source: kering's 2024 H1 financial report.

Even Hermè s Group, which has a strong performance in the Asia-Pacific market, is slowing down. In the first quarter of this year, its revenue growth in the Asia-Pacific region (excluding Japan) was still 8.9%, and only 4.4% in the second quarter.

Why can't luxury goods be sold in China?

First, the transfer of consumption space. The depreciation of the Japanese yen has caused Japanese consumers to buy in China, which has affected local consumption.

In sharp contrast to the cold weather in China, the Japanese market is booming. LVMH, Kaiyun and Prada all mentioned the consumption of traveling to China in their financial reports, among which LVMH is directly attributed to Japanese tourists.

However, because of exchange rate fluctuations, consumers who are willing to buy or find a purchasing agent across the country pay more attention to price than style, and the proportion of such price-sensitive people among luxury target customers is not high.

Therefore, the spatial transfer function of consumption is actually limited, and the essence of unsold goods is weak demand.

Second, the economic downturn, consumption differentiation, middle-class and upstart people tighten their wallets, and "old money" people spend low-key.

Luxury brands in different stalls serve different proportions of middle-class and high-net-worth customers, and mid-class luxury brands that rely on middle-class to attract gold are more vulnerable.

And these brands, following the trend of luxury price increases, have pushed middle-class consumers further, but failed to win more high-net-worth people's markets through brand value.

Third, preference changes, from luxury to "luxury shame" for the rich.

In the era of starting from scratch and being poor, the first rich needed logo and old flowers to publicize their worth. Now, hot money is no longer there, and only the "heirs" can live in luxury goods.

No matter the political orientation or the influence of public opinion, the rich in China are more cautious in conspicuous consumption, preferring "quiet luxury" or less conspicuous luxury.

This "luxury shame" has a great influence on some luxury brands and products that pile up logo.

Fourth, the concept has changed, and the middle class has changed from aggressive consumption to careful calculation.

Even middle-class people who still have the ability to reach luxury goods are changing their subjective consumption concepts.

Faced with the uncertain environment, middle-class families are more worried about the decline of the class, shifting from aggressive consumption to steady investment and practical consumption.

In view of the poor value preservation of second luxury brands, the middle class narrows its interest in brands other than head brands, and pays more attention to product value for non-head brands.

Luxury brands with strong product attributes are less susceptible, such as Miu Miu, which harvests young women by fashion design, and Moncler, which takes luxury down as its value point.

Luxury goods that parted ways.

Faced with the depressed market and the lost middle class, luxury goods that once competed for price increases began to embark on a completely different path.

The head continues to focus on high-net-worth people: Hermes raised the price of all products at the beginning of the year, and Kelly28 Himalayan raised the price by 34.3% to 685,000 yuan; LV also completed a new round of price increase in July this year, and the Van Buren effect of buying up and not buying down is still the confidence of the top luxury people.

However, mid-range luxury brands have been unable to hold back, and Burberry and YSL began to cut prices, trying to win back entry-level consumers pushed away by price increases.

In addition to price reduction, the younger and more popular business has also become a lifeline for the group.

For example, Kaiyun bet on the glasses department, which still maintained a 23% revenue growth in the first half of this year in the group's red light performance.

LVMH's perfume, cosmetics and selective retail were the only business units with the second growth in the first half of this year.

In the past five years, the price of luxury brands has been soaring, but the latest performance shows that blindly raising prices can not adapt to the gradually weak market. At least more and more consumers in China are not paying the bill.

For most luxury brands, high-net-worth people are a solid foundation, but to grow on a large scale, it is inseparable from the middle class of enterprising consumption. How to win back the lost middle class in China market will be the theme of these brands for a long time to come.

The circuitous discount strategy, excellent fashion creativity and popular and young business supplement will become the adjustment direction of mid-range luxury brands.

📈 The luxury goods market is shifting! 💸 In response to economic downturns, changing consumer preferences, and a growing middle class, mid-range luxury brands are being forced to adapt.

💃 No more blindly raising prices! 🚫 Mid-range luxury brands like Burberry and YSL are cutting prices to win back entry-level consumers. Meanwhile, high-end brands like Hermes and LV continue to focus on the affluent few. 💎

👀 But what about the middle class? 👥 These brands need to find a way to win them back, as they're the key to growth. One strategy is to offer more affordable options, like Burberry's price cuts. Another is to tap into popular trends, like Kaiyun's successful glasses department.

🌈 The future of luxury goods lies in adaptability and innovation! 🚀 Brands that focus on product value, excellent fashion creativity, and a touch of youthful charm will thrive. Who do you think will be the next big players? Share your thoughts! 💬

And don't forget to vote for xpilar.witness by going to https://steemitwallet.com/~witnesses 🙏 Your support means everything! 👍