War Drums Becoming Louder As Finances Visibly Crumble

Chicken Little(ish) “The-Sky-Is-Falling” pronouncements have been big populist draw cards in Alt-Right persuasions throughout history. Predictably, as a broken clock is right twice a day, at some point in time all the rational safeguards fail and there is an alignment of elements to rationalise the Big Reset(s).

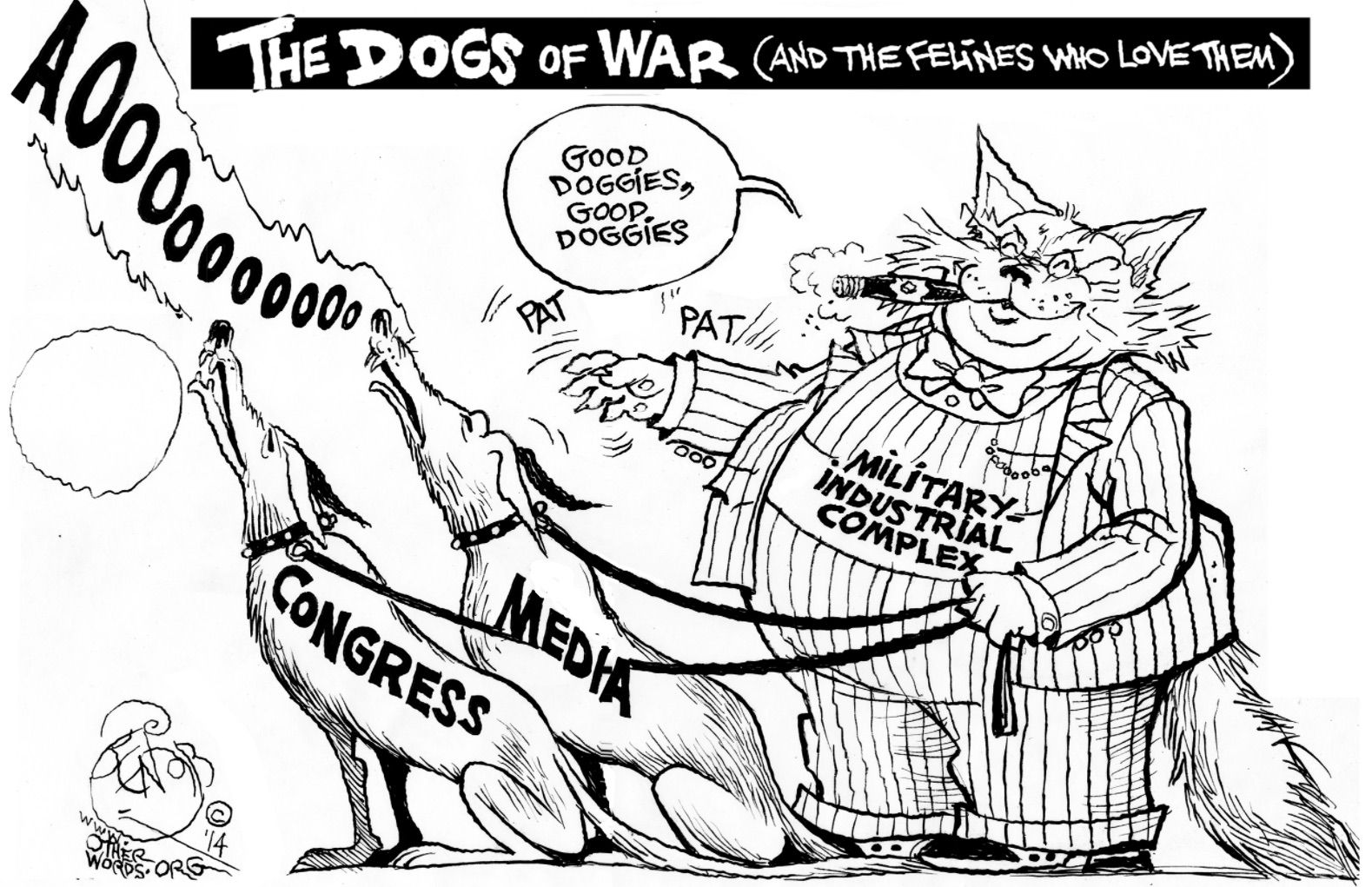

Historical factors for wars have traditionally been ailing economies, disenfranchised populations, and almost obscene inequality. Add to that witches’ brew a catalyst or two: for instance, a “scapegoat” and a widely perceived “enemy” of the State. Stir the mixture with inflammatory rhetoric add a dash of populism and militarism to destabilise, marginalise, and polarise a population. Stack the State’s leadership team with a heavy sprinkling of bankers, generals, and tycoons. Et voila!, all that’s necessary for a, “Cry havoc and let slip the dogs of war.” moment is a widely perceived precipitating event.

It would be difficult for even the dimmest among us to realise global economies are seriously ailing. We have the refugee/militant radical Muslim scapegoats. The Russia and North Korean actions and threats dominate the newsfeeds. Some countries’ Cabinet positions are decidedly right wing enthusiasts acting as cheer squads for the military-industrial enterprise. Some countries are now threatened with possible nuclear strikes to their homelands. The fall season has historically been the timeframe for financial meltdowns.

Institutions that traditionally helped keep the wheels from falling off the cart are being largely discredited as having no real solutions and shown to have little moral authority. Is it any wonder that growing segments of populations have lost trust in fiat currencies? It is any wonder the “trustlessness” of blockchain and the appeal of decentralised governance attracts growing numbers of thinking people? Is it any wonder that people are starting to understand that the decks have always been stacked against them – that moment of, “We’ve been had!” is dawning? Numbers of people are realising that since their "leaders" don’t have any magic bullet solutions, people might just as well take their fates into their own hands - take control of their assets and their futures to the extent legally possible.

Figuratively speaking, politicians confronted with growing crowds of pitchfork-wielding citizens demanding solutions have set up an agenda to use coercive means to save their political “skins.” They use these means to “protect” citizens from threats. Many people are realizing that the real threats are actually the politicians themselves.

Militarised police forces, invasive security organs, restrictive civil liberties policies, moves to repress dissent – these elements of control have and are being incrementally implemented. As these measures become less and less effective to control the populations and economies, the justification for The Big Reset becomes too attractive for politicians to resist.

War: Cui Bono? Whodaya think? Politicos deploy “State of Emergency” powers and suspension of the Rule of Law; the state’s debts are inflated away or simply written off; currency controls come into play – perhaps even a new, cashless economy; manufacturing flourishes bringing new technologies and production capabilities for the future; widespread employment; rebuilding a decrepit infrastructure to facilitate future commerce; population control in all its forms. These are a few of War’s favourite things.

Remaining realistic without being alarmist is a delicate balance. Given the situation, it’s reasonable to reduce personal debt by as much as practicable, avoid holding debt instruments as investments and invest in tradable, tangible assets, reduce fiat currency holdings to a working minimum; and, invest in food production and storage. It just seems a wise strategy to hope for the best… but be sure to tie up your horses.

Good Luck to Us