What the 2017 Nobel Prize winner can teach you about behavioural economics

It could change the way you handle money.

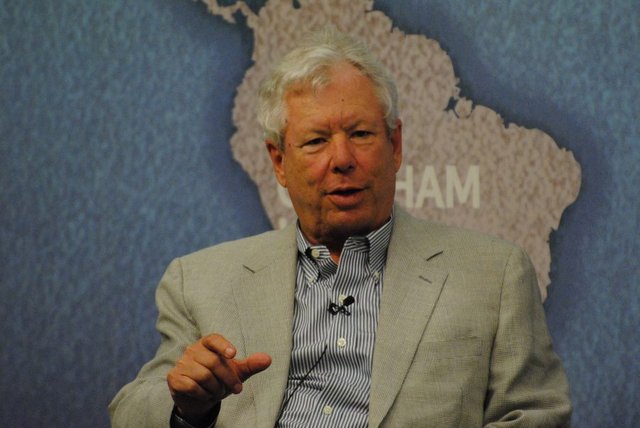

PHOTO: WIKI COMMONS

Earlier this week (Oct 9), American academic Richard Thaler won the Nobel Prize for Economics for his contribution to behavioural economics.

In particular, it was his findings and development of the ‘nudge theory’ that propelled him to the Nobel Prize hall of fame.

‘Nudging’, at its core, centers on the assumption that most of us are likely to make irrational decisions.

Therefore, ‘nudging’ is about using behavioural science, political theory and economics in a non-intrusive and positive way to help people exercise more self-control and ultimately make better decisions.

Because, according to Thaler, we’re all “just human” after all, and irrationality, is therefore a natural construct of the human psyche.

The trick, however, is to recognize this inherent fallacy we all possess, and learn how to combat it.

How?

Some examples of ‘nudge’ theory can be found in the most unassuming of places.

Cue the humble supermarket.

Most of us are busy, in a hurry and just don’t have the time to cook a proper meal every day (let alone three times a day for breakfast, lunch and dinner).

Hence, finding what’s convenient, even though it may not be very healthy, is one example of irrational behaviour in food consumption.

This means that more individuals would be inclined to buy a packet of chips or instant noodles from the supermarket aisle, because in accordance with ‘nudge’, people will choose what’s easiest to eat, rather than what’s wisest or healthiest.

The solution? Using a combination of ‘gentle-guiding’ to nudge people in the right direction. This is as simple as placing healthier foods on shelves at eye-level.

Tests have shown that as the healthy food is the first thing most would see when they visit their aisle of choice, they were more likely to buy that particular food product, regardless of what their views on obesity or healthy-eating is.

Other nifty theories by Thaler

Here are some other noteworthy theories by Thaler:

The endowment effect

This theory suggests that people often place more value on things they own, and less value on things that belong to others.

A good example of this is when people refuse to cut their losses and liquidate their investments when said investments take a sharp dive in value.

Thaler once proved this theory by setting up a famed experiment in his classroom.

PHOTO: WIKI COMMONS

Both Thaler and a fellow professor handed out mugs to half the students in his class. They then proceeded to start a market where students were encouraged to buy and sell the mugs.

Through the entire exchange, it was revealed that on average, the owners were only willing to part with their mugs for $7 while the buyers who did not have the mugs felt that $3 was more than a fair bargain.

The hot-hand fallacy

This theory operates on the fallacious thinking that anything that is happening now will continue to happen.

To illustrate this particular theory, Thaler appeared alongside pop star Selena Gomez in the award winning movie, The Big Short, and used gambling to explain the US housing market collapse.

In the clip, Gomez is dealt a pretty good hand in a game of Blackjack. And because she’s been on a winning streak and is currently set to give the house something to cry about, people believed that she would indeed win again.

This overconfidence causes a woman to make a bet with another man that Gomez will win. This similar overconfidence extends its reach to another person, who in turn makes a bet that the woman (who was betting on Gomez) will win.

All of the aforementioned people are therefore, operating on a baseless assumption that because Gomez is winning the current game, that she will therefore make a clean sweep of all future games.

So when and if Gomez loses, like a domino effect, her original bet of 10 million dollars (as stated in the clip) will inflate to billions of dollars of losses for not only her, but also everyone else whom both directly and indirectly betted on that one game of Blackjack.

PHOTO: YOUTUBE

Apply this to the US housing market – people were making the assumption that as home prices had been increasing consistently, that it will thus, always increase.

This lead to a housing bubble that eventually popped and caused mayhem and billions of dollars of losses for investors in the market.

‘Nudge’ for good

While these theories are fascinating on their own, Thaler’s findings has helped governments and economists around the world develop non-intrusive ‘nudges’ that uses positive reinforcement to help people make better decisions (case in point, the aforementioned supermarket example), and various economies to thrive.

And in good fun, when asked about how he was going to spend his SGD $1.5 million (9 million Swedish krona), the 72 year-old economist replied: I will try to spend it as irrationally as possible!