KINESIS - A monetary System Own by the People

Introducing Kinesis Monetary System, architected from scratch, with the combined efforts of an excellent team of experts in the financial, business and technology area, and with the alliance of leading and consolidated companies in the gold and silver exchange market.

Kinesis is born with the clear promise of providing an International Fungible Monetary System based on the advanced blockchain technology of decentralized ledger; and with the firm purpose of correcting the conceptual and historical failures of the cryptocurrencies markets that have not been able to incentivize the store of the value, and to give a new paradigm to money management as a tool of a country's economy.

IMPROVING THE WAY TO INVEST IN GOLD AND SILVER

Gold and Silver, are historically one of the safest commodities in the world. Kinesis users can quickly and safely access the traditional advantages of investing in gold and silver, such as the inherent stability and support, but also with the additional advantages having an expedited and flexible option of liquidating their investment through the use of digital currencies, like Kinesis cryptocurrencies, thus improving its use as a means of exchange, and taking advantage of the functionality of Kinesis subsystems that facilitate their transactions and commercial use.

Additionally, Kinesis users actually own their gold and silver bullion, and the property titles of these assets will be in their name, which adds as an implicit benefit the release of concerns such as the political risk of a given country. Those bullions are audited, safeguarded and can be exchanged, through the alliance and support of two great and recognized global players such as Allocated Bullion Exchange (ABX) and Deutsche Borse Group.

These titles will be registered in the customer's e-wallet, through which they can access, using Kinesis system platform, a large international market of assets trading and consumption of goods and services using the Kinesis debit card.

We can also add that, per client's request, their precious metals can be delivered to them physically if it is their wish.

Kinesis is based on blockchain technology, the user can rely on the security and protection of a decentralized framework for registering and safeguarding transactions, avoiding the potential acts of perversion of governments and institutions in the manipulation of assets, as occurred in the financial debacle of 2008.

Since gold and silver are precious metals with very stable behavior, they avoid that those cryptocurrencies, based on them with a 1:1 ratio, suffer high levels of volatility representing highly risky investments. Therefore, upon that premise, it would be reasonable to adopt the financial strategy to store value in these cryptocurrencies since they are backed by real and stable assets.

With the cryptocurrencies backed in this way, you can take advantage of a multifaceted yield system, "rewarding the exchange as well as the system shareholding and overall velocity of the Kinesis cryptocurrencies".

Kinesis and ABX Alliance for Gold and Silver Markets

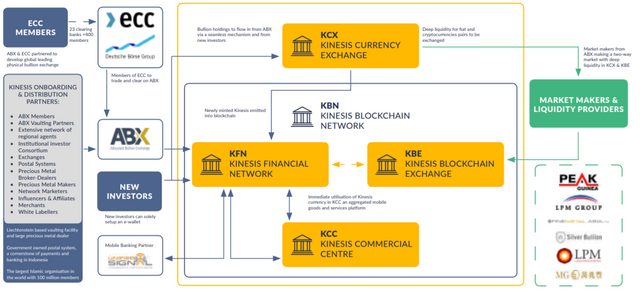

One of the main business units in the system is Kinesis’ Currency Exchange (KCE). This component is based on “the multi-layered third-party audit and verification system of ABX’s Quality Assurance Framework”. Here’s where ABX provides their business expertise and consolidated bullion exchange platform, connecting suppliers of precious metals like gold and silver to the platform, and then creating and minting the currency for the system.

Once the Kinesis currencies are created at KCE, and cryptocurrencies defined at Kinesis Blockchain Network (KBN), then they can be sent, spent, saved or traded by regular users through the other components of the system.

“Kinesis via its institutional integration with ABX and its operationally segregated wholesale contracts, which offer serial number and bar hallmark, provides an ideal globally efficient digital system solution for bi-lateral wholesale trading”. Therefore, the inherent problems of obsolete transactions at the OTC physical market (completely manual, problematic, inefficient and costly) are overcome, and the need for intermediaries for both suppliers and final consumers is eliminated.

ABX's Quality Assurance Framework, provides an interface for suppliers to enter the Kinesis market, and sell their metals directly at their offer price to the Exchange. Analogously, "ABX integrates the physical trade cycle, allowing for end consumers (Jewelers, Manufactures & Investors) to access the exchange directly".

Why does Kinesis inherently have less volatility?

As part of its design, and we have already highlighted it above, Kinesis establishes gold and silver as the backing of its currency, given the characteristics of security and historical stability. At the same time, it offers holders a whole global platform to market and use Kinesis cryptocurrencies, thus facilitating their liquidation at the convenience of the user.

Likewise, Kinesis promotes a passive income based on participation in the platform, and also an innovative mechanism of reward through a strategy of high incentives for performance based on the velocity of the currency (“rate that money changes hands”) rather than the legacy mechanism of print-currency/devaluate to stimulate economic activity.

That's the reason why Kinesis cryptocurrencies are stable an ideal for an effective store of value.

A Use-Case

Somewhere in the south of the american continent, Pedro is a newly retired middle-aged citizen, who is distressed by so many mistakes by the government in managing the economy of his country, and has the whole country struggling to protect the value of their money.

Pedro is about to receive an important amount of money that is supposed to guarantee at least an appropriate income for his subsistence. Although Pedro is not a finance professional, he knows that his money deposited in commercial banks will be devoured by inflation almost instantaneously. He also knows from his youth, that precious metals such as gold are highly valued and their value has never been completely destroyed by global disruptions.

He would like to invest his retirement money in gold bullion, but he doesn’t know how to do it, he wants the bullion to be his property and it is not diluted in the vaults of a commercial bank but in a safe place, he doesn’t know what tools there are to do that, nor which companies can perform this management, but he would also like to be able to trade part of that asset to generate a higher profitability, and spend part of that money buying some additional assets.

He told his friend José what he wanted, and José explained to him about a new monetary platform, which is also international, in such a way that it could not be intervened by Pedro’s government, and that it could provide all the advantages he wanted.

That platform is called Kinesis, and effectively provides a solution for Pedro, who with the help of his friend José is learning to handle the fruit of his retirement through a robust, flexible, international platform, and based on cutting edge technology such as blockchain.

Source for this article:

Kinesis.Money Website

Kinesis.Money WhitePaper

Kinesis.Money YouTube

kinesis2018

kinesistwitter

https://twitter.com/javiercarballob/status/1036767864609533958

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @mercuryjav! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!