Metavault.Trade

Metavault.Trade is another kind of Decentralized Trade, intended to give many exchanging highlights and extremely profound liquidity on many enormous cap crypto resources.

Merchants can involve it in two ways:

1.Spot exchanging with trade and cutoff orders.

2.Exchange Ceaseless Prospects with up to 30x influence on short and long positions.

Metavault.Trade means to be the go-to answer for brokers who need to remain in charge of their assets consistently without sharing their own information. Its inventive plan gives it many benefits over other existing Dees:

1.Exceptionally low exchange expenses.

2.No cost influence, in any event, for huge request sizes.

3.Insurance against liquidation occasions: unexpected cost changes that frequently happen inside a solitary trade ("trick wicks") are smoothed by the plan of a valuing system that depends on Chainlink cost takes care of. Across the board stage: Spot and Influence exchanging.

Outline

The MVLP comprises of a record of resources involved on the stage for trade and influence exchanging. The client can score MVLP by adding any file resource for the liquidity pool (LP) while the MVLP is singed at whatever point the client eliminates any record resource from the LP.

MVLP holders get prizes as MATIC and esMVX tokens.

The MVLP token is intended to supply the liquidity required for utilized exchanging. Hence, MVLP holders are providers of liquidity and they create a gain when influence brokers make losing exchanges. All things being equal, they lose cash when the influence dealer makes a productive exchange. Past Pall information and different measurements can be seen at https://stats.metavault.trade/.

Printing and Reclaim

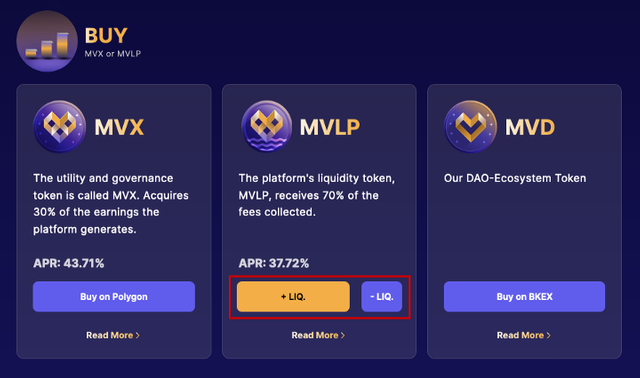

MVLP can be printed and reclaimed by going to the "Purchase" page from the header and tapping the "+ LIQ.", "- LIQ" buttons in the MVLP box.

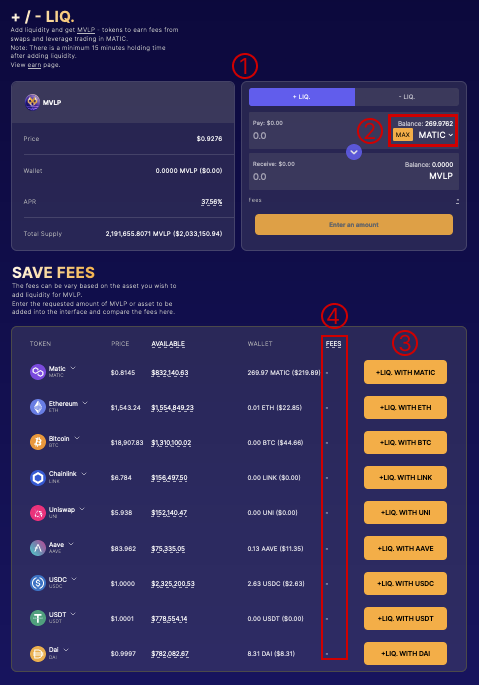

This will take you to the accompanying screen where you will see a recap of all the MVLP qualities:

*Cost.

*Wallet proprietorship.

*April

*Complete inventory.

In box 1 you can decide to print ("+ LIQ" button) or reclaim ("- LIQ") MVLP. You can choose a file resource for spend or trade involving button 2 or one of the buttons in zone 3.

Subsequent to choosing the resource, enter the sum to see the necessary expense in zone 4.

Costs for printing and reclamation are determined in light of the all out worth of resources in the record including gains and misfortunes from open/supply MVLP positions.

Having the option to arrangement/reclaim the most/less sought after resources by the convention will permit you to bring down your expenses.

Kindly note that stamped MVLPs begin procuring rewards right away and there is a brief stand by time in the wake of printing before you can recover MVLP tokens.

Token Data

MVX token location: 0x2760E46d9BB43dafCbEcaad1F64b93207f9f0eD7

In the wake of marking MVX, you will get the MVX marked:

MVX marked symbolic location: 0xaCEC858f6397Dd227dD4ed5bE91A5BB180b8c430

Stake

Marked MVX creates three kinds of remunerations:

*MATIC

*MVC

*Multiplier Focuses

30% of the trade and influence exchanging charges are switched over completely to $MATIC and appropriated to the MVX marking account.

Treasury Assets

The MVX-USDC LP liquidity is provided and owned by Protocol (MVX Treasury). 100% of the fees of this trading pair are converted into USDC and deposited to MVLP as liquidity belonging to the Protocol from MVX Treasury every Friday.

supply

The maximum supply of MVX is 10,000,000. Printing beyond this maximum supply is controlled by a time clock of 28 days, a possibility that will only be considered if protocol demands require an increase in supply.

The change in circulating supply is determined by the number of tokens distributed through other DEXs, vested, burned, and spent on marketing.

