#RBIFUD: RBI has neither banned any cryptocurrency nor its trading. A full guide to the situation & the way ahead!

Note: This body was sourced from of one my critical answers on Quora that got deleted in spite of having decent number of upvotes. The Quora Moderation might have deleted it due to the high number of external links provided. However, I have to provide the official/reference links to RBI notifications & news articles to fight with this FUD! I’ve raised a ticket with Quora to restore my original answer. Until then, please support me here and on Medium

Do I have to panic and sell my assets at lower rates provided that RBI has banned cryptocurrencies?

Absolutely, NO! The premise of the question is wrong — RBI has neither banned any cryptocurrency nor its trading. Read on for explanation.

This panic selling is the reason for such an unusual price difference between the prices at global level and Indian exchanges. Anyways, I can understand the situation and would try my best to discuss this.

What exactly did RBI notify?

The notification dated 5.04.2018 — which is now deleted — had notified banks to exit the relationship with the entities dealing in VCs (Virtual Currencies) within “a stipulated time”.

On April 06, 2018, RBI posted the notification again to reiterate its previous circular. The notification (RBI/2017–18/154) which is directed to All Commercial and Co-operative Banks /Payments Banks/Small Finance Banks/NBFCs/Payment System Providers and titled as “Prohibition on dealing in Virtual Currencies (VCs)” is as follows:

- Reserve Bank has repeatedly through its public notices on December 24, 2013, February 01, 2017 and December 05, 2017, cautioned users, holders and traders of virtual currencies, including Bitcoins, regarding various risks associated in dealing with such virtual currencies.

- In view of the associated risks, it has been decided that, with immediate effect, entities regulated by the Reserve Bank shall not deal in VCs or provide services for facilitating any person or entity in dealing with or settling VCs. Such services include maintaining accounts, registering, trading, settling, clearing, giving loans against virtual tokens, accepting them as collateral, opening accounts of exchanges dealing with them and transfer / receipt of money in accounts relating to purchase/ sale of VCs.

- Regulated entities which already provide such services shall exit the relationship within three months from the date of this circular.

- These instructions are issued in exercise of powers conferred by section 35A read with section 36(1)(a) of Banking Regulation Act, 1949, section 35A read with section 36(1)(a) and section 56 of the Banking Regulation Act, 1949, section 45JA and 45L of the Reserve Bank of India Act, 1934 and Section 10(2) read with Section 18 of Payment and Settlement Systems Act, 2007.

I’ve numbered the points correctly. Maybe they missed numbering the first one — I, thus, wonder how much have they researched about the cryptocurrencies! Please have a look at the bold statements above and then read this summary:

- It is clear now that the stipulated time is of three months.

- RBI has reiterated its warning regarding VCs and it is not notified anywhere that the VCs or trading of VCs is banned.

- The exchanges dealing with VCs are also not banned. Only, the banks and payment providers which are regulated by RBI are notified not to deal with those entities which deal in VCs (e.g. exchanges).

Media and the FUD

I don’t see any word related to “ban” anywhere in the circular. This is why I have linked the official notification here. Research about the news yourselves before believing whatever these wanna-be-famous news articles say. For example, read the headline of such a reputed news channel, Economic Times:

Although the body of the article is informative, I’m really concerned about the heading that would have made a larger population panic. Maybe these are some of the sources that made you frame this question. These are the some of the articles I referred to on April 05 — before RBI issued the updated circular:

- RBI asks banks to stop services to those dealing in virtual currencies (The Hindu)

- RBI Bans Regulated Entities From Dealing In Virtual Currencies

Moreover, how can cryptocurrencies be banned? Finance Ministry has already stated that they don’t treat VCs as legal tender and they are also not regulated by RBI — so how can they ban it? You cannot ban a decentralized currency or asset. Who can stop me storing some Bitcoins in my online wallet? At their best, they can only ban local exchanges but not crypto-currencies! And as I have said, exchanges are not banned as per the circular. I repeat, nothing is banned! Stop spreading this FUD (Fear, uncertainty and doubt) — we are already having enough of them that caused the market lose around 70–85% of its value!

Cryptocurrencies are not recongnized as a legal tender in India. Legal tender is a medium of payment recognized by a legal system to be valid for meeting a financial obligation. This doesn't mean they are illegal! A cheque is also not a legal tender in India but can they be termed as illegal? I'm not going to buy vegetables with my cryptocurrencies until mass adoption comes! Hence, another myth busted here - Cryptocurrencies are NOT ILLEGAL in India.

