Stock Market Hits New High? Not So Fast!

News headlines proclaim that the US stock market indexes like the Dow Jones Industrial Average and the S&P 500 are hitting all-time highs. And this is true, when measured in US Dollars. But for many people, this seems unreal - especially when so many are trying to find work, or struggling to afford a new home, or a new car, or pay college tuition. Or even keep food on the table! This leads many investors into a state of cognitive dissonance.

Measuring with a rubber ruler

One reason for this is that the US Dollar itself has a shifting value, and trying to measure anything with a "rubber ruler" is an exercise in futility. One USD today does not buy what it used to - the dime store of the 20th century has become the dollar store of today. And thus, the stock prices of the past were measured by a different yardstick, and cannot fairly be compared directly with prices today.

Economists use what they call "constant dollars" or "price deflators" to address this, but I've never seen a constant dollar IRL, and the calculations behind these numbers are based on extremely dubious measurements and formulas that are regularly redefined and often exclude key prices of energy, food, or other key items.

Measuring with the Golden Ruler

The best alternative I've found is gold. Until 1971, the USD was actually defined in law as a specific weight of gold. Although US citizens were prohibited from owning gold from 1933 until 1975, before 1965 they could exchange their dollars for a fixed weight of silver, and before 1971, all international trade balances were settled in gold at a fixed rate of 1/35 oz per US Dollar. Even today, I think it is more accurate to say "the fact that gold owners will trade their gold for dollars at a given rate gives the dollar value" than it is to say "the fact that dollar holders will trade some of their dollars for gold gives gold it's value". If the day comes where gold owners will no longer willingly trade their gold for dollars, no matter the number of dollars offered, then the dollar will truly be worthless.

Of course, gold has a track record as money going back thousands of years. And while many monetary experiments have been tried over that period, as each was abandoned, people returned to precious metal coins, over and over again. One reason for this is that gold and silver require effort to find, mine, refine, and fabricate into coins or bars. This limits the quantity that can be issued, which governments and central banks hate, but it protects savers and investors from losing their wealth due to dilution.

What about Crypto-currencies?

With the advent of crypto-currencies like Bitcoin and Steem, a new round of monetary experiments are being tried. These differ from the government and central bank issued monies in many ways, but in particular that their rules of issuance are defined in the open source code base run by the users, not by the whims of rulers in closed-door meetings. I find this immensely exciting! Unfortunately, these currencies are so new that they are still undergoing wild swings in value as users discover them, learn to use them, and experiment with the implications of their rule sets. Although they may in time become stable enough to use for measuring the prices of other things, that day is not yet here, IMHO. But that is the stuff of another post.

Is Gold perfect?

While gold is not a perfect yardstick to measure prices, it is pretty darned good, and has a long track record that allows price comparisons that go back centuries, if desired. Labor, commodities, real estate, homes, and other tangible goods, when priced in gold, show stable or gradually declining prices that cycle up and down with changes in supply and demand, but which do not exhibit the exponential growth that characterizes the dollar prices of the same goods. Again, I don't wish to argue here that gold is perfect, just that it is a decent place to start to get a look through the fog of confusion introduced by central bank manipulation of most currencies, including the US Dollar.

The Dow in Dollars and in Gold

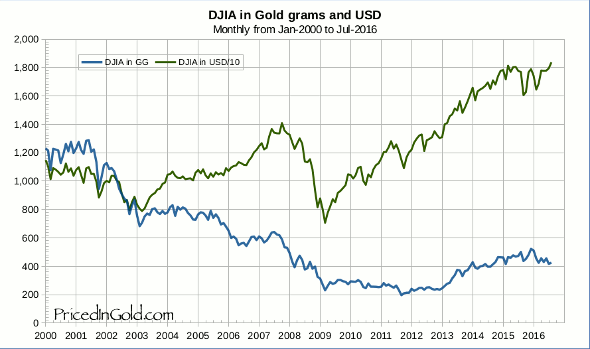

With all that said, take a look at this chart of the Dow Jones Industrial Average, plotted in USD and in grams of gold (based on the daily London PM gold fix). For each daily close of the Dow, I divide by that day's price of one ounce of gold to get a Dow price in ounces, and then multiply that by the number of grams in one troy ounce (31.1034768) to find the price in grams. To make the USD price fit the same scale, I divide it by 10:

As you can see, the USD price of the Dow has indeed hit a new high, more than 50% higher than the price back in 2000. But the gold price of the Dow is about one-third of its 2000 price, even after more than doubling in the last 5 years.

So for the last few years, stocks have been a great place to invest money. You could have sold some gold in 2011 or 2012, used the proceeds to buy a stock index fund, and if sold today, that would buy about twice as much gold as you started with.

But over the last 10 to 15 years, that same transaction would result in a loss. A loss of 50% to 75%, depending on the starting and ending dates. You might have sold about 1200 grams (about 2.6 pounds) of gold to buy the Dow in 2000. Today, those shares, if sold, would buy about 400 grams of gold (less than 1 pound).

This means just putting those gold coins in a safe rather than selling them to buy stocks, would have performed much better, and done so without the many risks of owning stocks: the counter-party risks, the business and management risks, currency risks, risk of fraud, etc. Keeping gold bars or coins in a safe isn't risk-free, of course - the safe could be stolen, for instance. But the overall level of risk would be much lower, and in this case, the return, much higher.

TL;DR

So: Is the stock market hitting new highs? Hardly. Most people are looking at prices for everything reflected in a fun-house mirror that is distorting them way out of shape. One trick to eliminating this distortion is to measure using a better ruler, gold. That's what I try to do every day with my site, Priced in Gold.

Helicopter money is what is propping the stocks currently...it will all implode very soon once one of the European banks collapse(Deutsche Bank, Unicredit SPA, Barclays).

Stock markets and the dollar itself is a bubble, which is every day even more and more inflated. Someday it will burst, then cryptocurrencies will jump in price

quickly escalated

You make a good point about the significance of coming off the gold standard in 1971. There are some advocating we should return the the gold standard.

Nicely articulated as usual, Charles! Many of our measures are rubber (even the various crypto currencies, "mining" notwithstanding). Absolute measures don't actually exist, but, as you have always advocated, gold comes closest.