Use Psychological Analysis, Not Technical Analysis

Can you outplay the market? Yes, you can. It is not easy, but not impossible either. It involves a chart, but not the price chart.

So, how can you do it? How can you outplay the market and make a lot of profits in the way? Short answer: by doing psychological analysis, not technical analysis.

Source

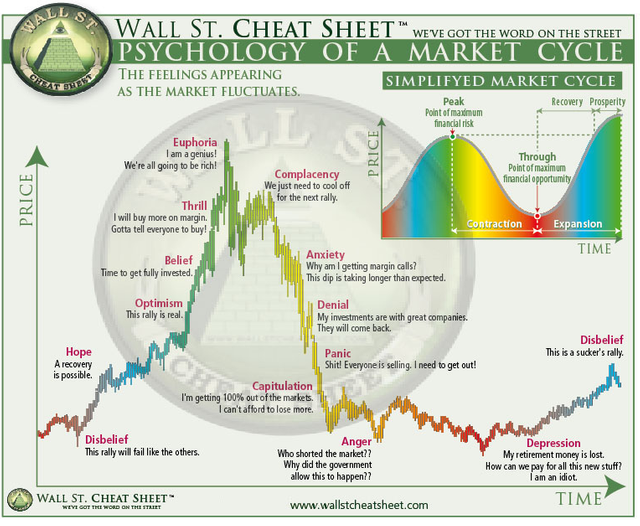

We Have Seen The Chart, But Never Used It

We have all seen this chart. We have all confirmed the truthness of its content. So, there is no doubt about it. However, we haven't learned to use it and benefit from it. The chart I am referring to is this:

As Daniel Jeffries says:

This cycle applies to all assets, at all times, in all markets. The cycle is eternal.

This is the universal market cycle.

No asset is exempt.

Every asset will follow this pattern at some point. The mountain might be spread out over many, many years, which is why most people miss it. They’re zoomed in too far.

Zoom out!

Look at the market over time and you’ll see this pattern again and again and again.

Why Is It Difficult To Use

Because human beings (yes, that is you and me) are not that rational! We have feelings and emotions, and they frequently control our behavior. Using this chart to outplay the market requires that we behave against our emotions, and that is what makes it so difficult.

That is why most of us help create this chart instead of using and benefitting from it.

So, What Should I Do?

First, never buy or sell when you feel you have to. never.

Second, assess the market's emotions, not the price. What is the general feeling of the market? Look at the trending memes, tweets, blog posts ...etc. Look at feeling that news outlets are trying to convey.

Then, once you have decided what is the general emotion of the market, go back to this chart and act:

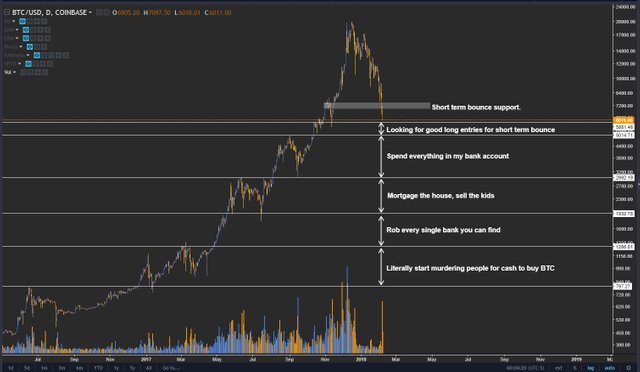

The Market is Thrilled

If the market is thrilled after a big price surge for a continuous period of time, and people are feeling that they are riding a rocket to the moon (yes, look for the "moon" word!), then you should wait a little bit. Wait until you see that people are buying out of FOMO. Wait until you feel the FOMO inside yourself. When that happens, then you should never buy. Instead, you should start selling!!

Usually, this means that the top is near. It might take some time. So, the best strategy is to sell gradually to make as much profit as possible. I would put 4 sell orders at increasing prices.

For example, when bitcoin started breaking ATH's every day, we should have noticed the thrill. It was so obvious. It started after BTC broke above $10,000.

we should have started putting sell orders like this:

- Sell 25% of your BTC holdings at $13,000.

- Sell 25% of your BTC holdings at $15,000.

- Sell 25% of your BTC holdings at $17,000.

- Sell 25% of your BTC holdings at $20,000.

The Market is Anxious

When the price starts falling from the top, people usually think it is only temporary. But when a suitable amount of time passes and the price does not recover, but rather stumble more, then you start to see anxiety.

You should not buy yet. Some people will start selling here creating a larger pressure on the price. When you see that people are starting to panic, then that is your buy signal. The best strategy is to put buy orders at decreasing prices.

Make sure to have some buy orders at very low prices. You would be surprised how low can the price go when people are desperate.

Trade Smart, Not Hard

Do Not Over-Trade. If you follow the above strategy, you can make a ton of profits with few trades. You don't need to stare at charts all day long. Actually, watching the price chart is a bad idea. It causes your eyes to swell, and makes you subject to the market psychology.

Remember that: "Effort is important, but knowing where to put that effort makes all the difference"

If you liked this article, please upvote, follow and resteem. Please, share your thoughts in the comments too. I usually upvote good comments. However, do not spam. You will probably be flagged.

Easier said than done! Especially when you’re new and just entering the market. It also depends on your goals of investing vs trading. But I agree that the emotion, the FOMO, it gets to everyone. The best is to try andanalyze the trends at both the micro and the macro scale. Also I’m a big proponent of ONLY using money that you’re willing to lose.

You need to have a very strong mind to do Psychological Analysis. I'm not saying you can't but I believe it would be little difficult for newbies like me.

Hey , @logicalidiot.

You should practice before you actually make any significant trades or investments. Otherwise, you may lose your money.

Thank you @sadekj. That was an excellent post.

I have to confess that I used to do the opposite exactly, and I lost of money because of that.

IMO, the most difficult part is to be able to HODL when the market is crashing, and to be able to sell when it is mooning.

Trade smart is the best way to make headway in this competitive market

I think it is the only way.

I'm going to look good.

I can not speak English because I do not live in an English speaking country. Thank you for your understanding.

I hope to be always healthy and full of happiness :)

@sadekj

This is written very well, it takes a lot of discipline to execute this.

I have followed, resteemed and upvoted.

good and useful information, thanks for the sharing

You are welcome.

The most important to note is trading smart, not hard else you might end up loosing than benefiting

It's also advicable not to sell when prices are down, but buy and hold till prices go up

Educative post

Thanks for sharing

Yes. Yet, it is easier said than done!

It is easier saying it than doing it... haha

I agree. But if you start practicing it, it becomes easier by time.

agree :)

Yes you are write we see the chart but not used this is common point for us we loss him self