Expectancy of growth is causing world of inequality, debt and depression. Will we ever see an end to this?

We're living in a world where the private sector is taking over pretty much everything. The inequality is rapidly growing. The 85 richest people in the world are richer than the poorest half of the population on the planet. The richest 1% will own more than the 99% by 2016. In US the richest 0.1% owns more than the lowest 90%. The wealthy elite is is directly linked to the politics. This is no secret. After all money is power.

(http://www.theguardian.com/business/2014/jan/20/oxfam-85-richest-people-half-of-the-world)

(http://www.theguardian.com/business/2014/nov/13/us-wealth-inequality-top-01-worth-as-much-as-the-bottom-90)

(http://www.oxfam.org/en/pressroom/pressreleases/2015-01-19/richest-1-will-own-more-all-rest-2016)

At the same time, the wealthiest 1% own only 5% of eg. US's private debt. I expect the numbers to be similar all around the world.

This also means, that media is turning private, if it isn't already, which leads to biased news, lobbying and driving political agendas. What agendas, one might ask? Anything that serves the shareholders. People are more or less lied to, to eventually get their votes and support. If nothing else - to influence views.

In private sector, quarterly revenues are the merit of success, which lead to short sighted planning in the competition to maximize the revenues. People are sacked and hired as pawns.

Equality doesn't always mean justice and that's the reason why progressive taxing is a good thing. Sadly it doesn't really work with all the tax avoiding and loopholes used by the wealthy. Banks are in the core of the problem, acting as cartels. They have been known to manipulate markets in pretty much every imaginable end, eg. LIBOR and other interest rates.

GDP is the common meter for economical growth, although it doesn't tell anything about the well being and general happiness and satisfaction of the people. Nature published a great article about this in January 2014:

(http://www.nature.com/news/development-time-to-leave-gdp-behind-1.14499)

Still, the growth of GDP is pretty much the only meaningful statistic in terms of "how countries are doing?" It's even listed in the UN's "Millenium Development Goals". The exponential growth will eventually stop, as at some point there's simply not enough resources on earth to squeeze the growth from. The renewable resources have been running out earlier and earlier by the year. In 2014 this happened in August 19th.

(http://www.theguardian.com/environment/2014/aug/19/earth-ecological-debt-earlier)

The growth of GDP can even be upheld by artificial measures, which has happened at least in China. Government is ordering local regions to build, in order to reach the GDP growth target set for the country as whole. Due to the policy, vast million people cities are essentially empty. The work labor cannot afford to purchase the apartments.

(http://www.wimp.com/ghostcities/)

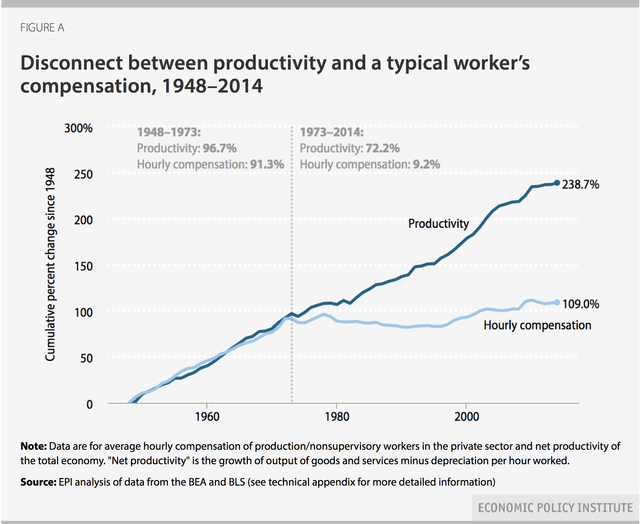

Since 1970's, the avg. hourly compensation hasn't really changed, although the productivity has multiplied. Total civil labor force in US has increased by roughly 90%. The people are working nearly as much as they did back then. Near 40 hour work weeks are still the common reality.

And why hasn't the actual hourly compensation been increasing? The answer lies in the growing inequality - the elite is hoarding the fruits of labor. Over 60% of all households in US haven't seen a real change in income since 1970s. The poorest 40% (awkward to call 40% of people "the poorest") percentile has seen a noticeable decrease in net wealth.

