RENASWAP : make money through arbitrage opportunities

RenaSwap is revolutionary in its design,it offers Volume as a service(VaaS) through primitives like Rebalancers,rTokens. RenaSwap users are able to make money through various arbitrage opportunities .

DEFI PROBLEMS AND RENASWAP SOLUTIONS

- Devaluation of tokens due to inflation : most DeFi protocols incentivizes protocol participation with emission of new tokens,as new tokens enter the market,the value tend to shrink and users most times are not incentivized to hold long term.

SOLUTION : The $RENA and $ITS tokens are deflationary in design.

High transaction tax that discourages trading : many protocols enforce a high transaction tax that strongly discourage trading volume

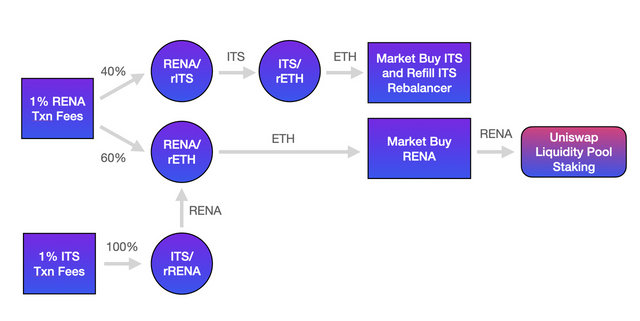

SOLUTION :RenaSwap uses a unique routing system that is able to arbitrage, reward liquidity providers as well as refuel RENA and ITS Rebalancers

RenaSwap is able to create arbitrage opportunities via more trading volume.Dilution of LP tokens as LP pools increase in Liquidity : By design,most protocols earmark a fixed token emission or distribution as incentive for liquidity providers for a particular pool.

If X = token rewards for providing liquidity to a certain pool

Y = volume of the pool

So most times,users get more LP rewards when the pool has less liquidity and vice versa.

SOLUTION : LP providers are rewarded by RenaSwap asset routing system

Dilution of LP stakes are enabled through rebalancers,rToken and protocol enforced claiming fees for LP rewards.

4.Low liquidity on AMMs : Low liquidity tends to give way for high price swings when tokens are swapped on such AMM,this in turn affects how much trading volume a project is able to generate and how much users are able to use the platform.

SOLUTION : RenaSwap is able to deepen a liquidity pool through its rebalancers.

THE RENA REBALANCER

The Rebalancer is called when the price of RENA tokens are higher on Uniswap than on RenaSwap,through this price difference,users are able to make money through this arbitrage opportunity.

Any user can call a Rebalancer,if they hold a minimum of 15,000 RENA token

How Rebalancers work

A percentage of a liquidity is removed as used as follow

1.The RENA/ETH pool is split into 50:50 ratio

2.The ETH is used to buy RENA from uniswap

The RENA bought is used as follow

1.15% of the RENA is sent to the RENA/rITS pair on RenaSwap

2.60% of the RENA is sent to the RENA/rETH pair on RenaSwap

3.7.5% is sent to the caller of the RENA Rebalance function

4.7.5% is sent to the RENA treasury

5.10% is burnt out of circulation.

Reduce the RENA supply on Uniswap

Thereby Increase the RENA supply on RenaSwap

After that, burn RENA

RENA TOKENOMICS

11,000,000 RENA ~ Maximum Total Supply

5,500,000 RENA ~ Reservation Event - 50%

3,750,000 RENA ~ Uniswap Liquidity - 34.1%

1,000,000 RENA ~ Grants / Bug Bounty Program (DAO Governed) - 9.1%

50,000 RENA ~ RENA/rITS Liquidity - 0.45%

150,000 RENA ~ RENA/rETH Liquidity - 1.36%

150,000 RENA ~ Immediate Education - 1.36%

150,000 RENA ~ Future Education (locked) - 1.36%

150,000 RENA ~ Team - 1.36%

100,000 RENA ~ DAO Dev Treasury - 0.91%

Video explainer :