REVIEW PROJECT POOLZ DEFI - Decentralized Layer-3 swapping protocol

PRESENTATION

As far as we know, there has been a massive DEFI boom here in the crypto space for now. This has made different people earn an insane amount of APY and earn a good amount of money. But with good news, there are also people who took advantage of this craze and deployed fake projects wherein they are like fly-by-night type of projects that just wanted to get the people's money and go away. Many people especially the legitimate developers of the DEFI space and community of course do not want those kinds of people to be around

More importantly, the Corona pandemic virus has brought about some architectural changes in the global economy and the importance of Bitcoin is received like never before. Perhaps at the present time many people will realize the value of this market.

Although the market is becoming more competitive and value-driven, early stage innovators are facing unprecedented challenges due to these rapid changes. Facilitate higher and safer profits through liquidity mining. Before listing, they must look for liquidity investments for their tokens. That’s how Poolz is evolving and now join me in exploring the details of Poolz.

From a source from Poolz, cryptocurrency innovators are looking for decentralized fundraising, to combat censorship, has the appearance of Initial DeFi Offer (IDO) and Initial Liquidity Offer(ILO). With the rise of Automatic Market Makers (AMMs), the liquidity of the token has become an important determinant of its market price. Poolz is a decentralized, layer 3 swap protocol that allows startups to manage liquidity auctions, thus bringing them closer to early-stage investors and liquidity miners.

Poolz’s solution begins with Ethereum, which is where Poolz embarked on a mission to completely disrupt and decentralize liquidity auctions. Poolz with a vision to facilitate greater interoperability through cross-chain interactions, thus, will further enhance the DeFi adoption and value. For ecosystems Poolz will have one refers to a Project Owners or Pool Creators, while Investors or Liquidity Providers (LP) comprise the other.

INFOMATION POOLZ

WHAT IS POOLZ PLATFORM ???

Poolz is a DeFi powered decentralized Layer three swapping protocol. The Protocol connect the investors and the owners, developing alternative for easier liquidity for revolutionary tasks and giving the investors an opportunity to get entry onto Swap pools.

Poolz has emerged to simplify the manner of fund elevating essentially for the Startup agencies. It offers possibility and same access to decentralized fundraising.

Poolz has eased the weight of the struggling entrepreneurs inclined to raise price to further develop their revolutionary blockchain concept. A core benefit from the poolz platform is as follows:

It permits access to liquidity via a obvious, cozy and a 100% decentralized fund elevating platform.

Among the features of Poolz ecosystem that you can look forward to are the following:

1-Cross Chain Swap

2-Governance and Staking

3-Early Stage liquidity bootstrapping

4-Poolz Bridge.

POOLZ ECOSYSTEM

Remember that Poolz connects investors and Innovators which are undertaking proprietors of the platform. The environment encompasses investors and the Pool creators. Investors represent the (LP), that means Liquidity Provider whilst Project owners are the Pool Creators.