The Response

Did we accept the differential data rates on internet services? I remember how we fought for Net Neutrality that made TRAI release recommendations on November 28, 2017. We are in a democracy — we know how get our voices heard.

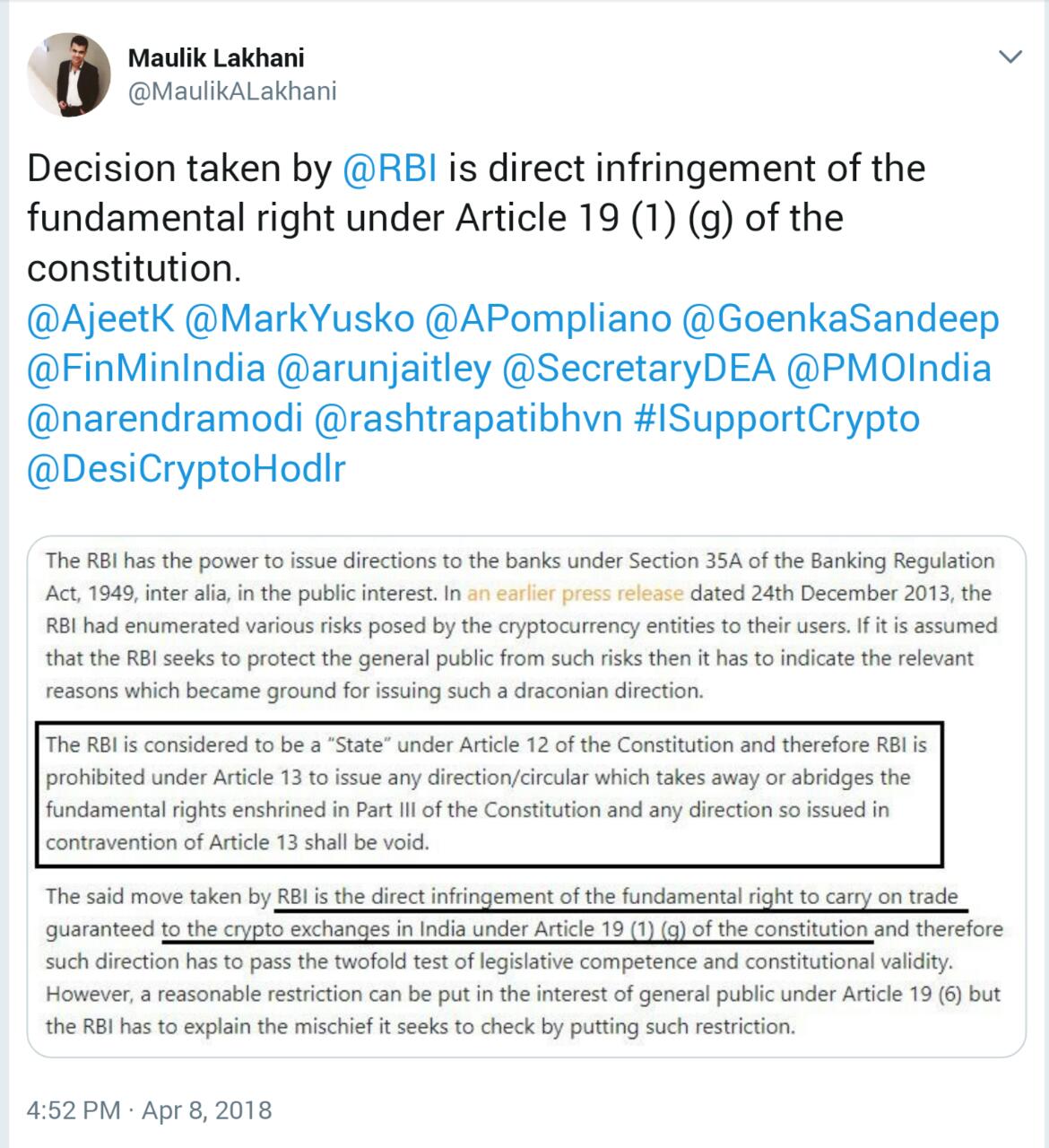

The report on cryptocurrencies is still awaited from Ministry of Finance. Supreme Court had also asked the government to clarify its stance on VCs. RBI is thinking about releasing its own cryptocurrency and Reliance Jio is already working to release ICO for JioCoin. Then how can RBI publish such an immature circular before time? RBI is not the supreme decision-making body. We have Supreme Court and Ministry of Finance, Government of India to head up next to.