The MVX allocation is:

*1.2 million for marketing, partnerships and community development

*6 million reserved for prizes (as esMVX which can be converted from time to time to MVX)

*1 million for liquidity on Unsnap (reserves stored in MVX-Multiring )

*300,000 for the MetavaultDAO team (linearly given over two years with a gap of three months)

*1.5 million allocated for presale

*Pre-sale

MVX token price at launch : 1 USDC

*GMX community sale = 200,000 MVX at 20% discount (0.8 USDC/MVX), 200 slots

*Whitelisted public presale = 1,000,000 MVX with 10% off (0.9 USDC/MVX), 500 slots

*Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

*Total $ to be collected in pre-sale: 1,060,000 USDC + Metavault DAO Treasury allocation from MVD -> MVX sale

*500,000 USDC paired with 500,000 MVX initial liquidity V3 Pool

*60,000 USDC as marketing budget

*500,000 USDC as initial MVLP liquidity (owned by MVX Treasury)

Compound or Claim a prize

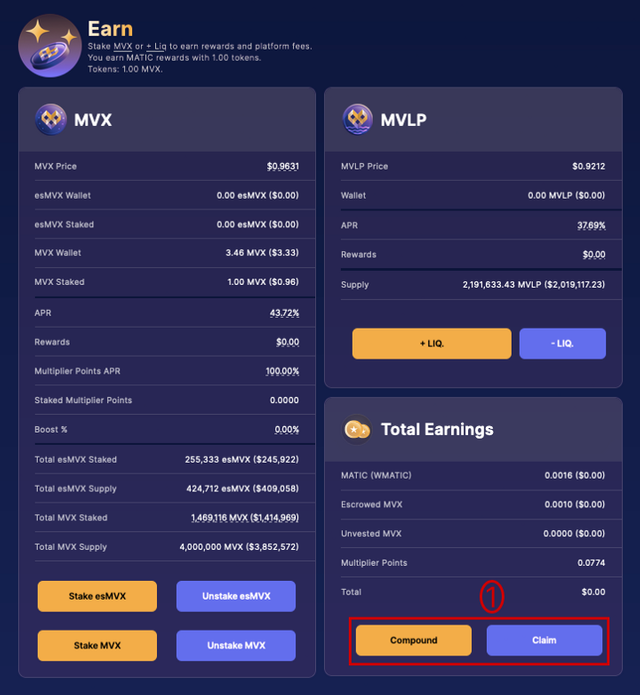

The user can claim the prize at any time by going to the “Earn” page and clicking the “Claim” button in zone 1, the “Total Earnings” box.

Claiming will transfer any pending esMVX and MATIC rewards to your wallet.

The stage likewise has a single tick method for consolidating every one of the awards. This will be exceptionally useful for clients who need to amplify their profit.

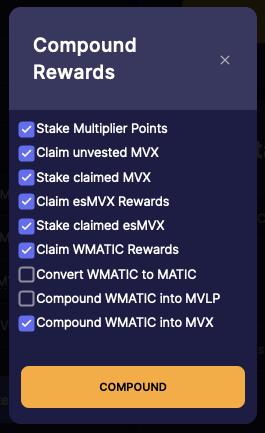

Tapping the "Compound" button will send a bunch exchange with just a single affirmation required. You will see a recap of all exchanges that will happen prior to affirming the exchange in your wallet:

*Asserting and afterward marking uninvested MVX or potentially MVC.

*Wagering MPs.

*Guarantee WMATIC rewards and convert them to MATIC.

*Asserting WMATIC and combining them into MVLP or MVX.

Kindly note that physically compounded or marked esMVX can be dumped for vesting whenever.

MVX box:

*Purchase, introduce, dismantle MVX.

*Stakes, dumps, vests (accessible soon) MVC

*Move record to another wallet (see exceptional area)

vesting

It is feasible to switch esMVX over completely to MVX through the vesting system, which includes requesting the typical MVX and MVLP used to get the MVC.

While vested, a limited quantity of esMVX is changed over completely to MVX consistently.

This MVX can be guaranteed right away.

Assuming the record misses the MVX or MVLP expected for the vest, the client should buy these tokens once more.

Tokens can be kept into the client's vault whenever during vesting.

Circulation Level

Circulation rates change consistently.

June 2022: 50,000 esMVX for MVLP suppliers and 50,000 esMVX for MVX partners

July 2022: 60,000 esMVX for MVLP suppliers and 60,000 esMVX for MVX partners

August 2022: 50,000 esMVX for MVLP suppliers and 50,000 esVMX for MVX partners

September 2022: 50,000 esMVX for MVLP suppliers and 50,000 esVMX for MVX Staker

Itemized Prize System

MVX holders are firmly urged to stake their tokens on the stage as it furnishes them with three unique kinds of remunerations. They get:

*A piece of the stage expense — paid in MATIC.

*New token: esMVX, produces its own prizes.

*Multiplier Focuses (MP) is one more method for expanding your MATIC income considerably more.

Find out More:

Site: https://metavault.trade/

Twitter: https://twitter.com/MetavaultTRADE/

Discord: https://discord.com/welcome/metavault

Telegram: https://t.me/MetavaultTrade

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=2675979

Polygon Address: 0xF8cddaeDB327f8aF77d798bb3C200Bc73F1Cee20