Could There Be New Regulations in 2023?

In the European Union, where a licence passporting system is in place, some chaos has been stirred among the regulators. The 27-nation bloc's top regulatory body, the European Securities and Markets Authority (ESMA), acknowledged weaknesses in the oversight of international investment activities, particularly in the power of the Cypriot regulator. In response, the Cyprus Securities and Exchange Commission (CySEC) stated that it has introduced extra policies and taken initiatives to improve the efficiency and effectiveness of surveillance and that it intends to increase the human resources required to oversee cross-border services offered by Cypriot investment firms.

In addition, the French and Dutch regulators issued a novel statement highlighting that they witnessed an increasing number of financial firms offering high-risk products that are continuously receiving complaints yet still can obtain a license and European passport in other EU member states.

The UK's Financial Conduct Authority (FCA) published a “Dear CEO” letter earlier this month outlining its ongoing concerns regarding the issues and “poor practices” in the retail CFDs industry. It noted the temporary passporting regime-operating EU brokers in the UK and claimed that its actions had prevented 24 firms from marketing CFDs in the UK.

There is already talk of new regulations in preparation for the new year. Although these rules may be more targeted at cryptocurrencies, they will also impact retail brokers.

The EU will likely vote on the eagerly awaited Markets in Crypto Assets Regulation in 2023 to regulate the cryptocurrency industry and prevent future occurrences like that of FTX, where it appears that the main issue was the complete lack of business conduct guidelines.

It is said that in 2023, a regulation will be set in place to prevent brokers or investment firms from providing cryptocurrency or services related to cryptocurrencies, as the new framework is expected to ringfence the financial system (which includes CFD brokers). In other words, no company will be able to serve as both a MiFID Investment Firm and a MiCA Crypto Asset Service Provider at the same time. The two regimes will run separately from one another. Other than some minor adjustments to the MiFID II, such as the EU finally agreeing to eliminate the requirement to publish RTS 27 reports. However, no revolutionary changes are expected to be imposed on the current framework for the financial system in 2023.

Additionally, the regulators might concentrate on combining the current financial services regulations next year. Although there may not be any significant regulatory reforms planned for the coming year, improving supervision may be a major concern for Europe. The CySEC may tighten its oversight even more due to the ESMA's focus on it, which could lead to increased enforcement actions and fines.

It could be suggested that the upcoming trend in 2023 will be more focused on strengthening supervision, as demonstrated by the actions of the AFM, AMF, FCA, and ESMA with regard to cross-border trading. Cryptocurrency and the Digital Operational Resilience Act are currently in different stages of approval, but they will be the center of major regulatory discussions next year.

A further indication of upcoming regulations in this area is provided by ESMA's ongoing public consultation on new rules governing the passporting of financial services licences. Although the regulations won't change much, the European regulator's demand for specific information from businesses during the passporting stage could result in more regulatory difficulties for brokers.

While national regulators are striving to tighten the existing regulations, it is important for retail traders and investors to also not to neglect the importance of choosing a legitimately regulated broker.

