Meet the New Fed Chairman

by James Corbett

corbettreport.com

February 17, 2018

Paul Volcker began his term as chairman of the Federal Reserve Board of Governors in August of 1979. In October, the S&P 500 index dropped 11% on its way to a 20% drop in 1980.

Alan Greenspan was sworn in as Fed chairman in August 1987. On October 19, 1987 the markets suffered through "Black Monday," a devastating sell-off that saw the Dow Jones lose a record 22.6% in a single day.

Ben Bernanke became chairman in February of 2006. In May of that year, the markets stumbled through a 7.8% sell-off on the rocky road to the Bear Stearns and Lehman Brothers meltdown.

Janet Yellen began her term as Fed chair in the midst of a market sell-off that ultimately saw the S&P drop 5.4%. The sell-off resumed in September, with a further 9% drop on an intraday basis from mid-September to mid-October.

For decades now, it has been an iron-clad rule: Every incoming Fed chair will face market turbulence or a major crisis shortly after taking office. But, to use the parlance of the internet meme generation, Yellen's newly-appointed successor at the helm of the Fed, Jerome "Jay" Powell, may have been heard to remark "hold my beer" before assuming the chair.

On Powell's very first day on the job earlier this month the markets began a flash crash, with the Dow down a staggering 1,500 points at one point before paring back some of those losses. This led to the extraordinary situation of Powell being labeled the "most disliked Fed chair ever" a mere three days into his job. Talk about trial by fire.

But as quickly as the rug was pulled out from under the central bank funny money-blown bubble economy, normalcy returned to the markets. And by "normalcy" I mean the "new normal," aka "EVERYTHING IS AWESOME!" As I write, global stocks are having their best week in six years and the sky-is-falling panic of the past two weeks is so...well, last week!

So I guess everything's tickety-boo with the economy after all and Jay Powell, having been associated with the market sell-off, will now be associated with the market "recovery," right? And now back to business as usual...

But wait. Who is Jay Powell? What's his background? What's his position on monetary policy and what can we expect the Fed's Board of Governors and Open Market Committee to do during his tenure?

If you saw any of the "WTF? Who is this new Fed guy and why is the market crashing?" coverage that the MSM trotted out earlier this month, you will have learned a few tidbits about Powell. Namely:

He's been a governor at the Fed since 2012.

He is not an economist (breaking a four decade tradition for the position).

He's one of the richest men to ever become Fed chair.

He worked at the "Bipartisan Policy Center" for a number of years and served as Assistant Secretary of the Treasury under "Poppy" Bush.

Etc., etc., blah blah blah.

Wait...what? One of the richest men to ever become chairman? He has an estimated net worth in the tens of millions? How did that happen?

Well, one thing that every one of the talking heads was anxious to blow past in Powell's CV is that he was a partner at the Carlyle Group from 1997 to 2005. Yes, that Carlyle Group. Yes, during 9/11.

I suppose this is the point I could just do the metaphorical mic drop and rest my case, but let's dig a little deeper into this market chaos and what's really going on as the Fed undergoes its facelift.

The first thing to note about this latest market turmoil (and "recovery") is the point I have been making over and over and over for the past several years; namely, that the "new normal" of the central bank-dominated post-Lehman economy is a reality inversion bubble. "Bad" economic news is great economic news and "good" economic news is terrible economic news.

Why? Because when the markets get hit with bad news it means there's a higher likelihood that the Fed (and/or the ECB, the BOE, the BOJ or another central bank) will spike the punch bowl to keep the good times rolling. Need more stimulus? Here you go! Markets not reaching record highs? We'll start investing directly! Interest rates still not low enough? Fine, we'll take them negative!

Conversely, when good news comes, it means the central banks might try to take the punch bowl away. If the government's cooked books show lower unemployment or higher economic growth, then they might try to reduce stimulus or even jack up rates, so markets plunge.

This led to the situation I outlined here last month where Bank of Japan Governor Haruhiko Kuroda hinted at the idea that the BOJ may be ready to start easing off on the stimulus gas pedal...and the markets threw a fit. Lesson learned. Now, Kuroda (recently securing a second term as Governor) is saying that talk of winding down the stimulus might be a bit premature, and the Japanese market is perking up accordingly.

So, black is white, up is down, and the only common denominator is that central bankers control our economic reality by deciding how much stimulus money to inject into the junkie...or how much to take away.

