#paymentsbrief: Interchange fees, Card Schemes and the Payment Card Reform Framework

Hello all,

(edit #2: Realised my earlier edited post did not include the graphics - sincere apologies!)

On 21 July 2017, it was reported that the UK court had blocked a US$18 bil class action lawsuit against MasterCard for allegedly overcharging more than 45 million people in Britain over a 16-year period.

An excerpt from Reuters:

(Source: Reuters)

What does it mean for MasterCard to overcharge consumers? Visa and MasterCard brands are not consumer-facing (that is, regular citizens like us do not buy actual products from them). If it can happen in the UK, is it happening right now in Malaysia, or for that matter, elsewhere?

In this post, I'll try to walk us through some of the basics of the interchange fees in the payment card industry, how Visa and MasterCard may overcharge consumers (although we may not be aware of it), and what has been done so far in Malaysia to ensure anti-competitive practices are being reined in.

Sit tight!

How does the payment card system work?

To understand interchange fees (IF), one has to understand how the payments card industry works. Credit cards may be an integral part of our daily transactions, yet not many people understand its underlying mechanics.

Allow me to point you to an excellent resource by Richard Gendal Brown for a simple, yet effective view on how it works.

https://gendal.me/2014/07/05/why-the-payment-card-system-works-the-way-it-does-and-why-bitcoin-isnt-going-to-replace-it-any-time-soon/

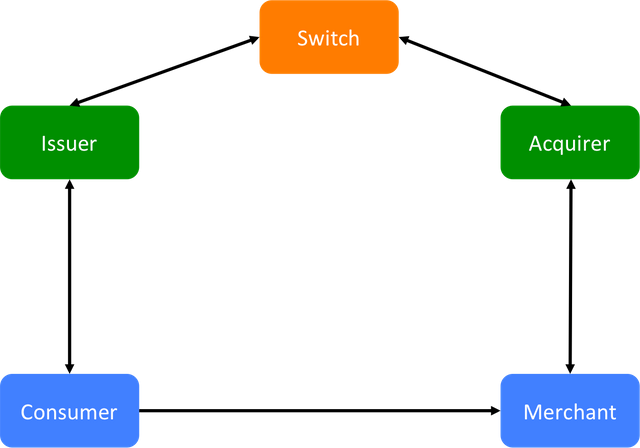

In a nutshell, lets imagine that there are four parties in this system (or scheme):

A: Tesco - supermarket

B: Maybank - supermarket's bank (also known as the acquiring bank. Maybank provides the point-of-sale (POS) terminals to Tesco and therefore allows Tesco to accept credit cards)

C: Alice - consumer (you or me)

D: CIMB - card issuer (Alice has a CIMB credit card. In this case, CIMB is also known as the issuing bank)

Lets say Alice decides to buy some bread from Tesco for breakfast. She uses her CIMB credit card to pay at Tesco's POS terminal. The transaction succeeds, Alice gets her bread, receipt and a nice breakfast.

What just happened behind the scenes?

I) When Alice swiped her CIMB card, the POS terminal captures Alice's card information and securely sends it to Maybank (Tesco's acquiring bank).

II) Maybank then sends the information to CIMB (the issuing bank) for authorisation. CIMB then has to check if the credit card used does indeed belong to Alice, with the proper authorisation (e.g. PIN or signature). In the case of debit cards, CIMB has to check if there are sufficient funds in Alice's account.

III) CIMB then routes the information back to Maybank and the merchant (Tesco) to inform if it is a pass or a fail. All these happen in a matter of seconds.

Okay then. But where does Visa / MasterCard come in then - we don't see them yet?

They come in step (II). Maybank sends Alice's information to CIMB through Visa or MasterCard. This is known as 'routing transactions'. In other words, Maybank has routed the transaction through Visa or MasterCard (depending if Alice's credit card is a Visa or MasterCard).

(Credit to Richard G. Brown for the schematic)

Visa and MasterCard then, are essentially central switches. They switch (or route) payment transactions between different banks. This is significant because now, banks and merchants do not need to maintain bilateral relationships with each other, in order to accept card payments.

As a merchant, all I have to do is to accept Visa and MasterCard, and I can accept payments from anyone globally that holds a Visa or MasterCard card. This is powerful stuff.

By now you may be appreciating the scale of this enterprise. Visa and MasterCard, also known as international payment card schemes, sit in the middle of the scheme and route transactions between their acquiring banks and their issuing banks. They charge fees for each transaction that goes through. You can imagine the billions.

As a side, this also explains why international payment schemes spend much of their marketing budget to end-users like us, even though we are not their primary customers.

They do this to ensure that customers know that they are able to pay using a Visa and MasterCard card virtually anywhere in the world. Because of course, the wider the network effect, the more revenue can they collect from an ever increasing number of acquiring and issuing banks.

An example of a Visa advertisement below.

(Source: Visa)

Got it. What then about IF and all this about overcharging the consumers?

Interchange fees (IF) are essentially the fees paid by the acquiring bank to the issuing bank for each card transaction. In the example above, Maybank (acquirer) would have to pay CIMB (issuer) the IF for Alice's transaction (the flow of funds goes a little deeper but this is sufficient for now).

It is important to note that the international schemes set the IF rates. This means that Visa or MasterCard could set high IF rates, forcing acquirers to pay high fees to issuers. This is where overcharging, market distortions may set in.

This situation is likely to have been the root of the class action lawsuit in the UK against MasterCard. High IF rates distorts the market for two main reasons:

I) Acquirers, being forced to pay higher fees, pass on the costs to the merchants through higher Merchant Discount Rates (MDR). Merchants in turn, forced to pay higher MDRs, hike the prices of their products, resulting in higher cost of goods and services for society.

(Excerpt from Reuters, 21 July 2017)

II) Issuers, incentivised by the high IF fees received (indeed, this is why payment schemes hike IF even though they do not directly benefit from it) are able to lure consumers with reward points or gifts to sign up for credit cards. This may result in high household indebtedness due to high spending with credit.

What's the situation like in Malaysia?

These high IF trends applied also to Malaysia, resulting in similar market distortions. In addition, because of the high cost of accepting payment cards, merchants preferred to accept cash instead of payment cards. This was a challenge to Bank Negara Malaysia's (BNM) migration to e-payment efforts.

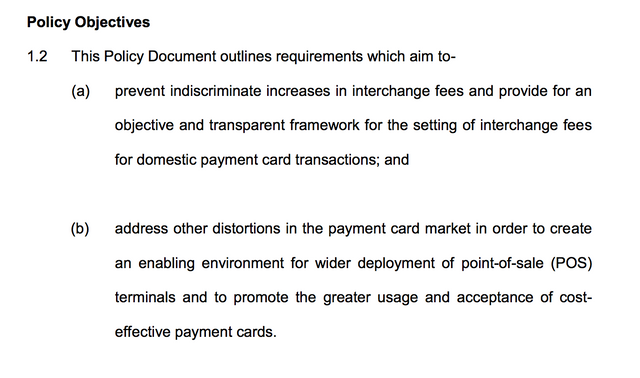

In December 2014, BNM introduced the Payment Card Reform Framework (PCRF) precisely to tackle some of these issues. I would recommend having a look at the policy document to understand things further.

(Bank Negara Malaysia, Payment Card Reform Framework (December 2014))

One of the measures taken to prevent indiscriminate increases in the IF rates is to introduce a ceiling on interchange fees.

Credit card:

Ceiling of 1.10% of the transaction value

International Debit card:

Ceiling of 0.21% of the transaction value or 70 sen + 0.01% of the transaction value, whichever is lower

In addition, part of the IF revenue collected by the issuing banks would have to be contributed to a pooled fund (the Market Development Fund) for the purpose of funding the deployment of POS terminals.

The idea presumably is to fund less loyalty points and rewards (and therefore exacerbating the household indebtedness issue) and instead channel the funds towards the expansion of the e-payment network.

There is more detail, but I will save that for another time.

I hope this has been helpful in understanding some part of the payment system, and also developments here in Malaysia.

Thanks for sticking around! I am learning as well, so please feel free to comment, resteem and discuss below.

Cheers!

Sources:

Reuters article on the UK class action lawsuit against MasterCard

https://www.reuters.com/article/us-mastercard-court-fees-idUSKBN1A61DJ

Richard G. Brown on payment card systems

https://gendal.me/2014/07/05/why-the-payment-card-system-works-the-way-it-does-and-why-bitcoin-isnt-going-to-replace-it-any-time-soon/

BNM Payment Card Reform Framework

http://www.bnm.gov.my/guidelines/50_others/Payment_Card_Reform_Framework.pdf

Cardfellow on interchange fees

https://www.cardfellow.com/interchange-fee/

Congratulations @astonbtc! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @astonbtc! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!