The National Debt Myth

If you live in the US and regularly get into conversations with people about taxes and spending, you are likely to run across the “national debt” argument. This argument says that we need to either increase taxes or cut spending because the national debt is out of control.

If you are talking to a “liberal,” the person will go on and on about how corporations and higher-income people are not paying enough in taxes and why this is causing the national debt to explode. If you are talking to a “conservative” or libertarian, the person will complain about all of the welfare spending that exists: social security, food stamps, disability, housing subsidies, health care subsidies, etc. and will say that this is the cause of the national debt getting bigger.

Both sides agree that the national debt is a problem for the government. Or, to be more precise, they believe it is a problem for “taxpayers” or voters.

In this article, I will argue that this “problem” is an illusion. There is no reason for voters or the government to worry about deficits and the national debt. Holders of US treasuries should worry, as should holders of cash in a bank account. But if you live paycheck-to-paycheck, spending every penny before you get paid again, or if your savings consist entirely of precious metals, crypto, and other non-dollar assets, the national debt is not your problem.

Households vs. government in a fiat currency system

It might seem as if the national debt must be something for voters to worry about. After all, imagine if your household gets into debt. Let’s say that your family is spending more than it is earning every single paycheck, so that your household is constantly going deeper and deeper into debt. And let’s say the way you are paying for this lifestyle is to borrow more and more from credit card companies. It seems obvious in this case that you are being reckless and endangering your family's financial security. So it might seem as if the government is being equally reckless if it runs perpetual deficits.

I point this out only to show why it is wrong. Unlike the government, you are not the issuer of the currency. If you go into debt, you have to work to make money to pay back your loan. The government, on the other hand, can issue bonds and sell them to banks to raise as much money as it needs. The banks can then sell these bonds to the Federal Reserve, who will simply create the money to buy them with. There is no need for the government to work to pay back its loans, and no chance that it will ever need to default on these loans.

It may appear that this is not the case because the government taxes us. You may think to yourself “Surely the government has to collect taxes to pay for services, doesn’t it?” But it turns out this is not the case either. As the perpetual deficits of the last 40+ years have proven, the government can collect much less tax revenue than it spends and have essentially no negative repercussions as result of it. In fact, it can even lower tax rates as it increases spending, as it did in the W. Bush era and has done recently under Trump. Far from being a problem for the government, this practice actually makes the government more popular. If taxes go down while spending goes up, the recipients of tax cuts and the recipients of government spending are all happier, making the government more popular than ever.

So why does the government tax us? Why doesn’t it just reduce taxes to zero and print whatever it needs? One reason is because there is a long-standing tradition of taxing the citizens. And this tradition is part of the myth that makes government spending seem legitimate. If the government were to suddenly reduce taxes to zero, it would be too obvious. Another reason is that if taxes were zero, there would be no method of removing money from the economy.

As it is, taxes are a means of annihilating currency. The government takes in taxes and pays the Federal Reserve for bonds that are maturing. When these transactions take place, the bonds cease to exist and so do the dollars. So taxes are a means of controlling inflation by limiting the amount of money that is created. Taxes are not the means of paying for government services. If the government wants to provide a service, it can create the money it needs to pay for it. It doesn’t need taxes for that.

The national debt, 2000-2018

Even after explaining this, you may still believe there must be something wrong with my analysis. It just can’t possibly be true that the national debt is not a problem for the U.S. government, right? If so, let me give you a few statistics that will prove to you that the national debt has gone down since 2000, not up.

Of course, this contradicts what we usually hear about the national debt. We are always told that the national debt is the highest it has ever been. But people who say this are measuring the debt in dollars. And since dollars are always depreciating in value, the national debt always appears to be going up. US Government revenue also always appears to be going up if we measure it in dollars, even though tax rates have been going down. But we can’t know whether these figures are going up in real terms unless we measure them with something objective, something that never loses its value.

One way of dealing with this problem is to measure the revenue, spending, deficits, and debt in Killowatt hours (Kwh). We need energy for everything we do in the Universe. We always face the problem of entropy. So it makes sense to measure finances in the one thing that will allow us to (temporarily) overcome entropy.