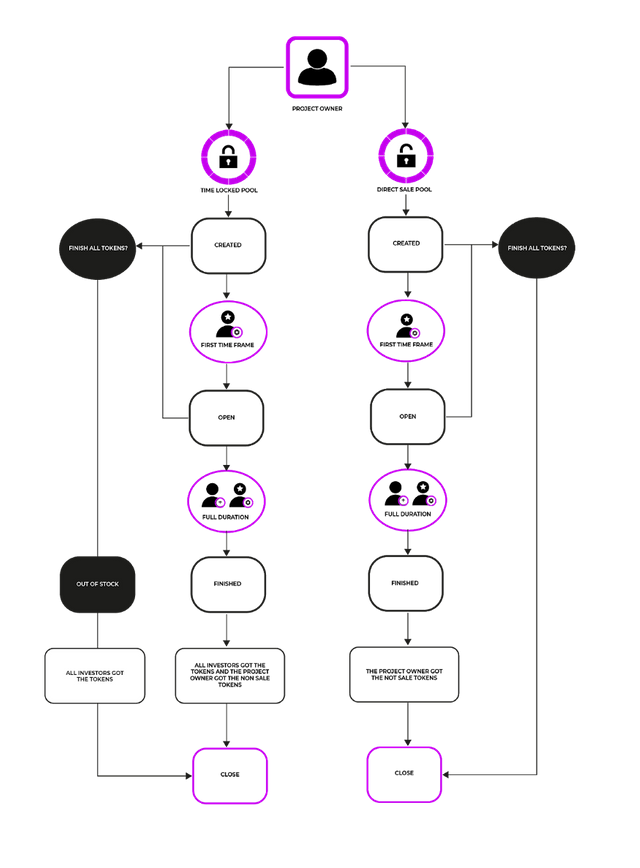

Poolz Platform have 2 distinctive styles of Pools, particularly:

DSP) Direct Sales Pools and

(TLP) the Time locked Pools

The Direct Sales Pools (DSP) are the swimming pools which doesn't have any lock in period, in this case buyers token are without delay launched to them after purchasing.

The (TLP) Time locked Pools have specific token lock duration, the investors property are locked periodically until the stop of locked duration. The investor on this class of pools received their swapped tokens after the length of token lock is achieved.

This is made easy through the smart contract programmed on the poolz platform; hence token lock and release is automatic.

Here are the most specific use cases of products from Poolz:

Liquidity Bootstrapping: Innovators can leverage the Poolz platform to launch token auctions, thus generating liquidity for their DEX listing. Although the platform is the most relevant for early-stage projects, it can be similarly used by any blockchain-based project.

OTC Trading: Strengthening widespread DeFi adoption, the Poolz platform can also be used as a marketplace for wide-ranging crypto OTC trading.

Yield Generation: Investors can participate in auctions hosted on the Poolz platform, thus generating passive yield from their ETH and DAI holdings by providing liquidity to auctioning projects.

Non-Fungible Token Bid Auction: NFT-based projects can launch dynamic ratio auctions on the Poolz platform, thus diversifying the options for liquidity providers.

Clearly defining who uses the day from the beginning will help Poolz define its goals and focus on developing the next product. I also think that Poolz will get strong support from users because we are in desperate need of a product that Poolz is aiming for.

Poolz also gives users very useful features:

Customizable pool options ensuring relevance for wide-ranging blockchain-based projects and use cases, alongside multi-chain integrations and support. Poolz is built with the long-term aim of enabling a unified interface with cross-chain interactions and other functionalities.

A fully decentralized, non-custodial, and trustless ecosystem with robust, Solidity-based smart contracts.

An interactive, intuitive, and responsive UI, coded in React for a smooth and seamless user experience. Moreover, Poolz integrates Web3 libraries to access continuous feedback from on-chain data, thus implementing necessary UI upgrades for optimum consistency.

Unit testing of smart contracts and network code using Ganache, ensuring optimal bug-resistance and security.

Continual and multi-level incentivization mechanisms, facilitating recurrent gains for investors, liquidity providers, and yield farmers.

Due to Poolz’s optimized network and contract architecture, innovators require substantially lesser gas fee for registering their pools, as compared to existing market standards

Token:

POZ is the ecosystem’s native ERC-20 token and will be used for incentivization, governance, project development, and token burns. As for investors and liquidity providers, the POZ token’s ownership makes them eligible for a range of use-cases.

