Universal Robina Corporation (URC) FY2019 Financial Results

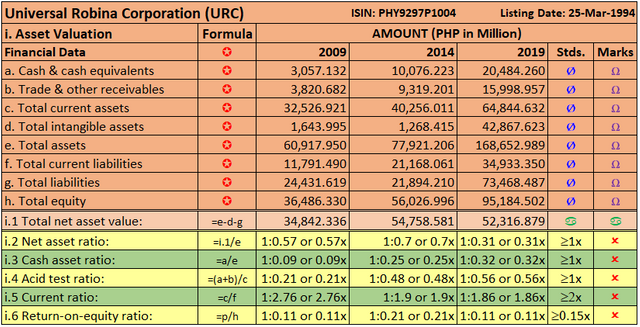

Earnings of URC is up almost flat by a sixteenth in the fiscal year 2019 compared to the prior year.

The net income increased by 6.89% to ₱10.12 billion compared to ₱9.46 billion in 2018 with the flattish growth in revenues at 5% to P134.17 billion.

Business Model. URC is among the largest branded food product companies in the Philippines. URC has established a strong presence in ASEAN and has further expanded its reach to the Oceania region. URC was founded in 1954 when Mr. John Gokongwei, Jr. established Universal Corn Products, Inc., a cornstarch manufacturing plant in Pasig. The Company is involved in a wide range of food-related businesses, including the manufacture and distribution of branded consumer foods, production of hogs and poultry, manufacture of animal feeds and veterinary products, flour milling, and sugar milling and refining. URC has also ventured in the renewables business for sustainability through Distillery and Cogeneration divisions. In the Philippines, URC is a dominant player with leading market shares in Snacks, Candies and Chocolates, and is a significant player in Biscuits. URC is also the largest player in the Ready-to-Drink (RTD) Tea market and Cup Noodles, and is a competitive 3rd player in the Coffee business. With six mills operating as of December 31, 2019, the URC Sugar division remains to be the largest producer in the country based on capacity.

The Risks. URC identifies the risks in their areas of its operations as described below.

Competition: The Company and its subsidiaries face competition in all segments of its businesses both in the Philippine market and in international markets where it operates. The Philippine food industry in general is highly competitive. Although the degree of competition and principal competitive factors vary among the different food industry segments in which the Company participates, the Company believes that the principal competitive factors include price, product quality, brand awareness and loyalty, distribution network, proximity of distribution outlets to customers, product variations and new product introductions. The Company’s ability to compete effectively is due to continuous efforts in sales and marketing of its existing products, development of new products and cost rationalization.

Financial Market: The Company has foreign exchange exposure primarily associated with fluctuations in the value of the Philippine Peso against the U.S. dollar and other foreign currencies. Majority of the Company’s revenues are denominated in Pesos, while certain of its expenses, including debt services and raw material costs, are denominated in U.S. dollars or based on prices determined in U.S. dollars. In addition, the majority of the Company’s debt are denominated in foreign currencies. Prudent fund management is employed to minimize effects of fluctuations in interest and currency rates.

Raw Materials: The Company’s production operations depend upon obtaining adequate supplies of raw materials on a timely basis. In addition, its profitability depends in part on the prices of raw materials since a portion of the Company’s raw material requirements is imported, including packaging materials. To mitigate these risks, alternative sources of raw materials are used in the Company’s operations.

Food Safety Concerns: The Company’s business could be adversely affected by the actual or alleged contamination or deterioration of certain of its flagship products, or of similar products produced by third parties. A risk of contamination or deterioration of its food products exists at each stage of the production cycle, including the purchase and delivery of food raw materials, the processing and packaging of food products, the stocking and delivery of the finished products to its customers, and the storage and display of finished products at the points of final sale. The Company conducts extensive research and development for new products, line extensions for existing products and for improved production, quality control and packaging as well as customizing products to meet the local needs and tastes in the international markets for its food business. For its agro-industrial business, its researchers are continually exploring advancements in breeding and farming technology. The Company regularly conducts market research and farm-test for all of its products. Moreover, the Company ensures that the products are safe for human consumption, and that the Company conforms to standards and quality measures prescribed by regulatory bodies such as BFAD, SRA, Bureau of Animal Industry, and Department of Agriculture.

Mortalities: The Company’s agro-industrial business is subject to risks of outbreaks of various diseases. The Company faces the risk of outbreaks of foot and mouth disease, which is highly contagious and destructive to susceptible livestock such as hogs, and avian influenza or bird flu for its chicken farming business. These diseases and many other types could result to mortality losses. Disease control measures are adopted by the Company to minimize and manage this risk.

Intellectual Property Rights: Approximately 78.9% of the Company’s sale of goods and services in 2019 were from its branded consumer foods segment. The Company has put considerable efforts to protect the portfolio of intellectual property rights, including trademark registrations. Security measures are continuously taken to protect its patents, licenses and proprietary formulae against infringement and misappropriation.

