Too Few Buyers to Mop Up Spring Housing Supply Surge - Australia Property Market Update for Week Ending 19 November 2017

The Sydney market appears to be on the verge of taking a beating as sellers are rushing to get their homes sold before buyers clue into just how damn expensive real estate in Australia is compared to most of the world.

Key Property Market Highlights:

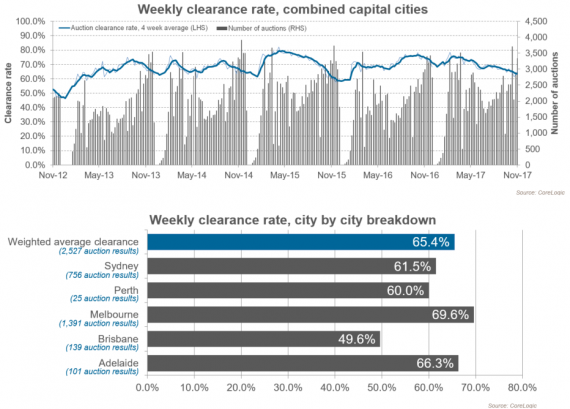

- Supply remains strong through the Spring selling season, with this week posting the third highest auction volume of the year.

- Demand lags behind as auction clearance rates weaken in our two largest capitals.

- Last week, Melbourne recorded its lowest clearance rate in 16 months.

- Home price growth continues to falter as Adelaide joins Sydney and Perth in the red for the rolling quarter.

The Latest Auction Activity

This was the third busiest week for auctions all year, which means a whole lot of people are trying to get their homes on the market while there are still buyers foolish enough to enslave themselves to lenders. Melbourne was the busiest as usual, with 1,717 auctions held. Sydney was host to 1,035 auctions.

According to the preliminary results, none of the capital cities cleared above 70 percent, which is a significant shift from previous weeks. Melbourne came close, with a clearance rate of 69.6 percent, but that likely won't hold up once all the results are counted later in the week. Sydney preliminary result in the 60's will also likey be adjusted down, into the 50's.

Here are the latest preliminary results for our five largest capital cities:

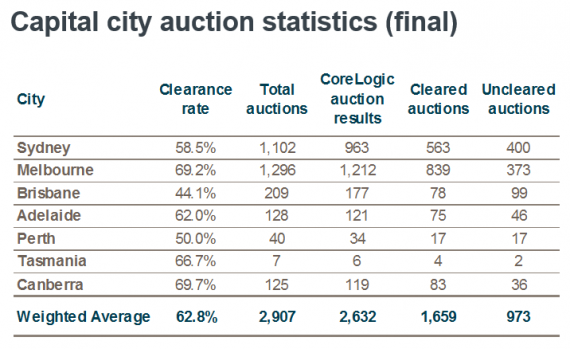

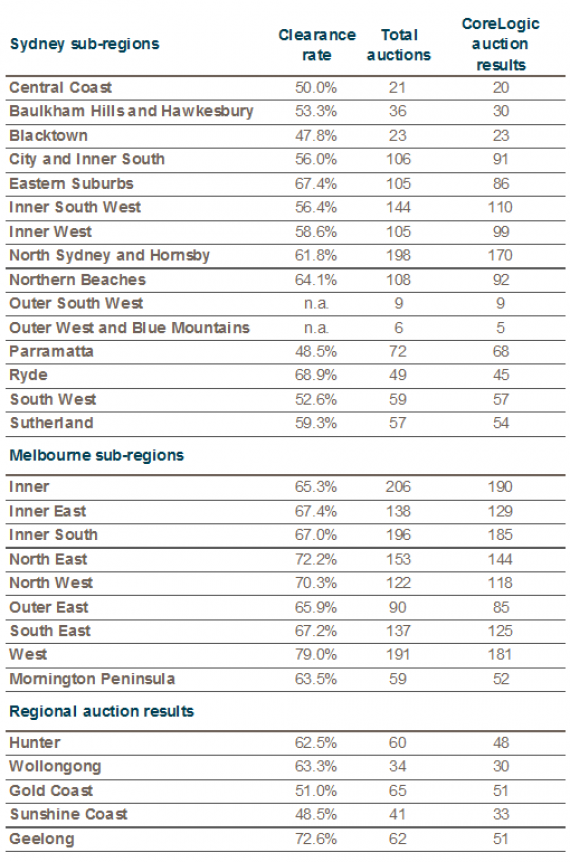

Here are last week's final results, followed by a breakdown of Sydney and Melbourne sub-regions, plus regional areas:

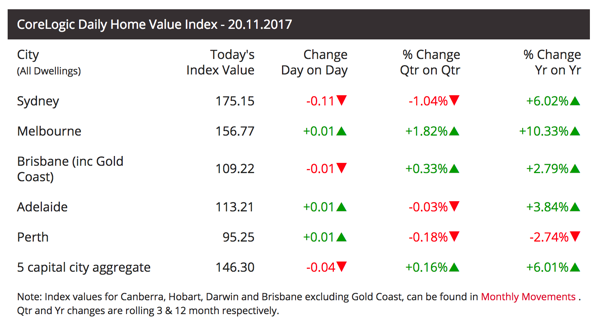

Recent Changes in House Prices

Sydney home prices have been falling over the last few weeks, with the median house price declining just over 1 percent over the past three months. Price growth is flattening out in Melbourne, but the annual growth is sitting just over 10 percent.