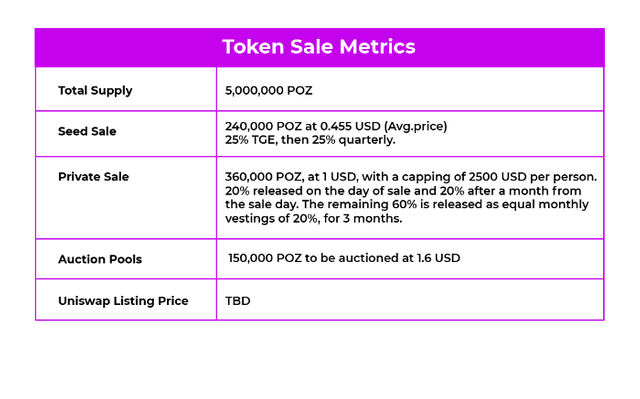

TOKEN PRICE

Total Supply: 5,000,000 POZ

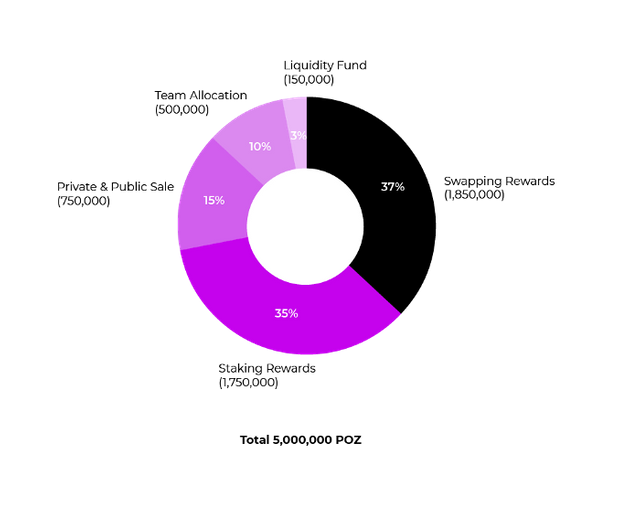

Token Allocation & Circulation

ROADMAP:

Q3 2020: Kick-starting Poolz

Platform, smart contract, and network development.

Seed sale completed.

Testnet Launched — built with Truffle and written in .NET core, for optimum security and stability.

Code published on GitHub

Q4 2020: Launching the MVP

Pre-listing POZ sale (liquidity auctions).

DEX listing.

First pool creation on Poolz platform.

Fixed token swaps.

Q1 2021: Accelerating Poolz

Cross-chain swap integration.

ERC721 (Non-Fungible Token) integration — NFT auction.

Integrations enabling Yield Project owners to bootstrap pre-listing liquidity.

Governance Launch & POZ Staking

Stablecoin Swap integration.

Implementing Bid Auction functionality.

Q3-Q4 2021: The Poolz DAO

Launching Poolz v.3 — A fully-functional DAO.

PARTNER:

OMS Capital:

OMS Capital is an investment firm specializing on technology in emerging cryptocurrencies. They invest in early stage blockchain startups and decentralized protocols.

Market Across:

They provide a complete end-to-end marketing solution for blockchain firms. They guarantee results, by using blockchain storytelling to execute success-based full-stack marketing and growth campaigns.

Advisors

https://poolz.medium.com/poolz-appoints-new-strategic-advisors-bcf7307b4d51

CONCLUSION

According to the information that I find out, Poolz is accelerating its development to soon bring products to the community of users. With Poolz’s idea, probably many people will be very curious about what Poolz solution will bring. For how they would bridge the gap between project owner and investor, provide immediate liquidity option for promising projects while also providing investor access to swap pools monopoly. With what DeFi has shown so far, we can hope that this market will continue to grow strongly in the future. And moreover, Poolz is also showing off as a company that has a clear strategy when the target audience has been identified from the start. Poolz showed me the confidence of the development team. With the information I have, Poolz receives an investment from MarketAcross and OMS Capital. POOLZ is a hot demand defi project now which is on the top list to the investors. As an wise investors, i would recommend to participate in token sale before sold out. It is The best DeFi protocol in 2020 cryptocurrency bulling world. Finally , I can say with full confidence that the project is really a breakthrough project, its benefits, both for the economy and for protecting the environment, are obvious.

For more enquiries, please visit:

Website: https://poolzdefi.com/

Medium: https://medium.com/@Poolz

Twitter: https://twitter.com/Poolz__

Telegram: https://t.me/PoolzOfficialCommunity

Telegram Channel: https://t.me/Poolz_Announcements

Github: https://github.com/PoolzAdmin/Poolz

Discord: https://discord.gg/8REVabc

AUTHOR:

Bitcointalk Name: lethingocthuy686868

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2017740