(http://www.npr.org/blogs/money/2014/10/02/349863761/40-years-of-income-inequality-in-america-in-graphs)

(http://www2.ucsc.edu/whorulesamerica/power/wealth.html)

At the same time, the US debt has increased by over 1500%. Although the GDP to debt ratio has been increasing more slowly, the debt has increased from around 40% of GDP to 104,5%. Consider that the GDP has been growing at the same time.

In the end of the day, the corporations are interested in nothing else but maximizing the profits. They're responsible for their shareholders and as such, corporations aim for growth, which essentially drives the growth of GDP. That's fueled through raising new loans, which the corporations need to expand. Shareholders can get their money out quick, so even if the company would have wealth, loans are prioritized to expand. If the company dies, the debt dies with it. The private wealth of board of directors is very rarely affected through bankruptcy. And as companies grow, they demand and supply more, fueling the general growth even more.

How can the demand increase, if the labor force compensation isn't increasing? The money from productivity increasing isn't something what the labor force sees, but instead it's reaped by the elite owning the companies employing the work force. So the answer must lie in the loans.

If you combine all the debt in the world and compare that to physical cash that has been printed, you'll get a ratio of roughly 99 to 1. I don't have the exact numbers. Pretty sure no one has. Point being, the overwhelming majority of all that wealth doesn't exist anywhere but as digital data - as debt. Creation of money happens mainly through banks, which can generate more money out of nowhere by issuing new loans. Eg. a bank that has assets worth of 1 billion dollars, is allowed to loan eg. 9 billion forward. After all, the repayments with interest for the banks will keep them floating happily...as long as the repayments are paid, that is. The European debt crisis began due to unhealthy fiscal policies from countries like eg. Greece, causing insolvency. Watch the following video if you're interested to know more.

(http://www.bloomberg.com/news/videos/b/88f037f8-06ec-4861-bcf4-b38692477e44)

None of the existing wealth (cash/debt) is standardized to any physical currency any longer, eg. gold, silver or oil as they used to be. The reason is, that there doesn't exist enough of these resources. At the same time, we "need" the banks to keep the loans flowing to keep GDP growth positive.

As the inequality grows, the living is more and more expensive for the majority of the people. Inflation is gnawing the income of labor force and it will eventually turn people to slaves. As more and more people cannot pay their debts to the creditors, any income you might receive in the future in any form (eg. compulsory auctions of homes, inheritance and salaries) will be transferred directly to the creditor. Governments, steered by the elite, assign policies which will cut your unemployment and other welfare benefits, unless you accept a job assigned by them. No matter of your education. McDonald needs you. Wonder why the depression and unhappiness statistics show 20% annual growth in US? 8-10% of US population is taking antidepressants. Like you shouldn't feel bad, sad and everything between?

(http://www.healthline.com/health/depression/statistics-infographic)

(http://www.scientificamerican.com/article/the-rise-of-all-purpose-antidepressants/)

Currently, the interests are lower than they've ever been. Negative even. On top of that, central banks have been flooding the market with money to make the loans extremely cheap and generate liquidity. ECB just started buying government bonds for 60 billion euros monthly for the next 18 months. Why? To make sure that the countries have enough assets to keep their banks a float. After all the banks require certain amount of assets to create more money in terms of debt.

The only way to combat the ever increasing burden from interests of pre-existing loans, is to make sure that the growth and productivity increase outmatches the interests. Central banks want the corporations and investors to raise the loans. As the banks generate more money through the loans, the GDP can (and will) increase. The money is used by the companies to increase their yields, expand processes, research etc - all of which allows more people to be employed. This will have an direct impact on supply and demand as well. Sadly the people with the new jobs just generally aren't us Western people anymore, as you've people willing to work for a lot less in the emerging markets.

The labor force carries the burden of the debt. The private debt will also be transferred from parents to their children, so if the collateral loses value for whatever reason, there debt still exists. Lannisters aren't the only ones always paying their debts. Too bad they weren't a corporation. The inequality between corporations and people is immense, considering how debts are written down.

In the upcoming years, nothing will change. The rich will get richer. The poor will get poorer. The growth of GDP and creation of new money, drives the productivity up, while the normal people won't see that money in their lives. The elite scoops that. And so the inequality grows. The amount of debt keeps grows exponentially, causing the expectancy of work, in terms to pay the debt, grows exponentially. The depression and crime grows steadily.