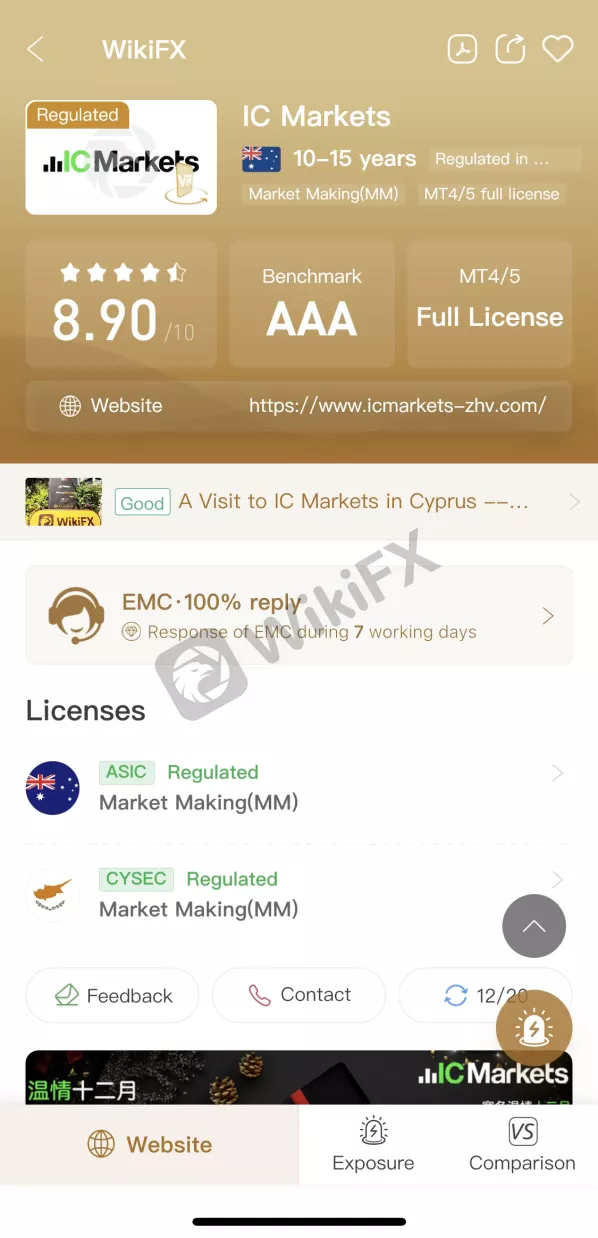

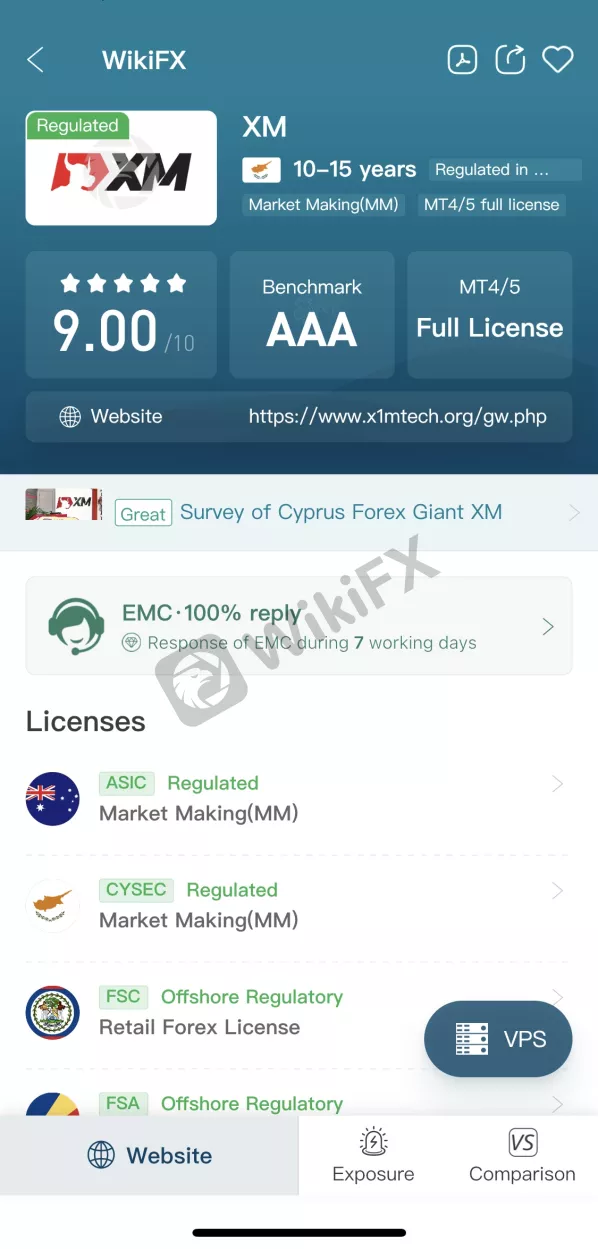

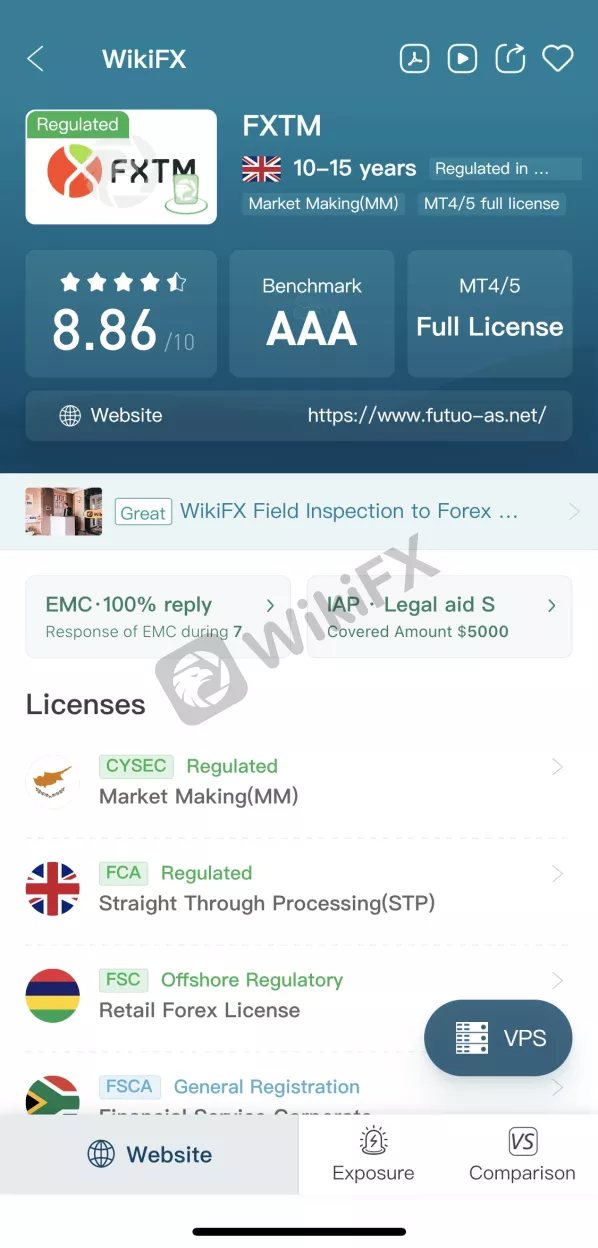

WikiFX works in a tight-knit manner with national regulators worldwide to provide verified information about brokers. Therefore, we sincerely urge everyone to download our free mobile app on Google Play/App Store and conduct a thorough background check on your selected broker(s). This can be done in a straightforward manner with our app. From the images attached below, you can see how comprehensive WikiFXs database is.

Please make entrusting a credible broker a resolution of yours in 2023!