- Indian govt focussed on deciding clear regulation on the trading of cryptocurrencies like Bitcoin: Report- Technology News, Firstpost

- SC seeks govt’s response on plea to regulate Bitcoin

- RBI looking to introduce central digital currency — Times of India

- Mukesh Ambani might be planning his own cryptocurrency, Jio Coin

There are over 1.5-4 million users indulged in cryptocurrencies in India. We are a big family! The campaigns, petitions and responses have started to flood the web.

All of the Indian exchanges acknowledge the RBI statement and are assuring users that their funds are safe with them. There is a time of 3 months for fostering dialogue with the concerned authorities — so, why panic now? All of the exchanges are working fine. I have tried both withdrawing and depositing funds on Koinex and BitBNS and there’s no reason to worry as of now. Check out the positive responses from all of the popular Indian exchanges here:

Check my tweet that contains thread of all the updates and support petitions/campaigns regarding this:

Show your support at these petitions and campaigns. We are already heading up to 25,000 supporters on the first one. Please take the pledge and help Blockchain-Lawyer-India to file a PIL in Supreme Court of India:

- Petition: Make India at the forefront of Blockchain Applications revolution

- Signature Campaign for PIL against RBI press release — Apr 05, 2018; creating crypto FUD

- I just Sent a mail to RBI regarding my concerns with their monetary policy and ring fencing of…

The Way Ahead

I’ve got a decent experience of filling RTIs and PILs and am really positive about the grievance redressal and process system of our country. But this needs support not panicking by your side.

Secretary of Economic affairs, Subhash Chandra Garg, says cryptocurrency traders can use cash and “other means”. Is this how they are going to stop tax evasion or illegitimate transactions? Exchanges with mandatory KYC & bank transactions were actually helping them have a track of transactions.

Since they cannot ban cryptocurrencies as a whole, this will only increase usage of Over-The-Counter ways of trading them. Peer-to-peer and OTC exchanges like localbitcoins.com and InstaShift.io don’t require any payment gateways/banks or regulation to work. Users would always be able to transfer their assets to international exchanges like Binance & CEX.IO. While most of these have Tether pairs, exchanges like CEX and Bitfinex allows fiat deposits and withdrawals. However, please be aware of Foreign Exchange Management Act and Prevention of Money Laundering Act.

Most of the popular banks had already withdrawn support for cryptocurrency exchanges long way back and exchanges were using third-party gateways thereafter. I’m sure they will find a way to keep continuing the fiat services. They have already joined hands to foster dialogue with RBI.

Conclusion

This is time to accumulate more at dips and not sell at such a lower price. After the statement was published, Bitcoin price was around $6800 globally and it fell to even ₹3,00,000 in India. 6800 USD is more than 4,40,000 in INR. When I started investing in cryptocurrency some months back, I remember how the prices included premium on Indian exchanges. I remember Bitcoin trading at ₹6,80,000 on Bittrex while it was over ₹8,40,000 on Koinex. Even now the Indian market has not recovered. You may not see these cheap prices again. I got some of my favourite coins at such a discounted price. No way I’m going to sell these at prices lower than global ones. I will rather hold them in online or offline wallets. No one can ban them! I will come back with those coins when the government is clear with their stand and will buy a Lambo and a Yacht selling part of those!

I tried my best to fight with this FUD and it’s your turn. You have done half the work reading this till the end. I want to thank you for this. I hope I have helped in any way. Feel free to criticize or appreciate. :)

Regards,

Paras Lehana.

Congratulations @bahubali! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

I feel honored. Thanks to everyone for the support. :)

Jai Mahishmati!

Congratulations @bahubali! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPJai Mahishmati!

If you leave the Crypto world, you'll definitely find yourself in it again, but it would have been too late!!

And the panic sellers don't realize that scarcity of something makes it more valuable. You can see the price recovering on Indian exchanges now. Think about economics - there had to be a saturation when we are left with no more panic sellers and only HODLers that are not going to sell at these undeserving prices.

Agree... My view: Banks and cryptos are like oil and water. They never mix together. We definitely need to find other ways out!

Congratulations @bahubali! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!