PCore’s INVOICE FACTORING FOR FIAT BUSINESSES

Small and Medium scale Enterprises (SMEs) are tipped to be perfect inputs to the growth of the global economy. Ironically, this notion may not see the light of the day, considering the limited access to capital. Despite measures aimed at funding such projects, there remains the nagging problem of invoice financing.

PCore, a blockchain-backed project, is taking a leap at this financial malaise. With its decentralized structure, the platform aims at reinventing invoice factoring. Let’s consider its proportions and the positive impact it will have on the target audience.

The Genesis of PCore’s Invention

It is a well-known fact that blockchain projects are here to decentralize and bring revolutions to the traditional way of conducting transactions. PCore has its focus on invoice factoring. It is pertinent to break down the concept for maximum comprehension of the project’s input to that regard.

As stated earlier, small businesses/startups often find it hard to access capital. Given the high-interest rates and stringent loan conditions by financial institutions, the last resort is to delegate the company/business’ invoice(s) to access funds.

Invoice factoring is a financial model in which a business sells its invoices (also called “accounts receivable”) to a third party (also called “a factor”). In this regard, the business sells the invoice at a discount. The amount it receives at the end of the transactions is used to keep its operations afloat pending the set date for repaying the received funds. This process is a viable way that allows businesses to raise funds for immediate cash needs.

The Downside/Existing Problem

As Pcore identified, the major problem in this financial model starts from the point of factoring the invoice. First, businesses (mostly SMEs) find it hard to locate a factoring company to strike a deal. Even when there are many “factors” waiting to proceed with the transaction, the business in question may not be disposed to the terms of the transaction.

On the other hand, there are tendencies of mistrust, because most of these transactions are fiat. Furthermore, reaching out to each party may take some time because of distance barriers. Sadly, the processing time may take longer than expected, given the paper-works that underscore the transaction.

PCore’s Solutions

Considering the viability of this sector and taking note of the liquidity that each party tends to benefit, PCore takes advantage of the blockchain technology to reinvent the application of invoice factoring in a way that will favor both parties.

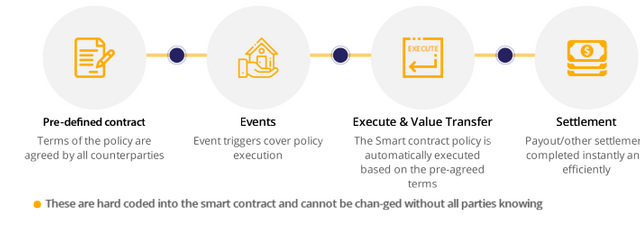

In a bid to restructure the system and further enhance trust among transacting parties, PCore makes use of the distributed ledger technology (blockchain) to perfect this. Furthermore, the network brings all parties together in one ecosystem. Hence, there tend to be limited alterations when transacting across borders. Below is the structure of transactions on the platform.

For the benefit of transparency, the platform instituted a separate platform where businesses can map their invoices for other members of the ecosystem to have an insight into it. From another perspective, this structure eliminates doubts because only real-time data can make it to the platform. Thus, a business cannot falsify its credit score or financial standing just to gain favor. On the lenders’ part, it’s emancipation from the shackles of deceit that precludes the fiat aspects of this transaction.

The Role of XBRL

It is worth mentioning that PCore opted for the eXtensible Business Reporting Language (XBRL). This financial reporting model that is in use in many companies around the globe, allows participants to access the current standing of reporting documents. In addition, it breeds trust and makes room for automated registration and sorting of documents within the PCore ecosystem. Thus, it is a viable medium to access and validate available data within the platform.

Altman Z-Score for Liquidity Assessment

The provisions surrounding invoice factoring stipulate that unused invoices are tradable to raise funds. While there may be fewer chances of altering the process within the PCore ecosystem, the platform took the verification parameters higher with the application of the Altman Z-Score rating.

The score is a way of accessing the risk factors in a company and the underlying invoice. Intending lenders can take advantage of this to check the liquidity of the business. The lender can back out of the transaction in the event of anticipated insolvency. If the “coast is clear”, the transaction can proceed because the lender has the conviction that the business can fulfill the repayment at the set date.

The Verification Process

PCore took its propositions higher with the integration of the Hive Ecosystem. This makes use of Personally Identifiable Information (PII) protocols to verify documents submitted in the platform. This implies it accesses the legitimacy of such documents by accessing it and correlating the same to the information provided by users. The picture below highlights the functionality of the Hive Ecosystem.

PCore’s Token Sales Structure

PCore has a total token supply to the tune of 52 million PCC tokens. Out of this lot, it sets aside 20 million for future developments. 20 million PCC tokens are billed for crowd-sales during the Initial Coin Offering (ICO). The remaining 500,000 PCC tokens will get to bounty participants/evangelists of the project.

The project targets a circulation of 1 million PCore Token at an interval of 4-5 years after the ICO. After the Initial Coin Offering (ICO), the project begins to raise funds using multiple sources.

For instance, it will charge certain percentages of the PCore Token (PCC) depending on the invoice cover/plan selected by a user. Second, it earns 8% of its income from overdue income cover payment. Finally, a greater bulk of its revenue will come from Peer-to-Peer (P2P) transactions in China.

Token Sales Information

Ticker: PCC

Token Type: Utility

Token Standard: ERC-20

Platform: Ethereum

Exchange Rate: 1 PCC = $0.39 USD

Soft Cap: $1 million USD

Hard Cap: $5 million USD

Country of Registration: The United Kingdom

Restricted Areas: The United States of America, China

Conclusion:

The propositions of this project are impressive. With the huge prospects that emanate from emerging economies/markets facilitated by Small and Medium scale Enterprises (SMEs), PCore’s decentralized solution will edge the fortunes of the industry to greater heights. Nevertheless, the blockchain technology, on which it took the premise, will go the extra mile to entrench trust and security of its participants.

For more information about PCore, kindly visit:

Website: http://www.pcore.co/

Whitepaper: http://www.pcore.co/assets/docs/White_Paper.pdf

Facebook: https://www.facebook.com/PcorePCC

Twitter: https://twitter.com/PcorePCC

Telegram: https://t.me/PcoreLTDGroup

Bitcointalk Username: Crypto4ruby

Congratulations @crypto4ruby! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!