Personal Finance Update: How Did Vacation Impact My Finances? + Radical Financial Growth Tactics for the Next 2-3 Months

Back From NYC — Finances Took a Small Hit

Where do I even begin? It has been about a month since my last financial update. I left 3 weeks ago for a long “vacation” - more of a “work vacation” since I was still doing a lot of productive stuff - and just got home two days ago.

NYC

While on the road, I didn’t try to improve my finances. It was enough effort just to maintain my Steem blog and to have a great time while traveling.

I was meeting up with many people, current and potential future Steemians alike… and in the process, I realized the value of a financial system that takes care of itself. You can’t think about money every day when you have other valuable things to ponder.

With all that said, my financial “machine” performed OK. It wasn’t amazing by any means - but compared to how it was a few years ago, it did great.

A Rough Start - Sent Money to the Wrong Place

Upon arriving in NYC I immediately sent a power down’s worth of Steem, about 150 (then worth around $550) using the wrong memo, but the correct address, for Bittrex. Luckily this is a fixable error since the address is right - but it took three weeks to fix.

I was able to get a short term loan from a fellow Steemian which cost me 20 steem of interest (ouch!), but at least got me out of the short-term pickle.

(The loan has already been paid off in full)

In a better system, I would have additional cash reserves on hand that I could access instantly in case of an emergency like this. The access to quick credit via Steem was an OK second option - it saved me - but it cost me a heavy fee (20 steem) and what if I hadn’t been able to access any loans?

Other than that, the trip was pretty smooth. I spent my money a little faster than I should have, and was definitely relying on my daily Steem payouts to survive. It would be better to have the full amount of money saved up before leaving for the trip, so I wouldn’t have to think about how much I am earning each day.

Ended Up At $0, But Safely Back Home and With Steady income

It wasn’t great to arrive home at roughly $0. Well I had $100 at first and then I bought weed with that money once I got home, so at least I had the spare cash on hand until I literally walked into my front door.

In spite of being “not great,” it also was “not bad.” Because hey, I got home in one piece, and now I’m here working on Steem, fridge full of groceries, cannabis jar stocked up. I haven’t spent one dollar today. The basics are covered.

can’t complain

And the trip was a HUGE success - absolutely worth the money. I was able to meet up with many of my best friends, who happen to be absolute experts at what they do. It was like chilling and having fun, and also consulting with best-in-the-world level people at production and drums and music business and all kind of stuff.

I’d love to travel again around my birthday (May 8), but that is probably too soon if I want to make my next trip better financially. So I’ll probably aim for a June trip back up to NYC to do more work there.

If I can visit NYC three more times this year (one visit per quarter, roughly speaking), that would be amazing.

How I’m Improving My Financial Foundation For The Next Trip

These trips to NYC are a great motivation for me to keep improving my finances on all levels. Every boost I’m able to make to my income, and each reduction I make to my expenses, enables me to have more flexibility and comfort in my future travels.