However, measuring these figures using energy would be difficult because there are many different energy products. One proxy we could use though would be crude oil. Oil is the most used energy product in our society, and its price has been fairly stable compared to natural gas, coal, and other products.

What I am going to suggest today though is that we just use gold to measure the national debt. Lest you object that gold is “just a commodity,” let me show you a chart of the price of gold in terms of the number of barrels of crude oil needed to buy one Troy ounce.

There is some fluctuation in this chart. The gold/oil ratio hit a high of 40 barrels per ounce in 2016 and a low of about seven barrels per ounce in 2005 and 2008. But what is clear from this chart is that the price is range-bound. Over the long-run, 1 oz. gold stays most of the time at around 15-16 barrels per ounce.

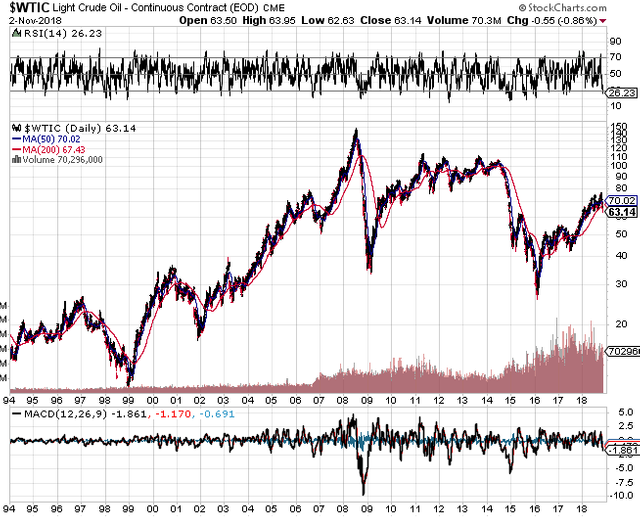

Now compare this to the dollar price of oil during the same time period.

This chart shows the price going up over time due to dollar depreciation. So while gold is not a perfect measurement of Kwh, it’s a pretty close approximation, and it’s definitely a better measuring stick than dollars are.

US Government revenue in gold

Here are the figures for US Government tax revenue in gold, 2000-2017. I don’t include 2018 because it isn’t over yet.

2000: 7.445 billion oz

2001: 7.197 billion oz

2002: 5.397 billion oz

2003: 4.122 billion oz

2004: 4.315 billion oz

2005: 4.191 billion oz

2006: 3.775 billion oz

2007: 3.072 billion oz

2008: 2.897 billion oz

2009: 1.931 billion oz

2010: 1.520 billion oz

2011: 1.502 billion oz

2012: 1.472 billion oz

2013: 2.299 billion oz

2014: 2.518 billion oz

2015: 3.066 billion oz

2016: 2.843 billion oz

2017: 2.886 billion oz

Clearly, tax revenue has been falling since 2000.

US Government spending in gold

So what about government spending. Is spending at record highs?

2000: 6.565 billion oz

2001: 6.726 billion oz

2002: 5.864 billion oz

2003: 5.176 billion oz

2004: 5.257 billion oz

2005: 4.814 billion oz

2006: 4.184 billion oz

2007: 3.263 billion oz

2008: 3.426 billion oz

2009: 3.236 billion oz

2010: 2.436 billion oz

2011: 2.351 billion oz

2012: 2.283 billion oz

2013: 3.154 billion oz

2014: 3.235 billion oz

2015: 3.830 billion oz

2016: 3.764 billion oz

2017: 3.478 billion oz

Nope. Spending is down too. So why are we running a deficit?

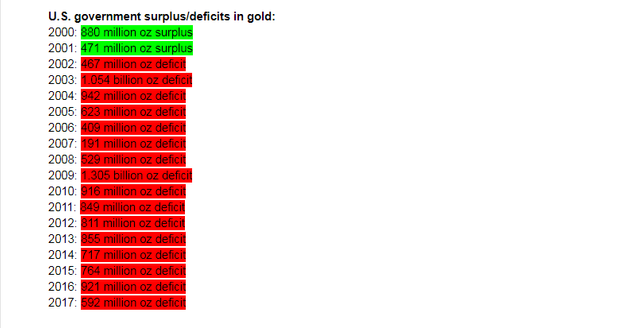

US Government deficits in gold

We had surpluses in 2000-2001 because revenue had fallen slower than spending. Since 2002, we’ve been running deficits as spending has fallen slower than revenue. So if we are running a deficit every year, shouldn’t the debt be getting larger?

