Review Project Poolz Defi - Decentralized Layer-3 swapping protocol, based on DeFi infrastructure

I/ INTRODUCTION

DeFi is a completely new financial system opened to every citizen of the world, it's a limitless blockchain based financial system that uses a cluster of decentralized application to power it's operations for seamless results. DeFi concept is growing in leeps and bounds because eschew high levels of transparency, security and autonomous transaction process.

DeFi requires no human resource input for it's management but it rather uses a powerful decentralized application to co-ordinate and organize the day to day management of users iñvestments. DeFi flexibility, security, decentralization & autonomous power is unparalleled. This makes it steps ahead of erstwhile traditional financial institutions with prevalent centralized structures who rely so much on human resources to manage it's users iñvestments/funds, centralized financial institutions services like Trading, loans, lending, savings, insurance etc are very much available in DeFi with a better value proposition.

DeFi is an observational form of distributed money operating on digital currency blockchains, mainly Ethereum. DeFi is advanced as providing high lending rates, with certain suppliers providing triple-digit funding prices, but it depends on elevated risk. Instead of trading at an embedded digital money transfer, transactions between participants are legally performed by smart contract systems.

Despite all this exponential development, there are differing degrees of problems in a fragmented process market, each staying together, becoming one huge avalanche. Not only is this significant, but it needs to be broken down. If not, all technology would shut down until it achieves its full speed. And as you already know, any new initiative is attempting to address any or all of the current problems. And the initiative I'm writing about right now is Poolz Defi.

II/ THE POOLZ DEFI IS HERE

Poolz DeFi can best be described as a top-notch liquidity exchange and is poised towards early stage provision for already existing tokens in different cross chain token exchange. Any DeFi inclined start-up aiming to increase their DeFi token will easily find poolz DeFi very appealing. Poolz DeFi will operate as a veritable platform for safe iñvestment, the growth of DeFi is hinged on the high liquidity pool it has so far garnered, this feat surpasses the feat of most centralized exchanges. Poolz DeFi offers solutions to beguiling issues of market entry liquidity and startup funding, for the first time start-ups can seamlessly raise funding and maximally increase liquidity.

Business start-ups will savour the goodies of the poolz decentralized finance platform, entrepreneurs, initiators, partners, businesses can now be certain of their iñvestment & returns. Poolz DeFi unbiased liquidity dissemination system provides high-valued liquidity pooling available for pre-listing phase & already existing crypto assets.

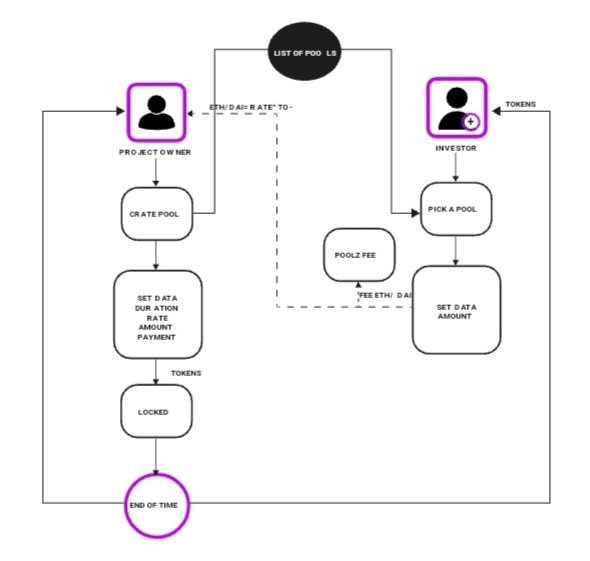

1.POOLZ BUSINESS MODEL FOR INNOVATORS

If you a business owner and tech enthusiast who seeks a DeFi platform to grow your business and to access liquidity for your recent project, you should consider the Poolz DeFi network. The design of this network encourages the success of every business, regardless of size, and ensures that owners of these businesses remain satisfied and happy. Let us consider a business case scenario for an innovator who intends to create liquidity for his token before listing and wants to work with the Poolz DeFi platform.

This first step for this type of business vendor is to generate a pool for the token on the platform and connect that token to a wallet. Defining the auction criteria for the token is the succeeding step. These criteria should consist of swap ration, the type of pool, the incoming payment process, pool duration, percentage reductions for Poolz token holders, etc. On the Poolz DeFi network, there are two kinds of pool available to users: the Direct Sale Pool and the Time-Locked Pool. A successful swapping of tokens in the wallet of the liquidity broker occurs in the former. There is a particular time indicated for the investor to access the token in the latter..

2.POOLZ BUSINESS MODEL FOR INVESTORS

The investors can access the auction criteria for listing new tokens on the Poolz platform and this allows them to provide the needed liquidity through linking their wallets. The investor can indicate the pools that intend to join and offer liquidity by simply clicking on the “open” button on the home page, they should also note that Poolz supports ERC20/ETH and DAI currently, and will extend to other exchange pairs in the future.

3.UNITING THE INNOVATORS AND INVESTORS

Striking a balance and common ground for business innovators and investors is paramount to the growth of a business. This is the objective of the Poolz DeFi network, to create a mutually beneficial platform for both investors and innovators. This is essential, why the management team of Poolz DeFi network focuses on establishing a platform that offers a robust and accessible early-stage liquidity for its innovators registered to the platform. With the availability of this liquidity, there will be incredible opportunities for investors during the initial stages of the business. In combination with other exciting and business-oriented features, Poolz DeFi creates a bridge that promotes the relationship of investors and innovators on its platform.

4.HOW LIQUIDITY POOL WORKS

In a completely conventional manner, liquidity pool is provided through the procedure of market making. This has to do with a state of affairs that decided on participant in the market with excessive volumes gives liquidity at a reduced price of their favor.

Although it helps in a manner, however it breeds numerous troubles like monopoly in the marketplace and custodial boundaries. Unfortunately, this is the approach which centralized Crypto exchanges have been using so far.

Unlike the traditional way explained above, the POOLZ DeFi will give us a completely dependable manner of creating liquidity pools to depend upon the automated market making that is completed with the aid of the POOLZ protocol.

POOLZ Ecosytem Operations

Poolz Dao Protocol: Poolz is built as a DAO protocol on ethereum, and the premise of the Poolz operations and governance is that, the community gets to decides how governance and operations will evolve, going forward. So even though our team get to set the initial operations, the community still gets to decide how it eventually evolves.

Please note that, this overview is not an exhaustive representation of the overall Poolz operations. That will be available in the litepaper. What is captured here is a brief summary of the its operation:

Poolz (POZ) Token: this is an ERC-2O token, since Poolz is deployed on Ethereum. It will be used for incentivization, to pay for developmental cost goin forward and governance requirements. Also, POZ holders get to be discounted with pool entry and simply for being holders of POZ, so you get to earn more POZ for having POZ.

Pool Type: there will be two pool types on Poolz, which is the direct sales pool (DSP), where the tokens are received by the investor, imediately after a swap, and the time-lock pools (TLP), where the pools have a lock-in-period, before the tokens are released to the investors.

Poolz Market Players: There are two categories of players in the market, which are the liquidity providers (LP), technically the market makers, and those in need of the liquidity or Pool creators.

Pool rule makers: every pool on Poolz come with basic rules and the pool creators, which are usually the project owners, for new tokens, get to set the rules. The parameters for this rule includes choices like: relevant blockchain protocol and wallet for the swap, pool type, pool duration (in the case of a timelock pool,) available token for the pool or auction, the swapping ratio and several others.

Planned Improvements: as an eventual milestone in the poolz functional agenda, there will be a cross-chain token transfer implementation, at a later stage of its developmental roadmap. This will allow for non-ethereum tokens to be swapped by the poolz protocol.

How Can You Get Benefit From POOLZ?

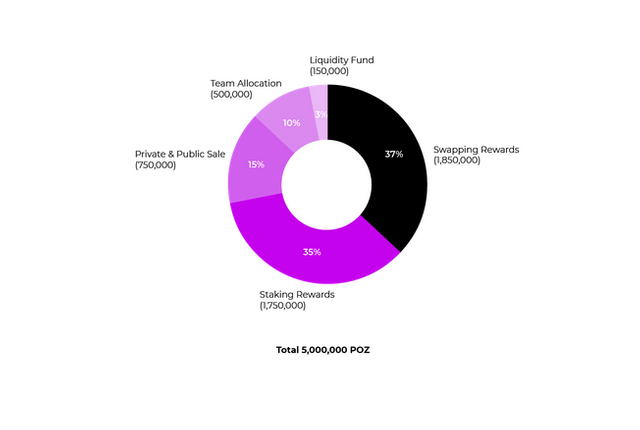

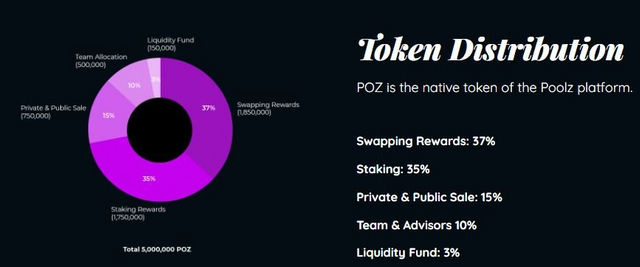

Swapping Rewards: 37% out of the total POZ supply — 1,850,000 POZ tokens — is allocated for swapping rewards for liquidity providers (LP), who will be participating across the various swapping pools on Poolz. The swapping rewards will be distributed over the next 10 years from launch. The Poolz ecosystem will release 185,000 POZ per year, equaling 3,577 tokens per week. The Poolz community may change the vesting ratio rule after the governance protocol launch

Staking Rewards: 35% of the total POZ supply, or 1,750,000 POZ, is allocated as staking rewards, which will be circulated as average annual yields (AYY) to users who stake POZ. The staking reward tokens will be locked in a publicly-auditable and secure Multi-Sig Wallet. And the rewards will be released in 10 annual instalments over 10 years at a rate of 175,000 POZ per-year.

Voting Right: Aside from constituting one of the most formidable DeFi ecosystems, Poolz DeFi is also creating a distinct Decentralized Autonomous Organization (DAO) ecosystem. It is via the ecosystem that you can use your Poolz (POZ) token to vote for or against major decisions taken on the platform.

III/ TOKEN POOLZ DEFI (POZ)

POOLZ platform is powered on POZ token . It is an ERC20 token .Amongs the utility functions of POZ token includes : Governance, incentivization, Project development and token burning acrross Poolz network .

POZ TOKEN INFO

POZ Total Supply :5,000,000

Budgeted Seed Sale : 240,000 POZ ,at 0.455$

POZ offered for Private Sale : 60,000 POZ, @1$

POZ offered for Auction Pools : 150,000 POZ @ |$1.6 USD.

DISTRIBUTION

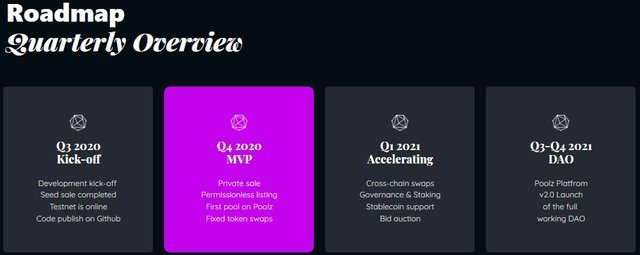

IV/ ROADMAP A CCORDING TO SERVICES

Strategical And Investing Partners

CONCLUSION

Having said all these, I believe that you will certainly agree with me that poolz DeFi is a bridging point between business innovators and investors, there peculiarities and infrastructure encourages objectivity, effectiveness, efficiency and transparency that will be mutually beneficial investors and business innovators. The team of poolz DeFi network have really done a good job by giving a truely DeFi platform that actually those what it says, poolz DeFi liquidity will certainly provide a plethora of incredible opportunities for investors during the early stages of the businesses. Poolz DeFi is no doubt a masterpiece.

For more information about the project click the links below:

Website: https://poolzdefi.com/

Lightpaper: https://docs.poolzdefi.com/whitepaper/litepaper

Whitepaper: https://docs.poolzdefi.com/whitepaper/whitepaper

Twitter: https://twitter.com/Poolz__

Discord: https://discord.gg/RgPjgUY

Telegram: https://t.me/PoolzOfficialCommunity

Medium: https://medium.com/@Poolz

AUTHOR:

BCT usename:zz9w9z

BCT URL: https://bitcointalk.org/index.php?action=profile;u=1115979

Tetegram: @Siner9586

ETH: 0xD9635878b44f209d2985a6a7282942152A6375EA