Peerplays Sensitivity Analysis for Variable Forecasts

I conducted a sensitivity analysis for variable forecasts in my valuation for PPY. With my last valuation, the terminal value wasn't discounted to its 2018 present value. I corrected this error in my expected value section of this analysis.

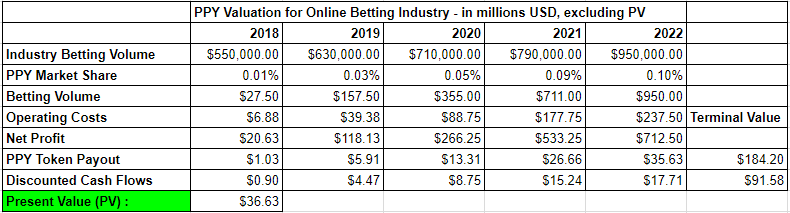

Less Than Expected Forecasts

- Operating Costs: 25%

- Tokens: 3,785,384

- Discount Rate: 15.00%

- Terminal Growth Rate: 5.00%

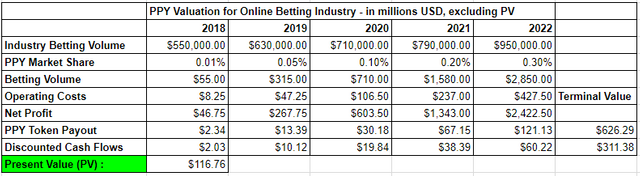

Expected Forecasts

- Operating Costs: 15%

- Tokens: 3,785,384

- Discount Rate: 15.00%

- Terminal Growth Rate: 5.00%

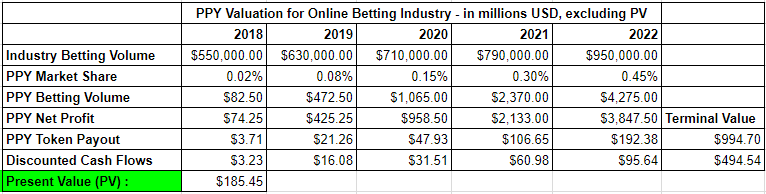

Exceeds Expected Forecasts

- Operating Costs: 10%

- Tokens: 3,785,384

- Discount Rate: 15.00%

- Terminal Growth Rate: 5.00%

If you have any suggestions for other simulated scenarios, please let me know!

I think a big source of error is the market share. Their market share will be tiny in this huge market. I think that you overestimate the market share. And since it is such a small number it is of course hard to estimate.

Initially, the market share will be small, however, over a period of 5 years with competitive Dapps I believe their market share will at least hit the first table's targets. I can certainly setup a few more models with smaller market share growth. Thanks for your input!

thanks