The take away of this story is that the central bankers, Bernanke and Yellen chief among them, have painted the global economy into a corner. If economic activity starts to pick up and we enter an actual recovery where workers gain full-time jobs and higher wages (as opposed to the phony baloney "jobless recovery" of the past ten years), then rates are likely to rise and inflation is in the cards. That is to say, good news is bad news.

Well, guess what? We've had a whole lot of good economic news lately. Whether it's the recent uptick in PMI, or reports of Apple repatriating $350 billion to the US, or stories of higher bonuses and wages due to the new tax bill, things haven't looked this rosy for a long time.

And it's not just a US phenomenon. Japan has posted its eighth straight quarter of GDP growth for the first time in 28 years. PwC's annual survey of business executives in the UK shows almost unanimous confidence in economic growth over the coming year. Heck, the entire world is in a pocket of growth and optimism; for the first time since the financial crisis, every one of the world's major economies is expanding at once. Let the good times roll?

Oh wait. There was a positive January jobs report in the US? That means the Fed is going to raise rates four times this year! Quick! Sell off!

No, hold on. This is turning into a bloodbath! Great, maybe the Fed will ease off on the rate hikes! Time to buy the dip!

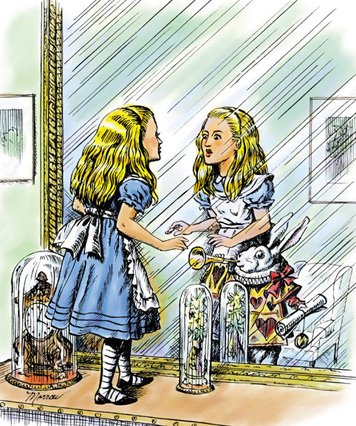

Are you getting motion sickness yet? Well, buckle in, because this is just the start of the market volatility we're likely to see as this recovery(?) really kicks in. And, because we are in this Alice in Wonderland economic universe now, it's entirely possible that actual global economic growth will pop the everything bubble that the central banks have spent the last decade inflating.

So, back to Powell. Where does he fit into all of this?

Well, here's one way to look at it: Yellen was a Democrat and she is the first Fed chair in the modern era to make it through her first term without being reappointed. Trump made it clear on the campaign trail that he was not a fan and would not be renewing her appointment, and, true to his word for a change, he has swapped her out for lifelong Republican Powell. If you're a believer in the left/right political paradigm myth, feel free to insert your own conspiracy theory about how the Dems have set up the GOP to take the blame for the popping of the bubble they blew, and feel free to use Yellen's parting shots at the economy as your evidence. But of course to make that theory work you'll have to disregard the fact that it was Bush-appointee Bernanke at the helm for the Lehman crisis and the blowing of the bubble in the first place.

Alternatively, if you believe that a super secret government insider is posting on 4chan under the name "Q" and spilling the totally super real goods about the secret battle between the valiant, crusading Trump regime and the evil deep state that they're definitely not a part of, then feel free to insert your own conspiracy theory about how the deep state is looking to take down Trump with an economic collapse.

Personally, I do believe that the deep state has been plotting its out from the central bank-dominated reality inversion bubble for a long time, and Powell may just be the chump who gets left holding the bag when the doodoo really starts to hit the oscillator. (He lost the game of musical chairs, you might say.)

But as gloomy as all of this might sound, there's actually a positive side to all of it. As Ron Paul points out in a recent edition of the Liberty Report, there are signs that the rug is being pulled out from under the Fed...but not by the deep state. Instead, Dr. Paul points to the explosion of bitcoin and crypto as a sign that people are scrambling to get their wealth out of the failing fiat paper dollar paradigm. Other signs including the growing number of states that are tabling laws to encourage the use of silver and gold as money.

As always, the people know that the markets are rigged, that the dollar is a paper promise with nothing to back it up, and that the central bankers and their financier cronies are not the "Wizards of Wall Street" but the "Wizard of Oz," i.e., little men behind a curtain desperately trying to distract the public with their hocus pocus parlor tricks.

So, yes, it's very possible that the dollar could fall and the economy of tomorrow will look nothing like the economy of today. But maybe that's a good thing. Once again, it depends on what steps the public is taking to prepare for that future, and whether they are going to stumble blindly into the next economic paradigm or actively seek ways out of the central bankers' trap.

So, welcome to your new position, Jay Powell! Good luck keeping that whole Federal Reserve charade going! You're gonna need it...