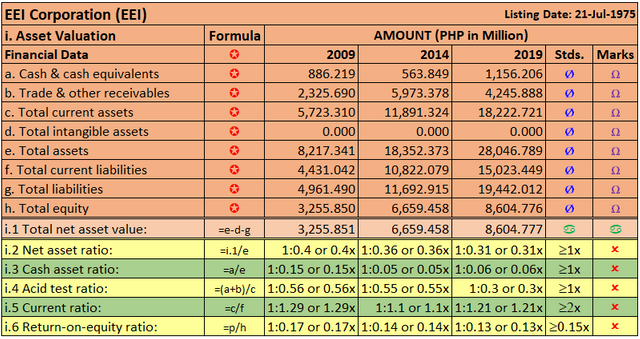

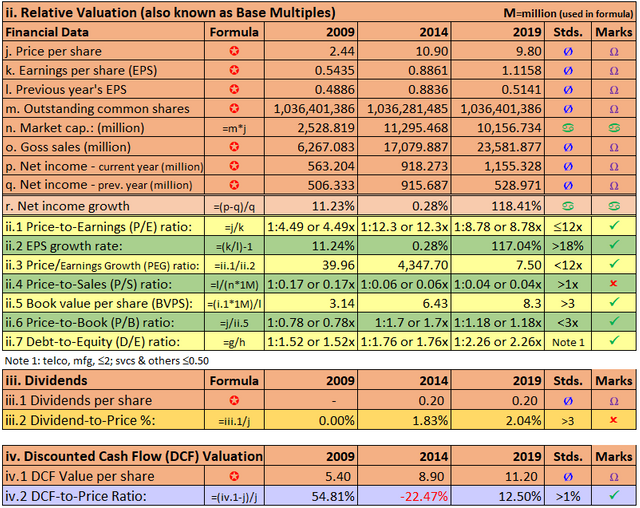

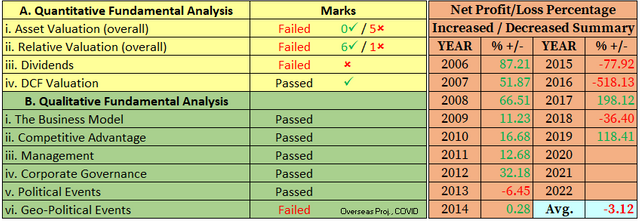

EEI Corporation (EEI) FY2019 Financial Results

Earnings of EEI up significantly by more than a fold in the fiscal year 2019 compared to the prior year.

The net income increased by 118.41% to ₱1.16 billion compared to ₱528.97 million in 2018 with the flattish growth in revenues at 6.48% to P23.58 billion.

Business Model. EEI has been involved in the installation, construction, and erection of power generating facilities; oil refineries; chemical production plants; cement plants; food and beverage manufacturing facilities; semiconductor assembly plants; roads, bridges, railroads, ports, airports, elevated expressways, metro rail transit system and other infrastructure; high rise residential and office towers, and hotel buildings. The Company also operates one of the country’s modern steel fabrication plants.

New Product and Services. In July 2019, EEI Corporation, in partnership with Showa Leasing Co., a Japan-based leasing company of the Shinsei Bank Group, and Saiga Co., a Japan-based crane rental company with operations worldwide, created a joint venture company, ShinBayanihan Heavy Equipment Corporation (SHEC). The new company will manage the rental of new and second-hand heavy construction equipment with the vision to expand its services in Southeast Asia. The new company was launched last October 10, 2019.

Also, EEI Corp. signed a strategic partnership with Hanjin Heavy Industries & Construction Co. Ltd. (HHIC) for its upcoming construction projects. HHIC is a South Korea-based shipbuilding and construction company with extensive knowledge and expertise in underground infrastructure, railway, and airport construction projects. This partnership is expected to maintain and strengthen the current competitive position of EEI in the fast-growing Philippine construction industry.

The Risks. A relatively sizable operation of the Company is situated in the Kingdom of Saudi Arabia and the uncertainties in that area can be of concern. The prevailing low oil prices, political instability, and regional security threats continue to be factors that affect operations in this area.