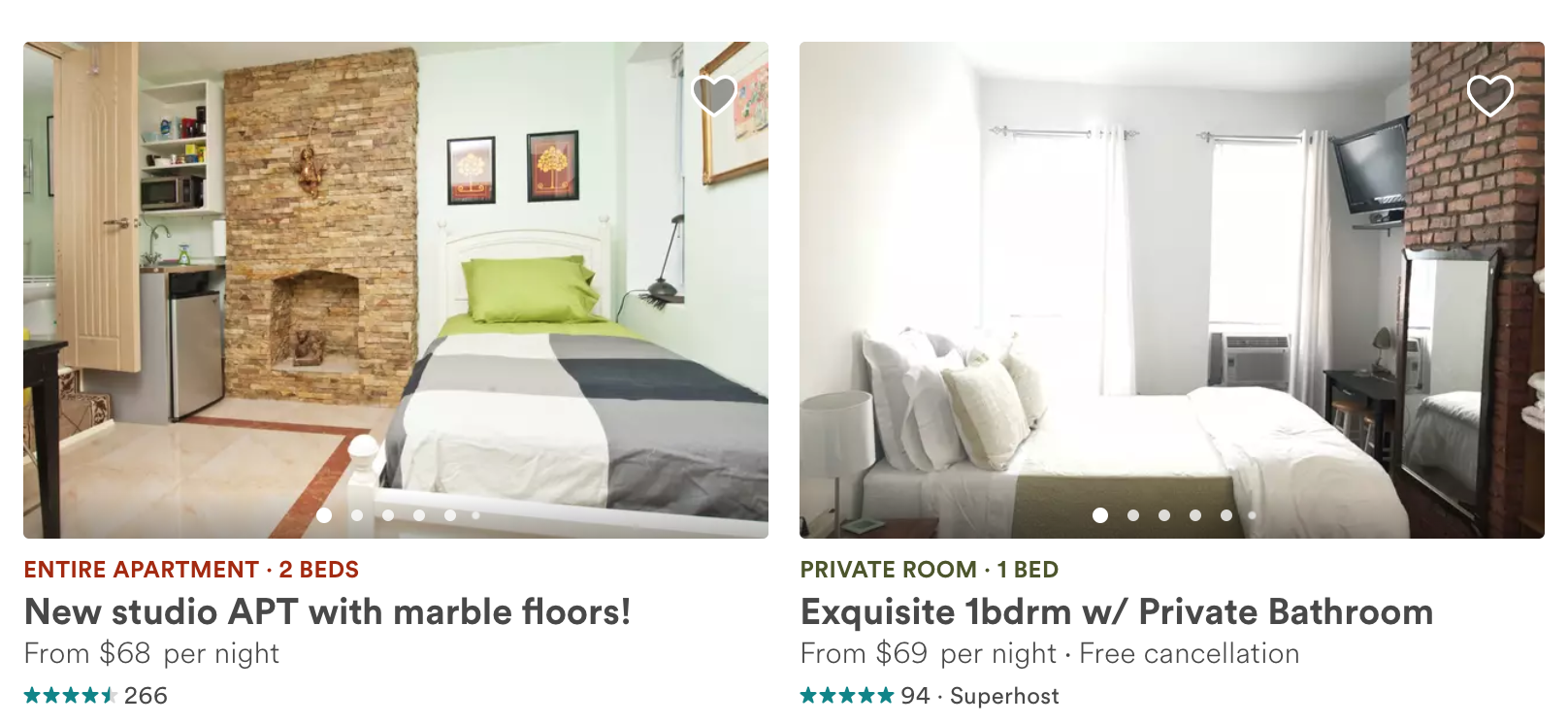

The biggest upgrade I can imagine in the short term is to rent my own apartment for the next time I visit NYC — rather than only renting a room in a multiple-person apartment. This will roughly double, maybe even triple, the cost of rental per day.

(actually it's a bit cheaper than I thought - looking at some Brooklyn options on AirBnB now makes this feel completely realistic):

It’s not impossible to achieve this while being financially intelligent, even within three months! If I cut down my spending in smart ways here in Raleigh, work hard to make more money, and perhaps get a little lucky with the Steem price, it could happen.

And if not, it’s fine. “Failure” in this case merely means enjoying a slightly different style of trip - sharing an apartment — not missing out on anything crucial. So having my own apartment next time in NYC is my “Stretch Goal.”

With that said, how does one radically improve their financial situation in 2-3 months? It’s not easy but I belive it can be done.

In the next section I will share my mental framework for creating radical financial improvement for your average “paycheck-to-paycheck” style freelancer. If you are in a situation similar to mine, you might find some extremely useful info in the rest of this post:

The Two-Pronged Method: Diversify Across Income Streams and Across Time

The key to maximizing your chance for financial success is to aim for the biggest reward you can WITHOUT taking on any undue risks.

Consider the following facts:

- There is some risk in every new thing you try.

- To radically improve your finances, you need to do new things.

- It is never a good idea to risk all of your financial resources in one or two decisions.

Given that there is a lot of risk, and that we need financial security, the only option is to diversify. You have to take on new opportunities that are risky (because you could waste your time and not end up making much money), while still maintaing current income streams.

You also want to diversify across time - doing things that are great for your short-term financial picture, and doing things that are great for your long-term picture.

After all the most powerful force in finance is compound interest. The second most powerful might be income. The former is long-term, the latter is short-term — so spending time on both makes sense.

———

Quote to Ponder:

———

And for someone like me — with a few thousand dollars in Steem Power, but not much else by way of savings — the first step to earning that compound interest is to merely pay off my debt and develop stable income so I can invest.

Right now I have enough income to survive and keep up with my debt payments. That’s pretty good! You are maybe in a similar boat - I know many of my readers are at a similar age and financial situation as me.

So how to go from “enough income to survive and keep up with the minimum debt payments” to “enough income to thrive and pay off WAY MORE than minimum debt, so I can focus 100% on investing by 2019?”

Here’s what I am doing for the next “quarter,” i.e. April through June:

- Re-integrate non-tokenized income streams: Freelance writing for a few good blogs that pay in USD

- Stabilize Steem income: Pay myself $400 per week regardless of steem price / weekly rewards

…that’s it!

