Quick Guide on How to Help Aging Parents Plan for Retirement

Are you worried that your aging parents might not be ready for retirement? Well, you should if your parents haven’t done any steps to prepare for their future needs. It’s important that you help them out in any way you can or else they might get in your way in the future and you wouldn’t want that, right?

They might be overwhelmed on how to plan for retirement since there are some issues that need to be addressed like debts, retirement income, long-term care needs, downsizing and others.

To help your parents prepare for retirement, here are some issues that needs to be addressed first.

Clearing Debts

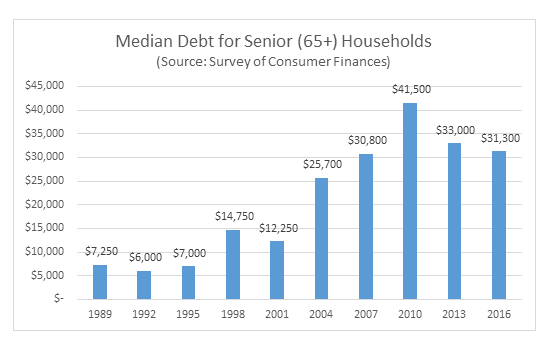

There are more seniors that carry debt into retirement nowadays. Just keeping pace with daily living expenses is already hard what more if you have debts. Accumulated debts such as credit card, mortgage and car loans can hurt your parents’ finances come retirement.

Talking about money with aging parents is tough especially if they have more debt. But no matter how frustrating it is, practice patience and persistence in determining your parents’ debts.

In case they have excessive debt, help them out by negotiating with their creditors and requesting to lower interest rates or by recommending bankruptcy. Clearing up some debts before entering retirement gives your aging parents a chance to have a comfortable retirement.

Long-term Care Planning

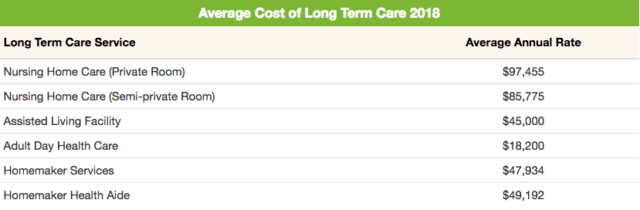

Around 7 out of 10 Americans 65 and above will require any form of long-term care. Aside from the high risk of needing this type of care, aging Americans should be wary of its high cost too.

The annual median cost of a private room in a nursing home is $100,379 while an assisted living facility will set you back around $44,350 annually. Health insurance doesn’t pay for long-term care likewise Medicare. Medicaid pays this type of care but it has limited coverage and requires eligibility. Long-term care insurance helps pay for nursing home, assisted living facility and other care services.

Start a conversation about long-term care is a tough one too. But you have no choice but to discuss this early with your aging parents or else they might end up living with you or ask you to pay for their care expenses. To help you start the conversation, here some tips to help your parents plan for long-term care.

Cut Other Expenses

The needs of your parents change, as they get older. They might need to change their spending priorities to make sure that they’ll have enough during retirement. This means they need to cut other expenses like cutting subscriptions they are not using. You can help them out by reviewing their recurring charges such as newspapers or magazines and cancel those that they are not using.

By helping them manage their money, your parents can boost their savings for retirement.

Downsizing

This is another delicate conversation that you need to have with your aging parents. It’s going to be tough since most seniors are reluctant in leaving their homes even if they can no longer afford it. Help your parents realize the need to move to a smaller and less expensive home to free up more money for retirement.

In addition to the cost of the house, you need to consider its location too. Make sure that your aging parents will move into a home that is close to services then need regularly.

Stay Away from Financial Scams

Seniors are the favorite preys of scammers since they are easy to persuade especially when it comes to making a huge profit out of a small investment. You need to warn your parents about these financial scams and educate them.

It’s best to point them to a professional that can give them helpful advice regarding investments.

Conclusion

It’s imperative for adult children to get involved and help their struggling parents to plan for retirement. By intervening now, you can help them address issues that can affect their finances later on or worse, will fall on you instead.

If you have questions about long-term care planning, we can provide you with objective advice that can help you choose the right policy for your future care needs. Get started by requesting for a free online quote.

Congratulations @samstein! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!