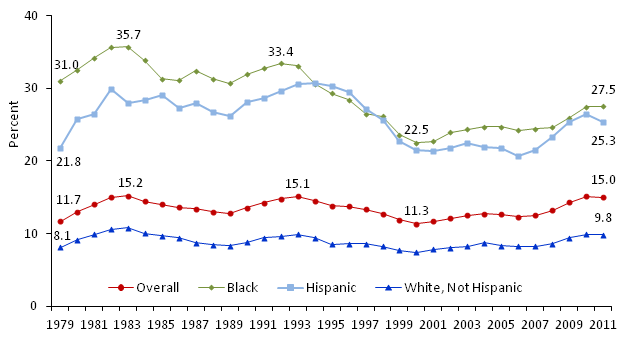

The poverty has a direct impact on crime. Poverty is defined as having 50% or less median income.

15% of US populace, around 40 million people, are living in poverty. Of those:

~27% are black, ~25% are hispanic, ~14% are other and ~10% are white.

AFAIK, the numbers do not add to 100%, since many of the states do not have information available but on certain races. On the latter link it says "due to rounding effects", but that quite doesn't make sense. Be as it may, it's the ratio that matters here.

( )

)

(http://kff.org/other/state-indicator/poverty-rate-by-raceethnicity/)

In some states you'll find blacks incarcerated over 10 times more likely than the non-hispanic white. No matter where you are, the African American are leading the incarceration statistics. Hispanic men are almost four times as likely to go to prison at some point in their lives as non-Hispanic white males, but less likely than black males, although this data is from 1997.

(http://www.sentencingproject.org/doc/publications/inc_hispanicprisoners.pdf)

However, incarceration isn't the tool to combat the crime. While necessary, incarceration is essentially a way of "accepting" the system that is causing the crime in the first place - poverty. To tackle crime statistics, eradicating the poverty should be the number one priority. Education is part of the solution, but not all of it. The least educated and the least fortunate will always be the poorest, suffering most from the inequality.

You cannot permanently get rid of the poverty by handing money to the poor. Instead the system causing the poverty has to change. Inequality is the main reason for poverty which is essentially creating a plutocracy.

Basic income would be a great start. An attempt, at the very least. I'd wager a half of my, probably negative, net worth that the basic income would reduce crime immensely, reducing the mind boggling costs from incarceration. Eg. the annual incarceration costs in US are somewhere between $63-70 billion.

By cutting that cost in half, you could support every person living in poverty in US by $700 per month.

Yes, the money for basic income has to come somewhere as well. For the sake of equality, I'd suggest the richest 1%.

Conclusion

People generally should raise as much loan as they can, as inflation is nearly even/or even higher than the interests rates, depending obviously on where you live. Then again, eventually the interests rates will raise. In EU that will possibly occur after the ECB buying of bonds ends, but on the other hand ECB has informed that they will extend the money pumping to the market, unless the 2% inflation target rate is reached. If nothing else, the mass insolvencies would probably rally the poor to the streets. Maybe we'd eventually see loan write offs.

(http://www.wsj.com/articles/ecb-says-asset-purchase-program-has-eased-eurozone-conditions-1426758059)

We are living in an era of class society, caused by the greed and expectancy of growth. We've the elite in power, controlling the corporations and the media. Their wealth is in corporations, which can collapse causing debt write offs. The labor force is carrying the burden of the debts. These debts aren't written off, but inherited. Talk about a legacy. And we've the poor, whom suffer the most. Majority of incarceration is caused by the poverty. Basic income should be at least attempted to reduce the effect of inequality on populace.

The only way for the world to get rid of the unsustainable growth cycle, is to eventually write down existing loans and limit how money is generated through creation of new debt. We're at a point, where the GDP shouldn't grow, although that's the general goal all around the world. We're already using the annual renewable resources of Earth sooner and sooner each year. Instead we should aim for a balance.

But which corporation would be willing to limit their growth? That'd be a commercial suicide. Money would be invested in to other corporations instead. Thus the change cannot come within the corporations today's global world.

The legislation for change has to come from the government. But will it, with the elite in power? After all, they're doing good, having more wealth than ever before. Why would they agree on paying the costs from eg. basic income? At least in theory, the democracy (which essentially is plutocracy) - people could still have an affect by voting a change. Or could they?

