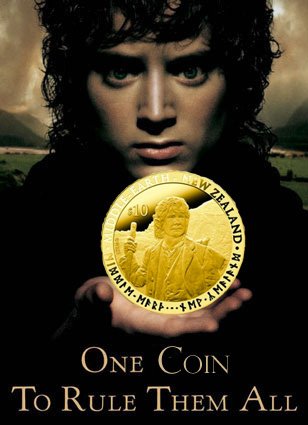

One Coin to Rule Them All? The Paradox of a Unilateral Crypto-Currency

Note: This was written in March of 2014.

I am reposting my writings on Steemit as a throwback and to show how things have evolved.

Cheers!

There is a growing divide in the crypto-currency community about whether it is better to have Bitcoin be the one coin that represents the entire community, or if the current trend of new alternative coins is good for the crypto-ecosystem long term.

Some arguments for using only Bitcoin are that too many coins dilute the buying power of the crypto-currency community at large, and that having too many coins makes it impossible to keep track of for the user. On the other hand, the arguments for alternative currencies are based around having more representation for minority groups, allowing special interests to pool their resources on a worldwide scale, and allowing the currency holder to decide what interests their currency supports.

In order to accurately understand the potential impact of either scenario, we need to first disambiguate the idea of a “currency” vs. the idea of a “commodity”

Currencies and commodities are consumed, used, and traded on a daily basis by almost everyone living in modern society. Despite this fact, these are two of the most commonly misunderstood concepts in of one of the most capitalistic societies on Earth, the United States of America.

For this reason, before moving any further into the topic of crypto-currencies, let’s review the Merriam Webster Dictionary’s definitions of these two terms.

cur•ren•cy

(1) the money that a country uses :

(2) a specific kind of money

: something that is used as money

: (3) the quality or state of being used or accepted by many people

com•mod•i•ty

(1) something that is bought and sold

(2) something or someone that is useful or valued

While both currency and commodity are clearly two different entities with completely different functions and purposes within modern economies, their paths merge in the world of crypto currency. That’s been the case with Bitcoin.

But before we dive into the new and novel, let’s get a better grasp of the current global economy.

What is a “currency” and how does it function?

Ultimately, a currency serves as a ledger. It’s a way to measure trade consistently.

In a barter system, the metric for value is determined between the parties involved in the trade. In other words, If you have a loaf of bread and I have a bunch of kale and we trade them, that loaf of bread is worth one bunch of kale because of our agreement.

In a “currency” system, a community establishes a common value that is recognized throughout the community.

An obvious example of this would be the U.S. Dollar. There are 50 states in the U.S. which all operate based around the U.S. Dollar. On the surface this seems trivial, since most countries use the same currency across their territory. But the United States has many micro-economies within its borders.

Take a look at the cost of an apartment in New York City and in Indianapolis, for example.

According to Numbeo.com, it takes $6,437 a month live at the same standard which $3,300 a month would buy you in Indianapolis. The average income in New York is higher than it is in Indianapolis, but when you factor in the cost of living it’s not extra income, just a reflection of the higher cost of living in that city. It’s obvious that the US dollar doesn’t have a consistent value there.

When examining the wealth disparity among micro-economies in the U.S. the disparity seems to be regulated by the locality. So if your costs are higher, your pay is generally higher.

This is true within the borders of the United States. However, when a US citizen from New York and a citizen from Indianapolis decide to go to France, then they both have to use the U.S. dollar to buy Euros. Quickly, the citizen from Indiana loses the sense of “equal” buying power because the disparate economies within the US give the person from New York City more USD for doing the same work.

When both of these citizens exit their local economies, they are using the same currency, but they received the currencies from different pay scales. Of course, no one in France cares about this when exchanging the dollar into Euros. It is not a “New York” dollar, or an “Indiana” dollar. It’s just a dollar.

Ultimately, a currency has a value within a micro-economy (on a local level) and a value within a macro-economy (on a national level).

