Megaworld Corporation (MEG) FY2019 Financial Results

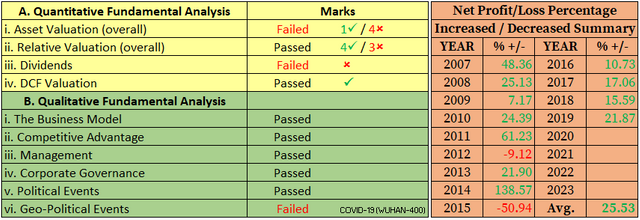

Earnings of MEG is up more than a fifth in the fiscal year 2019 compared to the prior year.

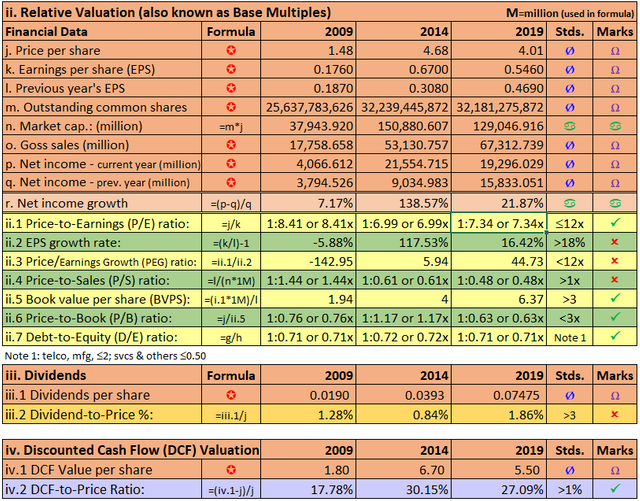

The net income increased by 21.87% to ₱19.30 billion compared to ₱15.83 billion in 2018 with the revenue growth at 17.21% to ₱67.31 billion from ₱57.43 billion a year earlier.

Business Model. MEG is engaged in the development of large scale mixed-use planned communities, or community townships, that comprise residential, commercial and office developments and integrate leisure, entertainment, and educational/training components. MEG began to focus on the development of mixed-use communities, primarily for the middle-income market, by commencing the development of its Eastwood City project. Also, the Company engages in other property-related activities such as project design, construction oversight, and property management. MEG’s real estate portfolio includes residential condominium units, subdivision lots and townhouses as well as office projects and retail space. The Company has the following three primary business segments: (a.) Real estate sales of residential developments; (b.) leasing of office space, primarily to Business Process Outsourcing ("BPO") enterprises and retail space; and (c.) management of hotel operations.

The Risks. MEG identified the risks management and business strategies in their areas of business operations as follows: (1.) Maximize earnings through integrated community township developments; (2.) Capitalize on brand and reputation; (3.) Continue to evaluate projects for synergies; (4.) Maintain a strong financial position; (5.) Sustain a diversified development portfolio; and (5.) Capitalize on growing opportunities in tourism development. For complete narratives, please refer to their annual report published at PSE Website.

The Philippine Pension Funds. As of March 31, 2020, Government Service Insurance System (GSIS) owned 613,508,213 shares, Social Security System (SSS) owned 245,480,297 shares and SSS Provident Fund owned 5,314,500 shares, comprises of 1.91%, 0.76% and 0.02% of MEG’s total outstanding shares respectively. I knew that before these pension funds infused with their member's money to any company, due diligence is religiously adopted and it always has strict provisions that the said company is bound to declare yearly dividends consistently. I believed it added confidence and investment value to its investors in the long run.

OBSERVATION: The real estate demand in the Philippines is now declining since 2017 and the global effect of COVID-19, which I always referred to as the WUHAN-400 plague, has a huge impact on MEG. The unemployment and Gross Domestic Products (GDP) in the Philippines and around the world are down dramatically, therefore, the demand in real estate is lackluster if not totally halted. We are now in the recession cycle and most economists around the globe anticipated a greater than the 1929 great depression. If this prediction materialized, real estate spending may be on sluggish if not on hold that influences MEG’s ability to maintain its projected profit.

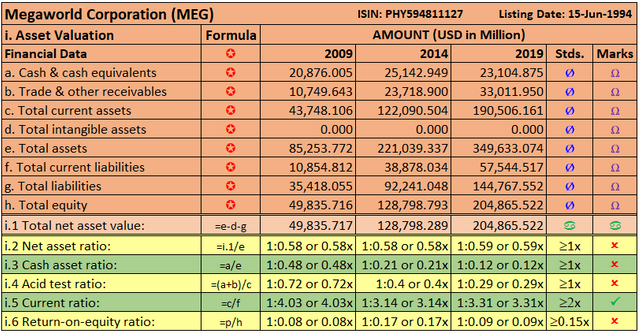

Now, is it time to invest in MEG? In my opinion, although the overall net income rate is at a decent rate of 25.53% since 2007 until the fiscal year 2019, this was due to the extremely high demand of real estate in the past but this demand is now faded as well as the demand in hotels and residential units were declining. On the other hand, MEG failed in my asset valuations though passed in my relative valuations. My DCF value per share is at 5.50 which is 113.18% premium against the closed price on 30-Apr-2020 at 2.58. MEG plunged 153.49% from its all-time high price at 6.54 on 15-Jul-2019 from the latter closed price.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of any securities.

Related Topics:

MAXS FY2019 Financial Results

TECH FY2019 Financial Results

World Stock Market Bloodbath On Oil Crash

What’s The Impact Of A Negative Oil Price?

EEI FY2019 Financial Results

MRSGI FY2019 Financial Results

MPI FY2019 Financial Results

DMC FY2019 Financial Results

Will MPI Benefit The Government Stimulus Package?

Metro Pacific Investments Corp. (MPI) share price bottom?

What’s next for MPI?

Please upvote and follow me on ----> https://steemit.com/@php-ph.

Please follow me on Facebook ------> Valencia, Bohol

Please follow me on Twitter ---------> Valencia, Bohol

Friday - May 1, 2020.