In US the plutocracy is probably further than anywhere else. I've seen some people to even call it sort of fascism. There's the recent militarization of police forces, illegal spying on the populace, constant warmongering, covert operations and pre-emptive drone strikes. Then there's PIPA, CISPA, TTIP, TTP - all of which seem to be arranged by the corporations, mandated by the government. If you're living in US, please shed some insight on the matter!

We're living in dark, but interesting times indeed, yet there's certainly hope due to technology and people being able to connect. Hopefully I'll get a decent job one day and get to enable people in some interesting way.

Consider this. It is as illegal for the rich as it is for the poor to squat in the (private) stairwells. Thus the laws must be equal, right?

So many unfounded assumptions. The reality is that there is no such thing as public wealth or public media. Claiming no bias in government news is the most hilliarious thing I have read in a while. Claiming private individuals are taking over while government spending exceeds all income from all private individuals combined is also funny.

When it comes to forests, private land is in most case better. When no one is accountable for the consequence of their action, what you end up with is mismanagement and looting by special interest...without the incentives to maintain the capital over long period of time(because they rent the public land). When someone own the forest, if he makes an error in judgement, he devalue his property...he is the one paying the consequence.

End your obsession with money. Money is not power. Money is merely a language for value exchange. Power can be expressed through that language but it doesn't mean the money itself as in the digits in the bank computer representing credit or debt or the pieces of gold are power. A dollar is a negotiable instrument at best.

What you have to understand is that power and wealth don't actually come from money. You can be dollar rich and knowledge poor. You can be dollar rich and be a puppet to an intelligence officer. You can be dollar rich and be friendless, hated, and all your money lost on security.

Wealth really isn't about how much money you have but more about what resources you have. Resources can be assets, it can be intangible like knowledge, it can be social like friendships (and reputation), it can be digital like crypto-tokens. These assets can be exchanged for money but your wealth is in your assets and if you don't have assets you'll have nothing to exchange in order to get money.

The only reason you need Dollars is because the IRS will only accept Dollars as payment of debt in the form of taxes. The Dollar does not have any identifiable fixed value so if I ask you what a Dollar is worth you can only tell me what it can be traded for in today's value. So it's not worth gold, and it's not your actual wealth. Unfortunately many people chase Dollars because they believe their worth is contained in their net-worth instead of their network. Wealth expressed as social power, it's about your network and overall resources you can put to productive use.

A problem faced by the millennial generation is the problem of being cash poor knowledge rich. We know more than any generation ever before but then instead of using our knowledge to build a higher quality of life, a sustainable self sufficient cash independent lifestyle, instead many millennials would rather use their knowledge to dis-empower other millennials rather than to empower millennials.

Compare Steem to Facebook and the philosophy of the Steem developers to the philosophy of Facebook. Steem empowers us and so we get rewarded for what we contribute. Facebook on the other hand pretends to be free while monetizing us to sell our data to advertisers. It's data which rightfully should belong to us, and it's content which we create that gives Facebook it's market value.

It goes to prove that data is a commodity but more importantly it's the process of turning data into knowledge which creates value. It's not enough to just collect some data but it's also necessary to apply algorithms to deduce meaning and useful knowledge from it. ( )

)

Perhaps the best thing you can do to empower yourself is to use Steem. Instead of letting Facebook or another company monetize you and sell you to advertisers maybe you should monetize the aspects of yourself you feel comfortable monetizing and sell yourself directly to the world. The same algorithms which Facebook is applying to create knowledge from our data can also be applied by ourselves to create self knowledge.

You are messing causes and effects. Inequality itself is not nearly as bad thing as many people claim it is.

Let's take an example. Two individuals are in the same position, have same amount of wealth and income. One of them decides to change his job to a better paying and also does some extra hours. Another one also decides to quit his job, but he moves to a tiny house and will make only every now and then little money by selling some organic vegetables.

Inequality increased but how that was a bad thing? Both individuals did it because they wanted to do that.

Usually the bad things that are associated with inequality are not caused by inequality itself. Instead they are caused by other things that cause also inequality at the same time.

If, for example, inequality is caused by corruption, then it's pretty much useless to fight against it by redistributing wealth. Problem will still exist. But if the corruption is removed, inequality will also disappear because the cause has been disappeared.