Renegade Rants Episode 2: Side effects of a Debt Based Monetary System (DTube Video)

In this video, I dive further into details about the negative ramifications of our debt based monetary system. Did you know that more money must be lent into existence every year to service the interest accrued on the older debt? Over time, both the banks and government have to take increasingly more extreme measures to keep the system propped up.

*“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

-Thomas Jefferson

Back when I originally wrote this article and recorded the video I was still having a lot of issues with DTube so I uploaded the video to YouTube and imbedded it instead. Since DTube has been working well for me lately, I feel like now is a good time to add this video to DTube before I continue the series.

I have included the the original article below, with a few tweaks, for your convenience as there are valuable information and sources in it.

In my last Rant, I explained how money is actually created and the two biggest problems I see with our current debt-based monetary system. If you haven't read that article yet, I would highly recommend reading it to get the base of understanding necessary to fully grasping this post.

In this episode, I will discuss the methods that modern countries use to continuously increase the money supply. They have to do this in order for there to be enough money in circulation to pay the interest on existing debts.

Primary Methods Used to Increase the Money Supply and Some of the Negative Side Effects Caused by Them

Lowering Interest Rates

This allows individuals, corporations, and governments the ability to borrow more without increasing debt carrying costs. This inevitably leads to increased borrowing.

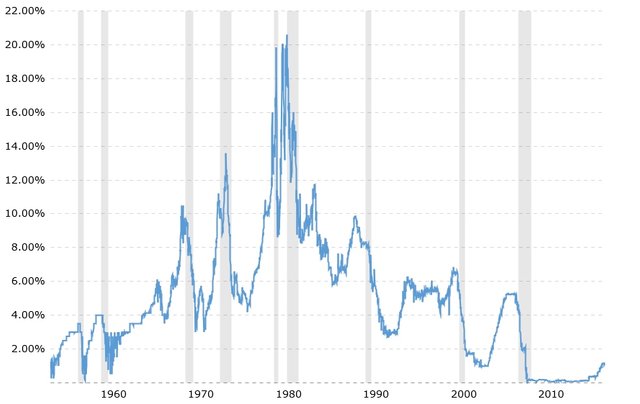

FederalFunds Rate - 62 Year Historical Chart

FederalFunds Rate - 62 Year Historical ChartInterest rates have been in decline since 1981.....

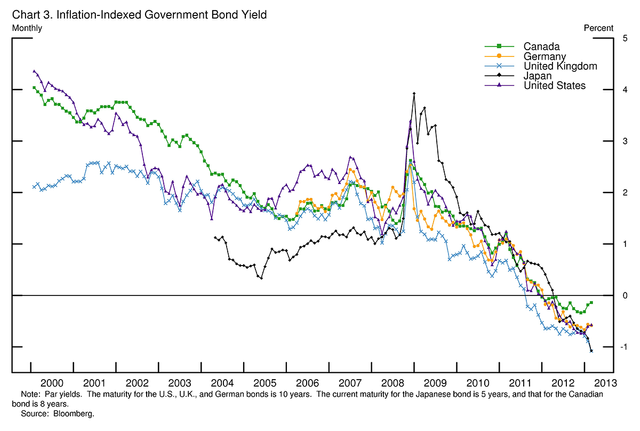

Falling interest rates are a major issue for retirees. Government bonds, which are traditionally considered the safest investment for those nearing or in retirement, no longer yield enough return to justify owning them. In fact, they often have a negative real rate of return once you factor in inflation.

As you can see, in this chart the return on Government bonds are below the rate of inflation

As you can see, in this chart the return on Government bonds are below the rate of inflationThis has been a major issue for government pension plans. Many of which are under funded.

Quantitative Easing

Quantitative easing is a more direct way of boosting the money supply. The government or corporations issue bonds and the central bank buys them. This injects more money into the system and allows the suppression of interest rates to levels lower than a free market could keep them at. Further reading on Quantitative Easing

Extremely low rates tend to inflate asset prices. Stocks, bonds, and real estate are at or near record highs. While many people are happy with record high asset prices, I believe that on the whole they are negative for society. Those that didn't own them before the drastic price increases are often priced out of the market or end up having to over extend themselves financially to afford to buy in. This is one of the reasons why the top 10% continue to get richer while the living standards of the poor and middle class continue to deteriorate.

Stock prices seem to be more affected by hype and stock buybacks than actual fundamentals. There is no need for large corporations to turn a profit when they can borrow money for nothing. European Corporations can borrow money at less then 0% interest.

Tesla now has the largest market cap of all North American auto makers and has yet to turn a profit!

The question of why Tesla, which lost $675 million on $7 billion in revenue last year, is worth more than GM (with 2016 revenue of $166.4 billion and net income of $9.43 billion) and Ford (with 2016 sales of $151.8 billion and net income of $4.6 billion) is a complicated one.

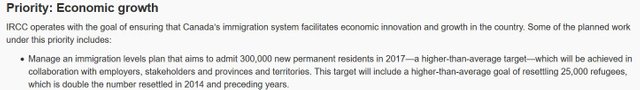

Immigration

Most people wouldn't consider immigration as a tool to manage the economy. In reality, immigration is a potent stimulant of both debt and GDP because it increases the population. All those new citizens want housing, new vehicles and credit cards just like everyone else. Excessive immigration can cause all sorts of societal issues, however, I'm not going to address that topic in this post. In the future, I will likely do a rant discussing some of the issues I see in Canada. Most people don't know that Canada has one of the highest per capita immigration rates in the world.

There are plenty of justifications for why we need high immigration levels including a need to replace an ageing population or offering humanitarian aid. In my opinion, the primary reason why the government allows mass immigration is that it creates more new suckers to prop up the ponzi-scheme debt-based monetary system.

Source

SourceWhat do Governments and Central Banks Try Next to Prop Up the System?

Negative Interest Rates

Negative rates are a continuation of the falling interest rate policy we have been under for the past 35 years. It further expands the money supply by punishing savers and rewarding borrowing.

Source

SourceWhile there are already many countries that have negative interest rates, I believe it will become even more wide spread and be adopted by countries like Canada and the United States. If the central bank tries to go too far into negative territory then people would simply hoard cash. Because of this, you can also expect a push for a cashless society.

Basic Income

Basically, this is a scheme where the government pays people a fairly large sum of money every month just for existing; the program is intended to cover their basic needs. While this sounds far fetched I have been hearing more and more about this on local talk radio and other media sources. Ontario even has a pilot project to study this idea.

Wikipedia'sexplanation of BasicIncome

Thanks for reading/watching everyone! Please upvote, follow and resteem to support this work. As always, comments are welcome and I would be more than happy to discuss this issue with you.

▶️ DTube

▶️ IPFS

Yeah, owning someones debt is not the economy that I want to be a part of.

Why is it that I like you two, more and more with every post?

Because we're cool AF?

I agree the system is not sustainable. looking forward to your next rant on diversifying/potecting for what will happening at some point. 👍

Thanks, I feel like I have some good ideas and am looking forward to sharing them.

We need the whole world to wake up from this nightmare and realize what kind of f*cked up system the masters created.

You know, I used to think it was hopeless but lately with crypto and some of the other technologies like IPFS cropping up I actually think we have a good chance at finally ridding ourselves of these vampires. It will definitely be interesting that is for sure.

IPFS is incredible! Was showing it to some friends last night!

very good information. How can we make money? but the government's system of rules is different.

"How can we make money?"

With crypto? The peoples money :)

YES!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Canadian Renegade from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.