Perth is looking a little better but is still in the red for the rolling quarter. Adelaide just recorded negative quarterly price growth for the first time in many months.

Annual price growth is declining in all the capital cities.

source

Market Analysis

The Sydney property market could be on the verge of taking a beating. By the end of November, we’ll most likely see three straight months of falling home prices. With clearance rates declining into the 50's, the auction market is definitely flashing yellow.

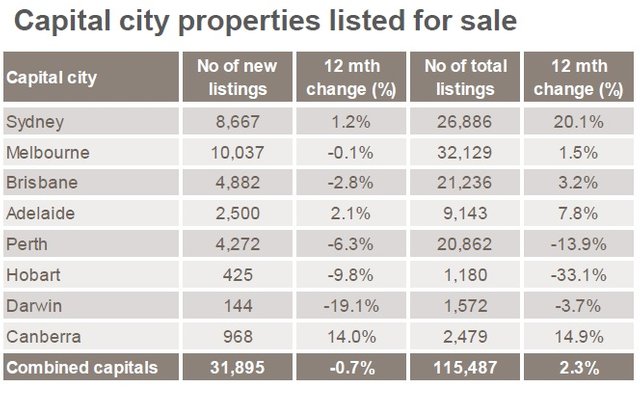

The blame for falling Sydney home prices lies with the recent sharp increase in supply. According to the latest data from CoreLogic, the number of homes for sale in Sydney has jumped a massive 20.1 percent over the past year. To offer some perspective, supply is up only 1.5 percent in Melbourne and 2.3 percent across the combined capital cities over that same period.

Given such a significant rise in supply, a minor 1 percent decline in house prices over the past three months indicates that demand remains somewhat resilient. That said, we still aren't seeing enough buyers in the New South Wales capital to mop up the flood of Spring listings.

Even though Sydney’s median house price has been declining, I still continue to speak to investors who remain convinced that “blue chip” areas are invincible and prices will not correct. They expect demand in those more exclusive areas to remain resilient and for home prices to remain at current levels or perhaps even rise, at least with inflation. The market remains exuberant, despite the signs that the end of the housing boom could be near.

While it may seem ridiculous to some of us that any parts of Sydney are bulletproof, there is some validity in the claim that some areas will fare better than others in a correction. Areas with the highest percentages of owner-occupiers and therefore fewer investment properties will likely hold their prices longer if times get tough. Lifestyle-motivated owner-occupiers are always the last to sell when investors are making a mad dash for the exits.

What I try to help investors understand is buying into a low-rental-yield area to speculate on capital growth is a very risky proposition. Yields can only go so low, and unless we see another rate cut from the RBA, it’s hard to justify any expectation for rising home prices from here.

Believe it or not, I still speak to investors who are planning to buy negatively geared investment properties (operating costs and interest payments exceed rental income - I wrote a whole article on it here) to speculate on even more capital growth. What they fail to see is how crucial it is that their returns far exceed inflation.

Moving forward, property investor will need to figure out how to win even when the whole market doesn’t go up. Without some more help from our regulators, that may be their only hope over the next few years.

What do you think? Is there still room for Sydney house prices to run higher?

Jason Staggers

Another fantastic assessment. Thank you!

With the Aussie dollar now slumping toward 0.75 and the market suggests a 99% chance of no change in interest rates for the December RBA meeting it does look like the decline will be setting in over the rest of 2017.

Keep up the good work!

Thanks @buggedout. It will be interesting to see what 2018 holds for the RBA. I wouldn't be surprised to see rates go a little lower, especially if there's any chaos overseas.

Interesting reading. Do you think this more than just the end of the spring listing peak?

Employment is high, interest rates are low. Is the difference the drop in overseas buyers?

I think it's a combination of the additional Spring supply, the challenge for many would-be buyers to service loans at such high prices, and the restrictions from APRA on investors, local and foreign.

I expect low rates to support current prices until a crisis overseas, then rates will rise and things will get interesting. But even if prices remain steady, inflation would destroy the buying power of the last few years' gains.

hello friend I would like to contribute something for its publication, but I would have to calculate all those accounts, and I am bad for that hahaha, greetings and blessings I wish from a distance.

Is this the beginning of the great migration away from the CBD?

With more staff working from home, proximity is less of a factor, and sea change/ tree change lifestyles are starting to look really good.

Yeah, great point mate. I think we're still a little ways off from that but it's coming, which itself will impact capital city property prices. Elon Musk may help with that. Imagine a hyperloop trip from Albury to Melbourne in 20 minutes.

Can I imagine the return trip, where I get to leave Melbourne, instead?

Great analysis, would you say it's a good time to sell a house in Melbourne right now?

Would you buy that property today at today's price? If not, then it's time to sell.

Another helpful question is... Which situation would you find more painful: you decided to sell to bank profits but the property went up in value and you missed out on more profit, or you decided to hold and the property went down in value, and you missed out on an opportunity to realise a significant gain?

The answer I was hoping for :)

A profit is a profit, can't be too greedy and get burned. I'm putting my house on the market hopefully this week or the next and hope to get 80-90% gain.

Sounds like a great time to sell to me :)

I hope everything is fine, I have days without seeing it here. Regards...