RedStone — Modular Oracles tailored to your dApp

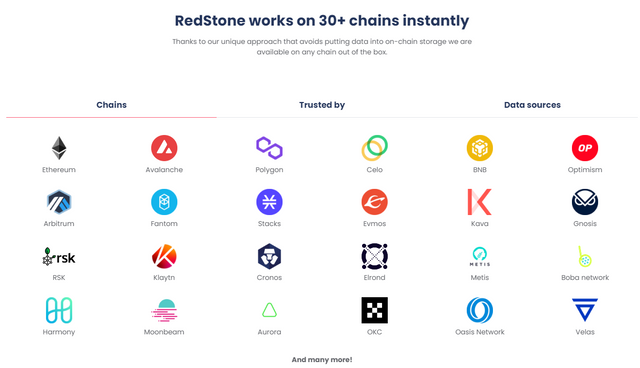

In 2021 the DeFi ecosystem exploded in size with the new protocols covered in various news portals. Financial data feeds are the foundation for projects offering decentralised products like synthetics or insurance. However, the real potential of Web 3.0 is still constrained by the lack of more diverse data types. That’s where RedStone Oracles bring the change with its unique approach of storing non-standard data on Arweave and delivering it to all EVM-compatible chains.

At their core, oracles are middleware that enables the communication between blockchains and off-chain systems such as data providers, cloud providers, IoT devices and payment systems.

RedStone Protocol, a next-generation cross-chain data oracle providing pricing data for financial protocols, announced it has raised a $7 million seed round led by Lemniscap. According to a press release on this occasion, RedStone intends to use funds to further develop Web3 through strategic hiring.

Other notable investors in RedStone’s just-closed seed funding round include Blockchain Capital, Coinbase Ventures, Distributed Global, Lattice Fund, Arweave, KR1 plc, Bering Waters, Maven11, SevenX, FoliusVentures, Numeus, The Graph, 4SV, PermanentVentures and ComputeVentures.

Speaking to investors earlier, Roderick van der Graaf, founder of Lemniscap, said they are backing RedStone as the company continues to highlight its reputation as the oracle platform of choice for DeFi users across the industry spectrum.

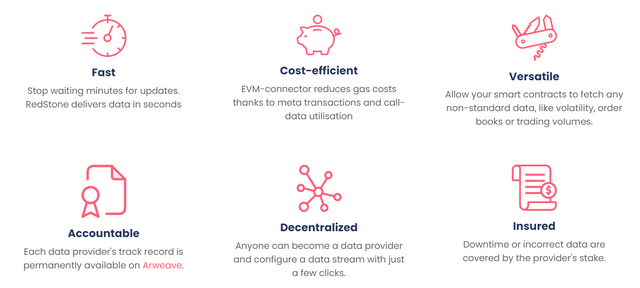

According to Graaf, the current oracles that power most decentralized finance (DeFi) platforms are slow but costly for developers to scale operations. Notably, RedStone uses the Arweave blockchain to create accessible storage with a permanent audit trail.

According to the developers, RedStone curates data sources and stores information using Arweave’s highly reliable and low-cost decentralized storage infrastructure, thereby providing a fully auditable historical audit trail of information.

RedStone Protocol and the Emerging DeFi Ecosystem

Over the past two years, the decentralized financial market (DeFi) has led to the industry’s adoption of cryptocurrencies and blockchains. According to data provided by DeFi Pulse, the total value locked (TVL) in decentralized finance protocols is $34.37 billion.

producer, AAVE, and Curve Finance are the leading DeFi protocols with $7.9B, $4.86B, and $4.73B respectively. Other notable DeFi protocols with significant TVL include support for Ethereum. Uniswap has about $3.42 billion, and Convex Finance has about $2.88 billion.

RedStone has previously raised funds from investors looking to develop fast and user-friendly DeFi oracles. Mid-July 2021, RedStone announced that it had raised $525K in a pre-seed funding round led by Maven 11 Capital.

Over time, the company has grown to become a major DeFi provider tracking over 1,000 assets from 46 sources. Additionally, the success of DeFi protocols depends on timely and accurate data, which can only be provided from reputable sources.

For example, the ETH/USD pair may have different prices at certain times, making it difficult for DeFi to play fairly with its clients. Thus, the RedStone protocol collects data from several cryptocurrency exchanges and finds the median data for all of them.

This way, customers get the best prices at any given time.

The Oracle Problem

Promising decentralisation, blockchain networks do not communicate with the outside world directly as they, by their very nature, have been designed to act independently of intermediary involvement in an isolated manner. Blockchains form a consensus to execute agreements or commands using data that is stored on their ledger, all of which is validated using nodes across distributed networks.

The decentralised nature of blockchains prevents them from pulling in or pushing out data from or to any external system as a built-in functionality.

Blockchains nodes must be kept in isolated sandboxes and as such cannot directly access traditional services or generate data in-house. Without this data, they cannot execute such contracts as deciding the results for insurance policy payouts, determining financial settlements, knowing when to release or settle payments — in other words a specific blockchain is helpless in decisions that are dependent on data from outside of its own infrastructure. All nodes must also operate in the same, predictable, deterministic environment.

Early Attempts

During the early days of blockchain, there was a distinct lack of standards and market leaders. This “wild west” landscape saw almost every protocol creating its own proprietary oracle solution. However, building an oracle is not a trivial task, and home-made oracles turned out to be vulnerable which ended with many hacks. Some of these hacks were far from low profile, with millions of dollars being stolen or lost due to poor practice or human error.

One of the biggest Oracle exploit resulted in almost $90M being liquidated

As exploits continued, protocol users started migrating towards professional solutions allowing market leaders to grow their shares.

Another early attempt at finding a solution came in the form of a “two phase approach”:

A contract submits a request for data to an Oracle Service;

An Oracle Service sends back a response with data.

This simple and flexible solution was pioneered by Oraclize (now Provable) and Chainlink as Basic Request Pattern, but the main disadvantage of this approach is that the contract cannot access data immediately as it requires two separate transactions; this kills usability as the client needs to wait until the data comes to a contract to see the result of an action.

A bigger problem, on top of that, is that fetching data is not atomic — meaning, not in a single transaction. As a result, an Oracle has to synchronise multiple contracts, which is complex, slow and ultimately kills interoperability.

Today’s State of Play

Currently, the most popular approach taken by blockchains in an attempt to address the aforementioned issues is to persist all data directly on-chain, so that the information is available in the context of a single transaction. Protocols have also formed syndicates around the most popular oracles using common standardised configuration.

However, high maintenance costs of this approach mean that storing data directly on-chain is extremely expensive. On a historically busy day, with a daily average 500gwei Gas price, a single transaction may cost above $100, so if we persist every 10m across 30 sources, the daily bill will be more than $400k per one token.

Conclusion

Redstone Finance represents an important step in the development of decentralized financial solutions. The platform provides investors and users with tools for secure, transparent and managed financial transactions. With a wide range of investment opportunities and a modern approach to asset management, Redstone Finance is making its mark on the evolution of the financial world.

By addressing these issues, Oracle’s new system can provide more efficient resource utilization, improved scalability, increased data reliability, and decentralized access, ultimately delivering a better overall user experience and reducing potential risks and limitations.

Links :

Website — https://redstone.finance/

Twitter — https://twitter.com/redstone_defi

Docs — https://docs.redstone.finance/

Blog — https://blog.redstone.finance/

Github — https://github.com/redstone-finance

Lens — https://lenster.xyz/u/redstone_oracles

Telegram — https://t.me/redstonefinance/