Weather and Catastrophe: Severe weather condition may have an impact on some aspects of the Company’s business, such as its sugar cane milling operations due to reduced availability of sugar cane. Weather condition may also affect the Company’s ability to obtain raw materials and the cost of those raw materials. Moreover, Philippines has experienced a number of major natural catastrophes over the years including typhoons, droughts, volcanic eruptions, and earthquakes. The Company and its subsidiaries continually maintain sufficient inventory level to neutralize any shortfall of raw materials from major suppliers whether local or imported.

Environmental Laws and Other Regulations: The Company is subject to numerous environmental laws and regulations relating to the protection of the environment and human health and safety, among others. The nature of the Company’s operations will continue to subject it to increasingly stringent environmental laws and regulations that may increase the costs of operating its facilities above currently projected levels and may require future capital expenditures. The Company is continually complying with environmental laws and regulations, such as the wastewater treatment plants as required by the Department of Environment and Natural Resources, to lessen the effect of these risks.

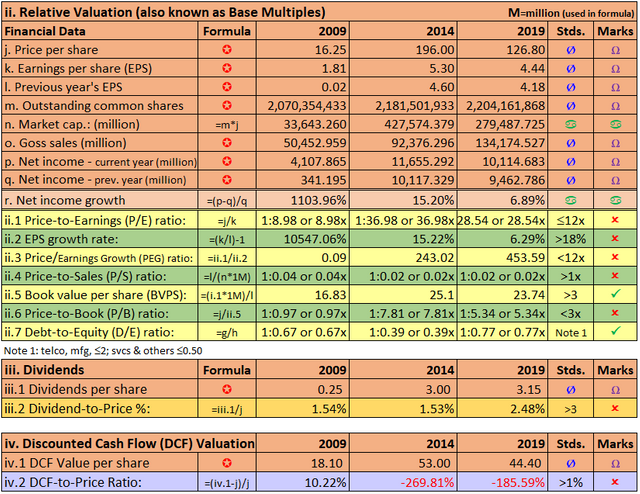

The Philippine Pension Funds. As of March 31, 2020, Social Security System (SSS) owned 46,285,087 shares, Government Service Insurance System (GSIS) owned 29,206,150 shares and SSS Provident Fund owned 405,770 shares comprises of 2.10%, 1.33% and .02% of URC’s total outstanding shares respectively. I knew that before these pension funds infused with their member's money to any company, due diligence is religiously adopted and it always has strict provisions that the said company is bound to declare yearly dividends consistently. I believed it added confidence and investment value to its investors in the long run.

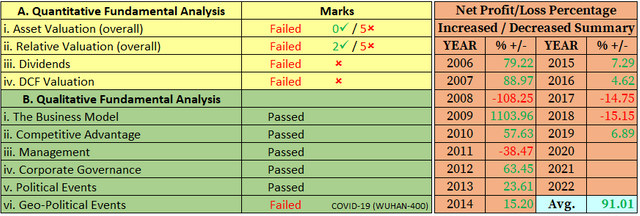

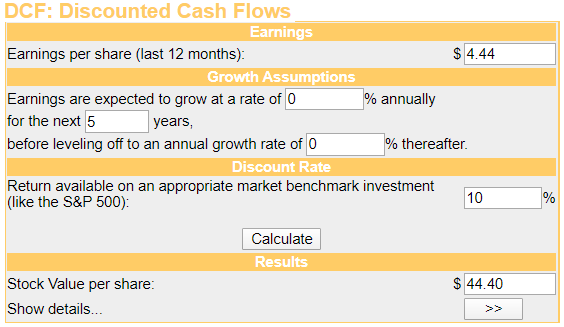

OBSERVATION: The global effect of COVID-19, which I always referred to as the WUHAN-400 plague, has a huge impact on URC. We are now in the recession cycle and most economists around the globe anticipated a greater than 1929 economic depression. If this prediction materialized, consumer spending may be on sluggish if not on hold that influences URC’s ability to maintain its projected profit. Now, is it time to invest URC? In my opinion, it is wise not to participate at this time due to the reasons above cited. Secondly, URC failed in my overall quantitative fundamental valuations. URC’s closed share price yesterday (17-Apr-2020) at 126.80 is 186% overvalued from my DCF per share calculation. However, in my worst-case scenario, if my DCF share price of 44.40 which is my target price will be broken in the coming months then time to invest all-in.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Related Topics:

EEI FY2019 Financial Results

GI FY2019 Financial Results

MPI FY2019 Financial Results

DMC FY2019 Financial Results

Will MPI Benefit The Government Stimulus Package?

Metro Pacific Investments Corp. (MPI) share price bottom?

What’s next for MPI?

Metro Pacific Investments Corp. (MPI)

DMCI Holdings, Inc. (DMC) FY2019 Financial Results

Bakit bumagsak ng bumagsak ang presyo ni DMC?

DMCI Holdings, Inc. (DMC)

Is Now The Time To Buy Belle Corporation (BEL)?

Please upvote and follow me on ----> https://steemit.com/@php-ph.

Please follow me on Facebook ------> Valencia, Bohol

Please follow me on Twitter ---------> Valencia, Bohol