Introducing the Blockchain Asset Index

An index that tracks the price of leading blockchain assets

What is a blockchain asset?

A blockchain asset is a digital asset, represented cryptographically on a distributed ledger, which plays an essential role in the use of a blockchain-based protocol. Examples of blockchain assets include digital currencies like bitcoin and tokens required to take actions on a protocol like REP.

Blockchain-based protocols are improving the security, privacy and usability of the infrastructure of the Internet. The growth of the blockchain asset class will depend on adoption of the protocols on which the assets are built.

Criteria for inclusion in The Control’s Blockchain Asset Index (BAI):

The network that the blockchain asset secures must have unique characteristics that are difficult to replicate and defensible by network effects.

The blockchain asset must be supported by a quality, active developer team and community.

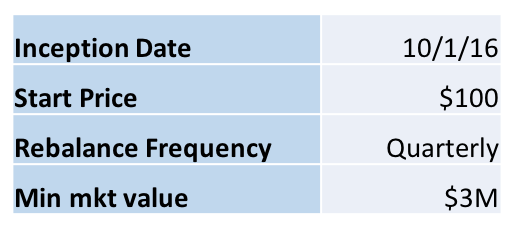

The blockchain asset must have a total market value of >$3M.

The blockchain asset must have fair and reasonable distribution of the token.

The blockchain asset must be trading for three months prior to being included in the index. Q4 2016 projects like Zcash and Golem are not yet eligible.

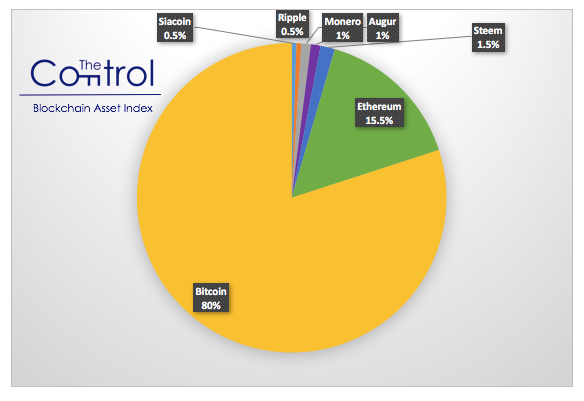

BAI Composition:

Bitcoin: 80%

Ethereum: 15.5%

Steem: 1.5%

Monero: 1%

Augur: 1%

Siacoin: 0.5%

Ripple: 0.5%

BAI at-a-glance:

BAI Performance:

Q4 2016: +33.24%

Note: This index is for informational purposes only. It’s not an investment recommendation or an investable security.

NOTE: THIS WAS ORIGINALLY PUBLISHED ON MEDIUM

About me: I run The Control and am an investor at Runa Capital, an early stage venture fund. Previously, I worked on business development and marketing at Coinbase and as an Associate at North Atlantic Capital. My work has been featured in publications like the Wall Street Journal and Entrepreneur and I’ve guest lectured at the Yale School of Management. Follow me on Twitter, signup for our newsletter and support us by becoming a member!

Great info. ☆☆☆☆☆😎

The index is very heavily weighted towards bitcoin. What criteria do you use to decide the weightings?

The weightings reflect my belief about the likelihood of long-term success of each protocol.

Most traditional indices represent a certain asset class, market, industry or economy. They can be used to give a benchmark where you can measure how well your assets are performing relative to the benchmark or about the health of a particular sector.

What uses would you see this index being used for?

it looks like the bitcoin pacman is eating all the altcoins! :)

😂