During the year, the drone attack on Saudi Aramco’s two oil facilities and the US assassination of Iran’s Al Quds commander in early January 2020 has embroiled Saudi Arabia in further heightened uncertainty. The threat of war between the US and Iran will turn away potential investment in the region and trigger the increase in oil prices.

On the other hand, emerging opportunities exist with the new Crown Prince’s Vision 2030 initiatives, Saudi Aramco’s Initial Public Offering (IPO) and alliance with Russia and China, which will not only stabilize the oil price but also create new economic activities. The restoration work the Company did on the oil facilities damaged by the drone attacks has opened golden opportunities for EEI’s Saudi operations from Aramco.

On March 8, 2020, Saudi Arabia initiated a price war with Russia, triggering a major fall in the price of oil by 30% since the start of the year. The price war is one of the major causes of the currently ongoing global stock market crash and will lead to oil’s global demand collapse and ultimately precipitates storage saturation. This is a threat to EEI’s business in Saudi and for GAIC's deployment to the Middle East and North Africa. On the other hand, EEI Marine will likely benefit from increased projects given the need for more storage tanks arising from the expected glut of petroleum products that cannot be sold and delivered.

The Pension Funds Invested in EEI. As of March 31, 2020, Government Service Insurance System (GSIS) owned 42,827,270 shares while Social Security System (SSS) owned 11,941,300 shares comprises of 4.13% and 1.15% of EEI’s total outstanding shares respectively. I knew that before these pension funds infused with their member's money to any company, due diligence is religiously adopted and it always has strict provisions that the said company is bound to declare yearly dividends consistently. I believed it added confidence and investment value to its investors in the long run.

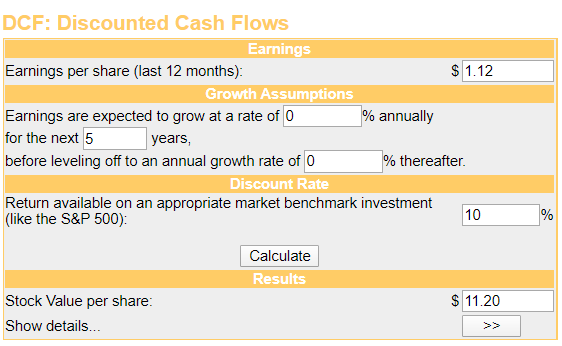

OBSERVATION: Due to COVID-19, which I always referred to as the WUHAN-400 plague, and the ongoing oil price war, EEI’s major oil and gas projects in Saudi Arabia have been put on hold. EEI failed in my asset valuation but the relative valuation is intact. Now, is it time to invest EEI? If the latest support at 5.00 on 30-Mar-2020 will be broken in the coming months, then I’m expecting EEI’s share price to touch on my second support at 4.54 on 27-Nov-2015. But if WUHAN-400 plague will not be contained soon as expected, and the oil price will not be stabilized, Saudi Aramco will likely hold some of its oilfield operations, that may depress EEI’s income projections, that will lead to dull its share price which I anticipated to revisit the low on 26-Sep-2011 at 2.80. At this share price level already trifold premium from my DCF per share calculation. The worst-case scenario will retreat to its worst share price plunged in history at 0.70 on 04-Dec-2008.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Related Topics:

MRSGI FY2019 Financial Results

MPI FY2019 Financial Results

DMC FY2019 Financial Results

Will MPI Benefit The Government Stimulus Package?

Metro Pacific Investments Corp. (MPI) share price bottom?

What’s next for MPI?

Metro Pacific Investments Corp. (MPI)

DMCI Holdings, Inc. (DMC) FY2019 Financial Results

Bakit bumagsak ng bumagsak ang presyo ni DMC?

DMCI Holdings, Inc. (DMC)

The Great Economic Depression Of The 21st Century

Is Now The Time To Buy Belle Corporation (BEL)?

Please upvote and follow me on ----> https://steemit.com/@php-ph.

Please follow me on Facebook ------> Valencia, Bohol

Please follow me on Twitter ---------> Valencia, Bohol