What’s the Solution?

One solution that has come about to solving the disparate economy problem is having localized currencies.

What this does is allow a micro-community to establish their own currency that goes farther within the community than the macro-currency, allowing the community to keep capital local, and not have the macro-currency drain it into international corporations or even into different states where the taxes do not contribute to local infrastructure.

This has been taken even further to have currency specific to one store or one commodity. There are time based currencies, which allows a person to trade currency for labor, and there are commodity based currencies, the most well-known being the gold standard.

But commodities and currencies are not mutually exclusive. A coin made out of gold is both a commodity and a currency if it is traded. But in the face of increased globalization and centralization, most countries have abandoned commodity based currencies for fiat currency. This ties the currency to their macro-economy.

While this system is in place to help the macro-economy have better long term stability, the major problem is the centralization of authority over resources. Having a centralized currency puts the control of the resource mobility in the hands of whoever controls the currency.

In the case of the United States, the resources are controlled by the banking system. The government provides tax funded subsidies to corporations to invest in the infrastructure of the United States. This is the principle of trickle-down economics. The centralization is part of the governing mechanism.

While trickle-down economics is nothing new, the recent development of crypto-currencies poses a threat to the centralized monetary system, and a major component of that is the variety of currencies being developed.

Currently, the most widely accepted crypto-currency is Bitcoin.

While Bitcoin is very much being used as a currency, it is also being traded like a commodity. Investors have seen arbitrage opportunities that exist with crypto-currencies, and they have taken advantage of them. This was standard practice with international currencies until laws made the profit not worth the time of arbitrage.

Since most “crypto-currencies” are not actually accepted for trade, they’re considered commodities. Many crypto-traders treat coins as penny stocks, and simply see them as opportunities for arbitrage. It is important to note that just because something is called a “crypto-currency” it does not actually mean it is a “currency”.

When talking about free-market economic theories, one cannot help but see the current state of crypto-currencies as the closest manifestation to a “free market” that has ever been seen on a global scale.

Crypto-currencies have allowed us the capacity to trade between borders under the same currency, and also to develop currencies that have a global interest at the root of their cause. Great examples of this are Potcoin, Rainbowcoin, and Marinecoin. If you look at the purpose statements of each of these currencies, they have intentions to use resources on a global scale to affect change.

Potcoin is aiming to be a commodity backed coin that allows users to purchase legal cannabis with it. If you live in the United States, you can use US Dollars to support legalization groups, but in the process actively using USD contributes to an economy that prosecutes cannabis smokers federally, and switching to Potcoin not only allows a person to not contribute to that system, but it puts resources towards legalizing cannabis on a global scale.

The same is true for Rainbowcoin. It is very easy for an American citizen to use USD to support activism to help the LGBT community, but in the process, they still are supporting the very government that has been legislating that they are second class citizens. Putting resources into Rainbowcoin allows people to actively avoid paying to persecute themselves, as a member of the LGBT community must pay taxes in America, while not enjoying the same protections and rights as a non-LGBT American.

Marinecoin is even more different than the aforementioned currencies, because as an entity, Marinecoin is trying to build an actual eco-system that supports the currency, and also use hashing power to compute equations that will solve real-world problems, such as genome sequencing, cancer research, and basically anything that can be broken down into variables. Marinecoin is working to become an actual “currency” and not just another penny-stock commodity.

While these three coins have very different goals, strategies, and methods of execution, ultimately they serve as resource repositories. A group of people has decided to pool their resources towards one goal. Crypto-currencies are allowing special interest groups to connect with each other on a global scale and pool their resources together, whether computing power, or actual currency. One currency will not, and CAN NOT, represent 7 billion people.

Funny to note that out of the tokens mentioned in the article, Potcoin and Marinecoin are still in operation. I believe Rainbowcoin was rebranded, but I am not certain.

Classic! These articles you wrote back in the day were dynamite, and I'm glad we got to work together through all this