Metavault Trade - Decentralised spot & perpetual exchange

About

Metavault Trade Is A Decentralised Spot And Perpetual Exchange With Low Swap Fees And Zero Price Impact Trades. Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers.

Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers. Liquidity Providers Receive Rewards From Swap Fees, Market Making, Rebalancing And Leverage Trading. MVX Uses Chainlink Oracles And TWAP Pricing From Large-Volume Decentralized Exchanges For Dynamic Pricing.

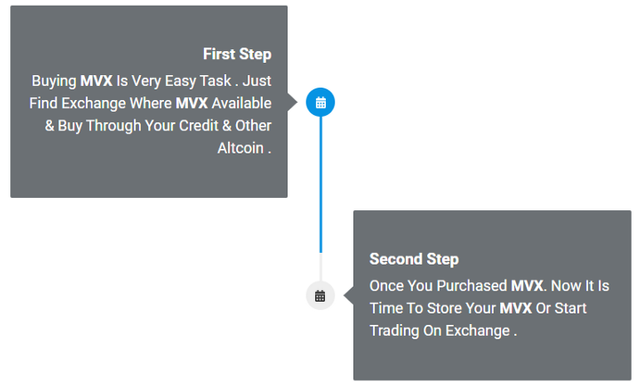

How To Buy The Continental & Trade On Exchange?

Metavault Trade Decentralized Perpetual Exchange

Trade Top Cryptocurrencies With Up To 30x Leverage Directly From Your Private Wallet.

Reduce Liquidation Risks

An Aggregate Of High-Quality Price Feeds Determines When Liquidations Occur. This Keeps Positions Safe From Temporary Wicks.

Save On Costs

Enter And Exit Positions With Minimal Spread And Zero Price Impact. Get The Optimal Price Without Incurring Additional Costs.

Simple Swaps

Open Positions Through A Simple Swap Interface. Conveniently Swap From Any Supported Asset Into The Position Of Your Choice.

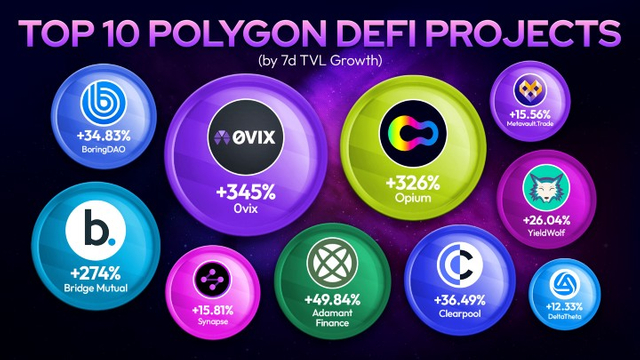

Available On The Following Networks

Metavault Trade Is Currently Deployed To Polygon Network And Fantom Opera.Near Protocol Is Coming Soon.

Trading

Metavault.Trade Is A Cutting-Edge Decentralised Exchange Platform That Doesn’t Require Registration. To Start Trading On Metavault.Trade All You Need Is A Web3 Wallet.

Connect Wallet

Connect Your Wallet By Clicking The “Connect Wallet” Button In The Header.

Open A Position

Users Can Take Either A Or A Long Or Short Position On A Coin — A Long Position Results In Profit If The Price Goes Up, While A Short Position Results In Profit If The Price Goes Down.After Selecting Either “Long” Or “Short” As You Require, Enter The Pay Amount (The Amount You Wish To Trade) And Use The Slider To Specify The Leverage.

In The Above Example, The Price Of Entry Is $3,372.40 And The Price Of Liquidation Is $2,824.65.The Fees For Opening And Closing A Position Are Both 0.1%. Additionally, There Is A “Borrow Fee”, Which Is Paid Every Hour To The Trade’s Counterparty.

Check This Fee Under The Swap Box. Note — There May Be Some Slippage Since There Is A Delay Between The Time The Trade Is Submitted And Its Confirmation On The Blockchain. You Can Customise The Slippage By Pressing The “…” Icon In The Top-Right Of The App.

Position Management

A List Of Open Positions Can Be Viewed By Clicking On “Positions”. Click “Edit” To Manage Your Leverage And The Liquidation Price By Depositing Or Withdrawing Collateral. By Default, The List Displays Leverage As Position Size Divided By Its Collateral. To Display Leverage As Position Size +PnL Divided By Position Collateral, Click On “…” In The Top-Right Of The App.

MVLP

MVLP Is A Token Whose Value Is Made Up Of An Index Of Assets Used In Swaps And Leverage Trading. Users Can Mint MVLP Using Any Index Asset Or Burn It To Collect An Index Asset. The Price Of Minting Or Redemption Is The Combined Value Of The Indexed Assets / MVLP Supply. MVLP Holders Earn EsMVX. Since MVLP Holders Supply The Liquidity Required For Leverage Trading, They Profit When Metavault.Trade Leverage Traders Make Losing Trades. They Also Make A Loss When Leverage Traders Make Profitable Trades, With Their Collateral Going Towards The Payout.

Tokenomics

Staking

Staked MVX Generates Three Reward Types:

- (Native Token Like MATIC/CRO)

- EsMVX

- Multiplier Points

30% Of Swap And Leverage Trading Fees Are Converted To (Native Token Like FTM/MATIC) And Distributed To The Accounts Staking MVX.

Treasury Assets

The MVX-USDC LP-Pair Gets Provided By And Owned By The Protocol. 100% Of The Fees From This Pair Are Converted To MVX And Deposited Into The MVX Treasury.

Supply

The Maximum Supply Of MVX Is 10,000,000. Minting Beyond This Maximum Supply Is Controlled By A 28 Day Timelock, An Eventuality That Will Only Be Considered If The Demands Of The Protocol Necesitate An Increase In Liquidity.The Rate At Which The Circulating Supply Changes Will Be Dictated By The Number Of Tokens That Are Distributed Through Other DEXs, Vested, Burnt And Spent On Marketing:

- 1.2 Million For Marketing, Partnerships And Community Development

- 2 Million For The Metavault DAO Treasury (Staked+Locked)

- 4 Million Reserved For Rewards (EsMVX Reserve For Multichain Expansion)

- 1 Million Paired With USDC For Liquidity On Uniswap

- 300,000 For MetavaultDAO Team (Linearly Vested Over Two Years With A Three-Month Cliff)

- 1.5 Million Allocated To Presale

Important Points Table Of Metavault Trade

Basic PointsCoin

Name Metavault Trade

Short Name MVX

Max 10,000,000

Learn More:

Website: https://metavault.trade/

Twitter: https://twitter.com/MetavaultTRADE/

Discord: https://discord.com/invite/metavault

Telegram: https://t.me/MetavaultTrade

Author:

Bitcointalk Unsername : Tokyo Ghoul

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1849613

Telegram Unsername : @Tokyoghoulmen

Polygon Address : 0x3D5D32D6986277B050b00CE1B4926446833c63d4