I am a big believer in simple methods. Now more than ever. So as listed above, I’ve got one short-term goal and one long-term goal. If I sustain both of them for all of April and May, I’ll maximize my financial potential over those two months with the minimum effort, stress, or risk.

Let’s go deeper on these two goals:

The Short Term Goal

Here’s the short term goal again:

- Re-integrate non-tokenized income streams: Freelance writing for a few good blogs

This is all about adding non-tokenized income, gigs that pay in USD dollars instead of bitcoin or steem. This way when the markets go down, I have as much non-token income as possible, and can withdraw the fewest possible steem tokens at bad prices.

Imagine I’m earning roughly $200 per week in non-tokenized income - that is $200 I don’t have to withdraw from my Steem account. Today that would be about 80 steem per week saved.

This is easy for me because my previous non-Steem work as a freelance writer is very flexible. I have to be careful not to take anything too low - doing some of those crappier $6 per hour jobs just isn’t a good use of time for me anymore - but if I can secure $10-15 per hour from a few of my best older gigs, I can do ~10 hours of that a week to immediately bolster my income.

In fact I plan to start doing so in about two weeks— doing roughly 10 hours, or two 5 hour “shifts”, per week of non-Steem freelance writing.

The Long Term Goal

Here’s the long term goal again:

- Stabilize Steem income: Pay myself $400 per week regardless of steem price / weekly rewards

This is a BIG ONE. Rather than living in the boom-or-bust style of cashing out my liquid rewards every week, I will only cash out enough Steem to reach $400 in income each week.

I believe this is a huge step towards long-term financial stability. By stablizing my income, I stop spending my money in weird spurts and sprees. Instead I can plan a steady budget, at least while I’m at home in Raleigh, and can work hard to keep expenses down.

All of the extra money just piles up in my Steem account, and I can diversify some of that into other accounts - perhaps into emergency cash savings for the short term.

Over the long run, I can increase my own paycheck once it seems sustainable. $400 is the most I can trust myself to maintain for now… but $500 a week would be a more comfortable income for me at this stage of my life. After I can do that sustainably, I may simply let any future income boosts pile up until I have enough for a lump sum payment on the remainder of my debt.

Without a stable weekly paycheck, I’ll never have the restraint to let thousands of dollars build up and sit there, untouched - but that buffer of a few thousand is exactly what I need. Therefore, I’m using this system to make it easier for me to separate my “pay” each week from my extra earnings.

It’s Not About “Easy”

It won’t be easy.

It's a self-imposed financial winter in the short-term...

I’d much rather relax more, not do any extra gigs, and enjoy the freedom that Steem offers me. I definitely do not need to do any other jobs, nor do I need to force myself to pay a steady weekly paycheck to my own bank account.

I’m doing these things even though they are a difficult adjustment, because they are the two most powerful financial tactics I can think of for this moment. Because I strive not just for momentary survival - but for a lifetime of financial comfort and eventual freedom.

And there’s a plus side: I won’t change anything else in my life, or stress out literally at all, to do this.

No budgets or radical frugality. No thinking about investments or trying to time the crypto markets. I won’t stress out if I have to power down a few times this season to cover some bad weeks — nor will I celebrate too much if I earn a crazy payday.

I’ll just live my life and know that my financial plan is working in the background, so I don’t have to think about these things.

The real gift isn’t in earning a lot of money, but in learning to live a life where you don’t have to think about money too much.

Of course you always consider it — you spend wisely, you invest, and sometimes you splurge within reason. But to not stress, to not even think about money most days — that’s the real goal.

I hope this mega-post served as a worthwhile update for the personal finance side of my blog. I’ll try to avoid any month-long gaps on this subject in the future. Next time I’ll share an update on my bank accounts and overall net worth — nothing much has changed there, I promise you :-P.

What do you think? Do you have any financial goals you are working on at the moment?

Interesting point, i actually got to the same conclusion some weeks ago, i created a plan to daily put some SBD as saves to withdraw every 2 weeks but then the market starts dumping more and i came to the conclusion that im wasting account grow. I managed to get other source of income and i changed the strategy, im investing time and sbd earned to build my steem balance.

keep up the good work

Great minds think alike :-) $$

This comment made me laugh 'I bought weed with that money once I got home'.

But seriously @heymattsokol I hope things improve for you on the Steem price, it took a big dump last night, just after I invested some more doh!

I seem to have a knack of buying crypto's and shares just before they sink.

Sounds like you're taking the middle path.... good plan!

Hope the steem price picks up soon.