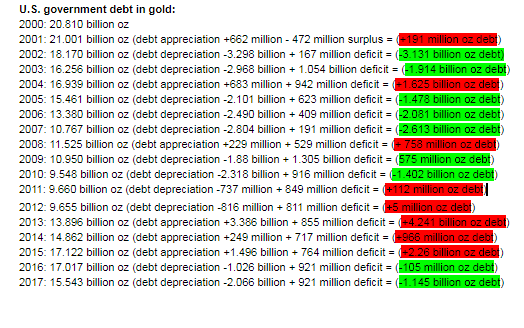

US Government debt in gold

The years in green are ones where the national debt shrank. The years in red are the ones where the national debt grew larger.

In some years, the value of the dollar fell. This made the true value of the debt fall. I call this “debt depreciation.” If the government ran a deficit these years, whether the debt grew larger depended on whether the deficits were so big that they counteracted the fall in the dollar. For example, 2002-2003, 2005-2007, 2009-2012, and 2016-2017 were all years of debt depreciation. In all of these years except 2011 and 2012, the national debt shrank. In those two outlying years, the national debt increased because the deficit was larger than the amount of debt depreciation.

In other years, the value of the dollar increased. This made the true value of the debt rise. I call this “debt appreciation.” If the government ran a surplus these years, whether the debt shrank depended on whether the surpluses were large enough to counteract the rise in the dollar. For example, in 2001 the debt rose even though the government ran a surplus that year. In 2004, 2008, and 2013-2015, the debt rose because of a double whammy of deficits on top of debt appreciation.

The most important fact shown by this data is that the national debt was equal to 20.810 billion oz. of gold in 2000, but was only equal to 15.543 billion oz. at the end of 2017. Contrary to the “national debt is highest it’s ever been” mantra, it has fallen by almost 25%.

The true problem of the national debt

So the national debt is falling in value and getting easier to pay off. This should be greeted as good news to taxpayers and voters. However, this does not mean that there is no problem with the national debt.

A national debt that is falling in value means that wealth is being transferred from creditors to the government. It means that anyone who owns treasury bonds is seeing his or her investment depreciate over time. This is how the government is paying for all of the welfare spending and tax cuts it has been enacting over the past 18 years. And since holders of cash in a bank account are de-facto owners of treasuries (because that’s what your bank invests your cash in), this means that holders of US dollars are footing the bill for government largesse.

The lesson here should be clear: stay out of the US dollar. Buy gold, silver, crypto, oil, copper, maybe foreign bonds or stocks in countries like Russia that don’t hold dollars; whatever you can find whose value isn’t dependent on the Fed restraining itself.

And most importantly, stop saying “the national debt is being passed onto our children and grandchildren.” It’s not true. It’s being “paid” right now by everyone holding US assets.

I hope you’ve enjoyed this article. Please comment below with your thoughts and questions. And if you like this kind of thing, follow me so that you’ll see when my next article is posted.

Data sources:

Tax revenues: https://www.thebalance.com/current-u-s-federal-government-tax-revenue-3305762

Gold prices 2000-2015: http://onlygold.com/Info/Historical-Gold-Prices.asp

Gold prices 2016-present: FX Choice forex brokerage on MT4 (closing price taken at December 1 of each year): $1,150.14 in 2016 and $1,302.41 in 2017

U.S. government spending: https://www.usgovernmentspending.com/spending_chart_2000_2017USr_13s1li111mcn_F0f

U.S. national debt: http://www.polidiotic.com/by-the-numbers/us-national-debt-by-year/

Images:

"National-debt" by Missy Schmidt, licensed under CC BY 2.0

Well said...gold and silver are on the launching pad..and ready to (by 2021) shock people.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Congratulations @tomblackstone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @tomblackstone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @tomblackstone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @tomblackstone! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: