Crypto Futures And Uncertainty in 2020

Crypto rang in 2020 with some bullish signs from the start. A major reason for this is the tensions between the U.S. And Iran. Anytime there is uncertainty about economic, political futures or tensions between nations, people naturally look for stability. Since the inception of Bitcoin in 2009, we have taken a bit more solace in an asset that is accepted across international borders.

Crypto Value Factors: Awareness, Understanding, Adoption

I was among those who discovered bitcoin when the market price was under a dollar. However, I didn't really ask what bitcoin is until it went up to roughly $100 per bitcoin. That is when I adopted the concept of blockchain technology and really got involved.

My crypto path was rocky and hilly as it was a very new space and seemed (still does) to most like a magic money. Accepting bitcoin as payment wasn't enough, I had to have a faucet (give away free bitcoin). This is at a time when government regulators (FINCEN) started looking for ways to get their share or ban it. This is also at a time when new blockchain companies were popping up and just before ICO's were off the rails.

TL;DR But I digress...

Today, we are seeing crypto more frequently and in more places. Large companies accept bitcoin payments, Bitcoin Teller Machines (BTMs) are popping up, crypto is traded openly and legally in a lot of places, and companies are seeking ways to create their own tokens using blockchain.

Awareness is becoming more widespread and those who currently hold crypto are in for a ride. More people are using crypto and that number will continue to climb as adoption gains momentum.

Crypto Momentum and Uncertainty

To the moon!

That's a popular way of saying that cryptocurrency is on the verge of experiencing exponential growth. And when you sprinkle in some uncertainty, like the potential for war, fiat currencies and the markets respond with dips. The word recession gets tossed around and grocery stores sell out of water, et cetera. Any major uncertainty or potential major change can cause this.

What does this mean for crypto like bitcoin?

If you look at bitcoin as an asset or commodity like gold, you can draw comparisons to the price. Since fiat is government issued and the U.S. Dollar is no longer backed by gold but the belief it holds value, it can be hard to trust it. Banks are centralized and hold most of your money, whereas gold is tangible and valuable. Same can be said for crypto, though by tangible we mean your hardware containing your wallet.

Nothing puts someone's mind at ease more than being able to physically control their assets during times of uncertainty.

Crypto Math in Action

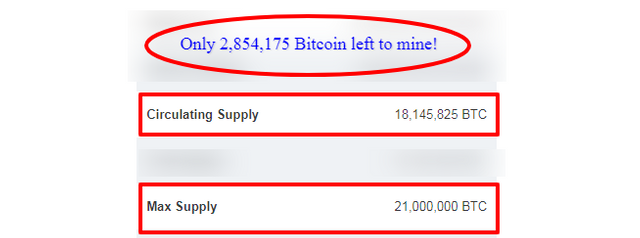

Chart 1: Bitcoin Total Supply YTD via CoinMarketCap.com

Given the three main factors outlined just now (awareness, understanding and adoption), there is one more to consider: currency inflation. To fight this, bitcoin by design, will only ever produce 21 million bitcoins (see chart 1). This may cause people to hoard or hodl their BTC, but as long as there is active circulation and a use for bitcoin, it will continue to hold value.

Chart 2: Bitcoin Market Trends Since January 2019 via CoinMarketCap.com

In the last year alone we have seen the market trends echo awareness, adoption and uncertainty as the market volume and prices bull or bear. Essentially, more awareness or uncertainty leads to more trading volume (higher demand), and higher prices. Conversely, we can also see that uncertainty in crypto futures leads to sell offs and declining prices shortly after before stabilizing.

To read these trends in the charts (see chart 2), simply watch the high and low price narrow and converge over time during a declining period (bear). The opposite for the bull. Over the last year, even the bull trend shows a higher stabilizing average price as the volume (amount traded) goes up.

Crypto in 2020 and Beyond

Bitcoin was the first ever blockchain created, but there have been many practical platforms created with this technology since. Ethereum was the first to offer smart contracts and there are different mining methods available to save energy. Blockchains are being integrated everywhere to solve big problems and reach the previously unreachable.

It has never been easier to start buying, selling and trading crypto then it is today. You can even invest or loan out your crypto and earn compounding interest.

We are just now bracing for exponential crypto growth as the awareness and adoption gains momentum. I for one am excited for the future of blockchain technology and the potential it has to make a positive impact in the world.

What are your thoughts?

Original Post : https://www.jerokiahdarr.com/crypto-2020/

Congratulations @tunnelrat! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!